Alphabet Poised for $93.8 Billion Q2 Revenue Amid AI Acceleration and Antitrust Scrutiny

Mountain View, CA – Alphabet Inc. (NASDAQ: GOOG, GOOGL), the parent company of Google, is set to announce its second-quarter 2025 financial results on Wednesday, July 23, 2025, after the U.S. market closes. The announcement comes as investors keenly anticipate insights into the company's performance, particularly concerning its aggressive artificial intelligence (AI) investments and ongoing regulatory challenges. Sundar Pichai, CEO of Alphabet and Google, signaled the impending release via social media, stating, > "Get more details here: https://t.co/NZXcjVHWbd."

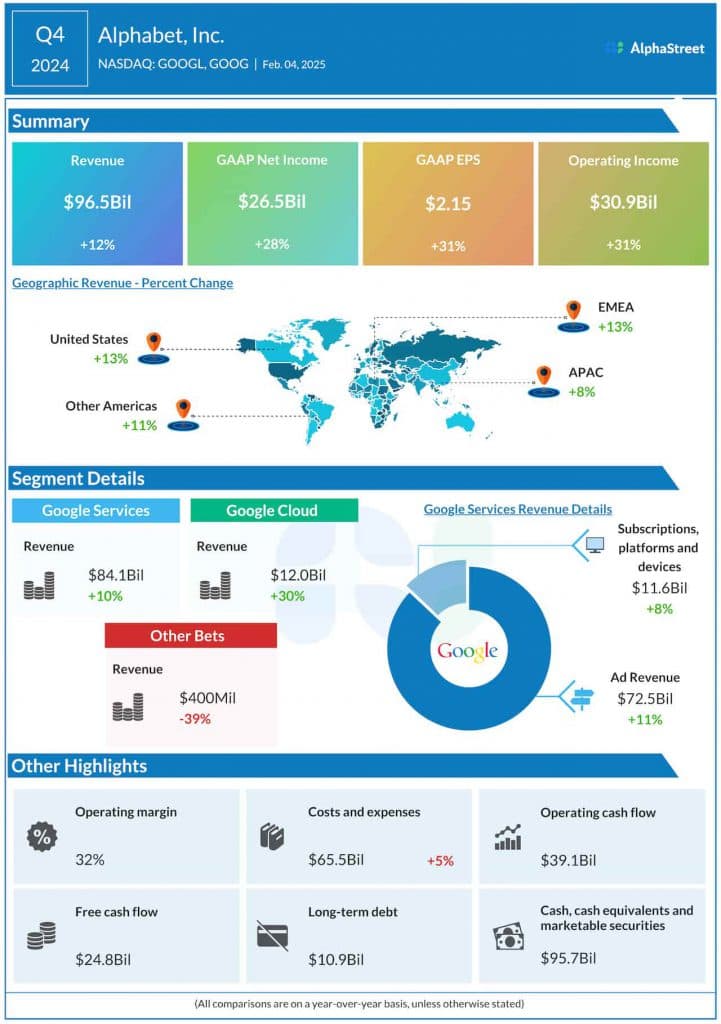

Analysts project Alphabet to report approximately $93.8 billion in revenue for Q2 2025, marking a 10.7% year-over-year increase. Net income is expected to reach around $26.5 billion, reflecting a 12.2% rise from the previous year. These projections follow a strong first quarter where Alphabet exceeded estimates, driven by resilient advertising revenue and robust growth in its cloud services.

A significant driver of Alphabet's anticipated growth is its continued leadership in artificial intelligence. The company has heavily invested in AI infrastructure, with a planned $75 billion in capital expenditures for 2025. Innovations such as the Gemini 2.5 Pro model and AI Overviews, now integrated into Google Search and reaching 1.5 billion monthly users, are enhancing user engagement and bolstering advertising revenue. Google Cloud, a key growth segment, is expected to see its revenue jump by 26% year-over-year in Q2, fueled by strong enterprise demand for AI-infused solutions.

Despite positive financial forecasts, Alphabet faces considerable regulatory headwinds. The company is currently defending against antitrust lawsuits in the U.S., which allege monopolistic practices in its search engine and online advertising markets. A recent district court ruling in the U.S. found Google guilty of antitrust violations in its advertising business, potentially leading to structural changes. In Europe, an unresolved €4.1 billion fine related to Android's anticompetitive practices also looms.

Market sentiment remains cautiously optimistic, with analysts largely maintaining "buy" or "strong buy" ratings for Alphabet stock. However, concerns about the potential impact of regulatory rulings and increasing competition in the AI space have led to a slight decline in the average target price. Investors will closely monitor management's commentary during the upcoming earnings call for updates on these critical issues and the company's strategic direction.