Banks Arrange $38 Billion Debt for Oracle-Linked AI Data Centers Amidst Market Bubble Concerns

Financial institutions are reportedly arranging a substantial $38 billion debt package to fund the development of data centers tied to Oracle Corporation's ambitious artificial intelligence infrastructure expansion. This significant financing move comes as industry observers raise concerns about the increasing reliance on debt to fuel the AI boom, with some likening current market conditions to a potential bubble.

The debt package, led by JPMorgan Chase & Co. and Mitsubishi UFJ Financial Group, is intended to finance data center projects in Wisconsin and Texas. A $23 billion loan for a campus in Shackelford County, Texas, is already secured, with these facilities expected to support Oracle's massive cloud computing commitments, particularly its reported $300 billion deal with OpenAI over five years.

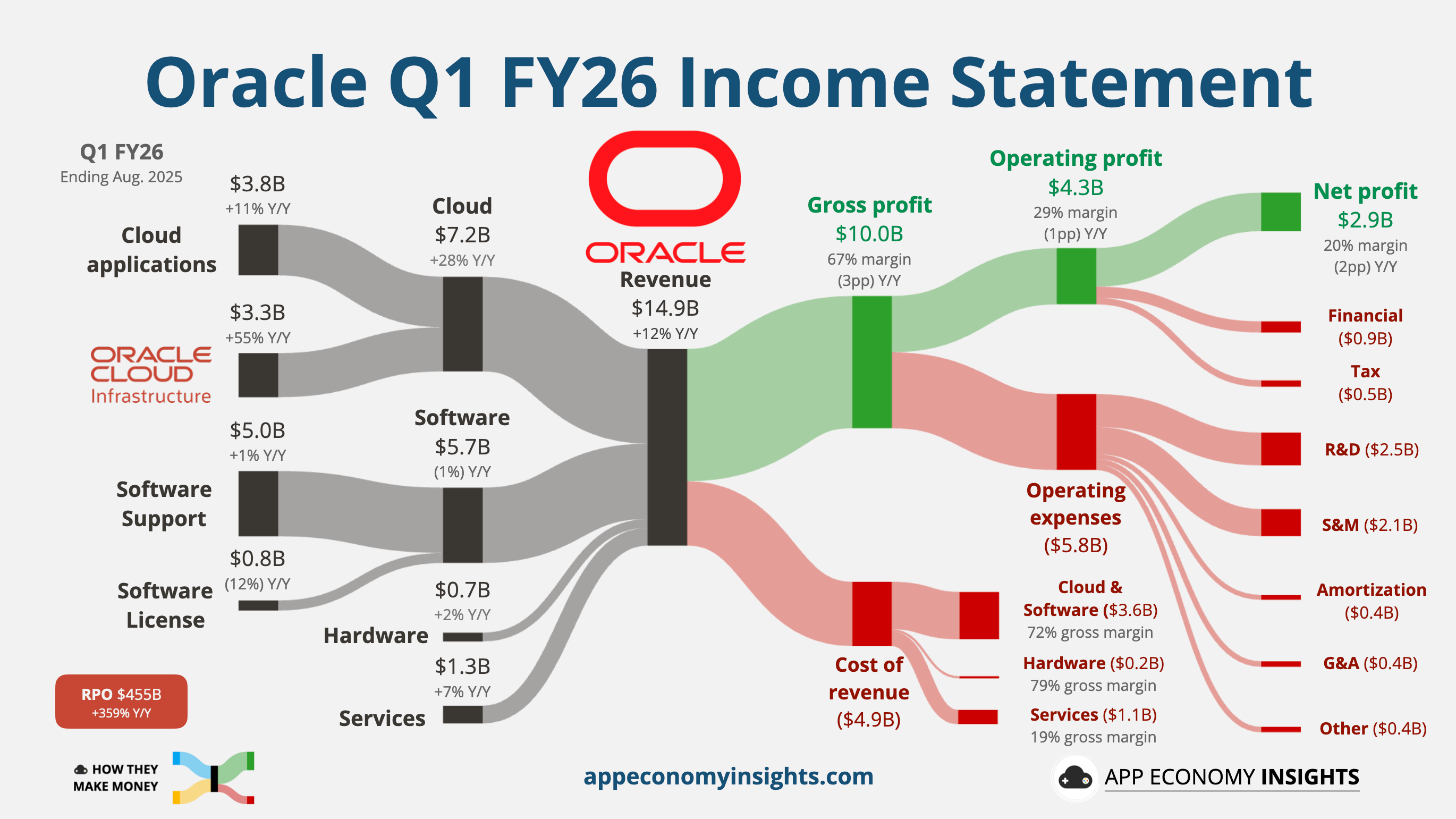

Oracle has been aggressively expanding its AI cloud capabilities, announcing plans to invest $1 billion in the Netherlands and $2 billion in Germany over the next five years for AI and cloud infrastructure. The company's Remaining Performance Obligations (RPO) quadrupled to $455 billion, largely driven by its partnership with OpenAI, which includes the "Stargate" project, a joint venture aiming for $500 billion in AI infrastructure by 2029. However, Oracle's debt-to-equity ratio has been noted as significantly higher than some competitors, reaching over 400%.

The use of substantial debt to fund this expansion has drawn scrutiny. As one social media user, ƁЕΗ, noted in a tweet, "> Oracle getting into AI infra with debt, not cash, is a major phase shift sign. When people start competing in a bubble on debt, we are in the late stages. Then failure ripples out to the lenders too." This sentiment reflects broader market anxieties.

OpenAI CEO Sam Altman has also expressed concerns, stating he believes the AI market is in a bubble and warning that "someone's gonna get burned." An MIT study further highlighted that 95% of corporate generative AI projects have yet to yield meaningful financial returns, intensifying worries that investment hype may be outpacing real-world profitability. The discrepancy between OpenAI's current annual revenue run rate of approximately $12 billion and its $60 billion annual compute commitment to Oracle raises questions about the long-term financial viability and the potential risks for lenders involved in these massive infrastructure projects.