China's 90% Dominance in Key Mineral Processing Threatens US Tech Production

China controls over 90% of the global processing capacity for several critical minerals vital for advanced technology, posing a significant challenge to the United States' technological independence. This extensive control, highlighted by a recent tweet from Tim Gradous, underscores a global scramble to secure essential raw materials. Gradous stated, "Without these minerals, US tech production stops. And China has 90% of them," adding, "The race is on to dig up the dirt America needs to keep its technological lead."

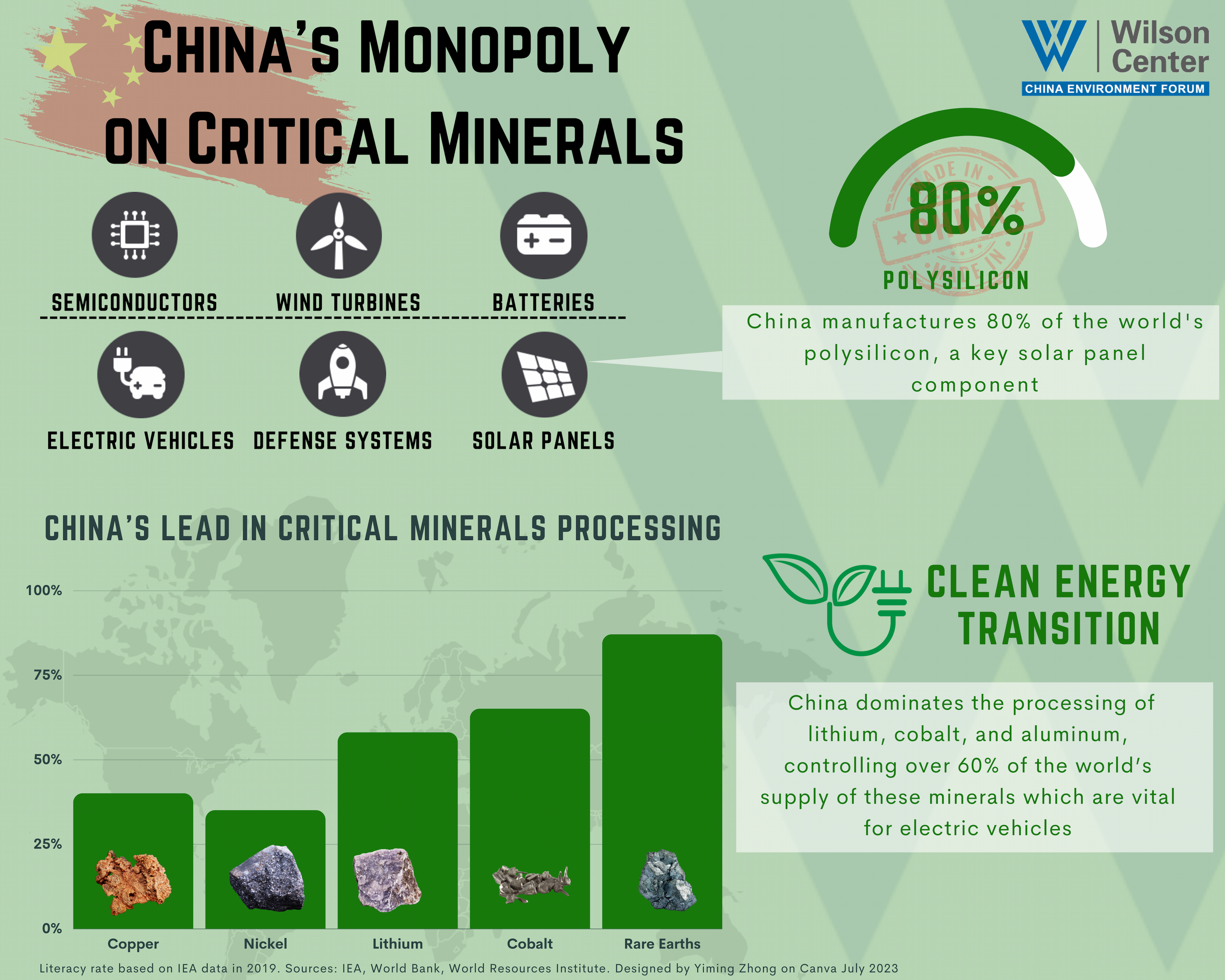

Beijing's near-monopoly extends to the refining of rare earth elements, gallium, and magnesium, all indispensable for sectors ranging from consumer electronics and electric vehicles to defense systems and renewable energy. In 2024, China accounted for over 90% of global gallium and magnesium refining, and approximately 70% of rare earth element mining, with its processing share even higher. This dominance has been strategically built over decades through government support and investments in global mining operations, notably through initiatives like the Belt and Road.

The geopolitical implications of this concentration became starkly evident in 2023 and 2025 when China implemented export restrictions on critical minerals, including gallium, germanium, and rare earth elements. These measures prompted concerns about supply chain disruptions, with some US and European carmakers reportedly facing production cuts due to shortages of components like permanent magnets. The International Energy Agency (IEA) reported in October 2025 that China's expanded export controls on rare earths and lithium-ion battery supply chains could severely impact strategic sectors globally.

In response to China's leverage, the United States and the European Union are actively pursuing strategies to diversify their critical mineral supply chains. The US Department of Defense, for instance, has entered into a significant agreement with MP Materials, which operates the only rare earth mining and processing facility in the US, to bolster domestic production. Similarly, the EU announced 13 new projects in June aimed at increasing local mining and processing of raw materials, including cobalt and graphite, to reduce reliance on external suppliers.

These initiatives reflect a concerted effort by Western nations to mitigate vulnerabilities and ensure the long-term resilience of their technological and industrial bases. The global competition for critical minerals is intensifying, with countries seeking to establish secure and diversified sources to power their advanced manufacturing and green energy transitions.