1994 Legislation Ends 67-Year Interstate Branching Ban, Reshaping U.S. Financial Landscape

A significant shift in the American banking sector occurred in 1994 with the passage of the Riegle-Neal Interstate Banking and Branching Efficiency Act, which repealed long-standing federal prohibitions on banks operating branches across state lines. This landmark legislation fundamentally altered the geographic structure of U.S. banking, a restriction that had been in place for decades. As noted by Kevin Lacker on social media, "TIL that until 1994, it was forbidden for a bank to open a branch in another state."

Prior to 1994, federal laws, including the McFadden Act of 1927 and the Douglas Amendment to the Bank Holding Company Act of 1956, largely prevented banks from expanding beyond their home states. While some states began to relax their own laws in the 1980s, allowing reciprocal agreements for out-of-state bank holding companies, a uniform federal standard was absent. This created a complex and often inefficient "patchwork system" across the nation.

The push for reform gained momentum in the early 1990s, driven by a desire for increased banking efficiency and consolidation following the banking crisis of the 1980s. Proponents, including then-Treasury Secretary Lloyd Bentsen and NationsBank CEO Hugh L. McColl, argued that the existing regulations were outdated and hindered banks' ability to serve a mobile populace and adapt to economic realities. The Clinton administration actively supported the move towards a more integrated banking system.

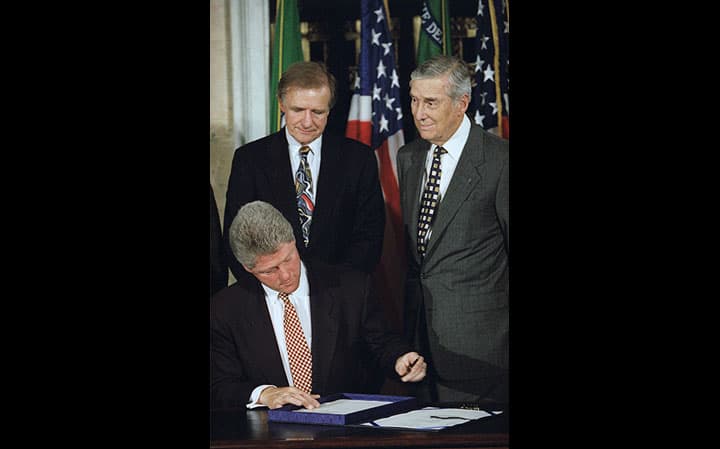

Signed into law by President Bill Clinton on September 29, 1994, the Riegle-Neal Act permitted well-managed and well-capitalized bank holding companies to acquire banks in any other state after October 1, 1995. Furthermore, it allowed banks located in different states to merge into single nationwide branch networks beginning June 1, 1997. The Act also included stipulations, such as a 10% national deposit cap and a 30% state deposit cap, to prevent excessive concentration.

The legislation ushered in an era of nationwide banking, leading to significant industry consolidation and the rise of larger financial institutions. While supporters lauded the benefits for consumers through expanded access and lower costs, critics raised concerns about the potential for "mega-banks" to become less efficient or impersonal. The Riegle-Neal Act marked a pivotal moment in banking deregulation, setting the stage for further changes in the financial industry.