China's Capital Markets: A Dual-Edged Sword Amidst Economic Pressures

BEIJING, China – China's formidable capital markets, a key driver of its economic ascent, are increasingly viewed by some as a potential source of instability, despite their immense scale. This dichotomy was sharply articulated in a recent social media post by user 'cat', who stated, "> China is so fucking based. our greatest strength (capital markets) will be our downfall. it is written." This sentiment underscores a growing debate about the long-term resilience of China's financial system amidst significant domestic and global challenges.

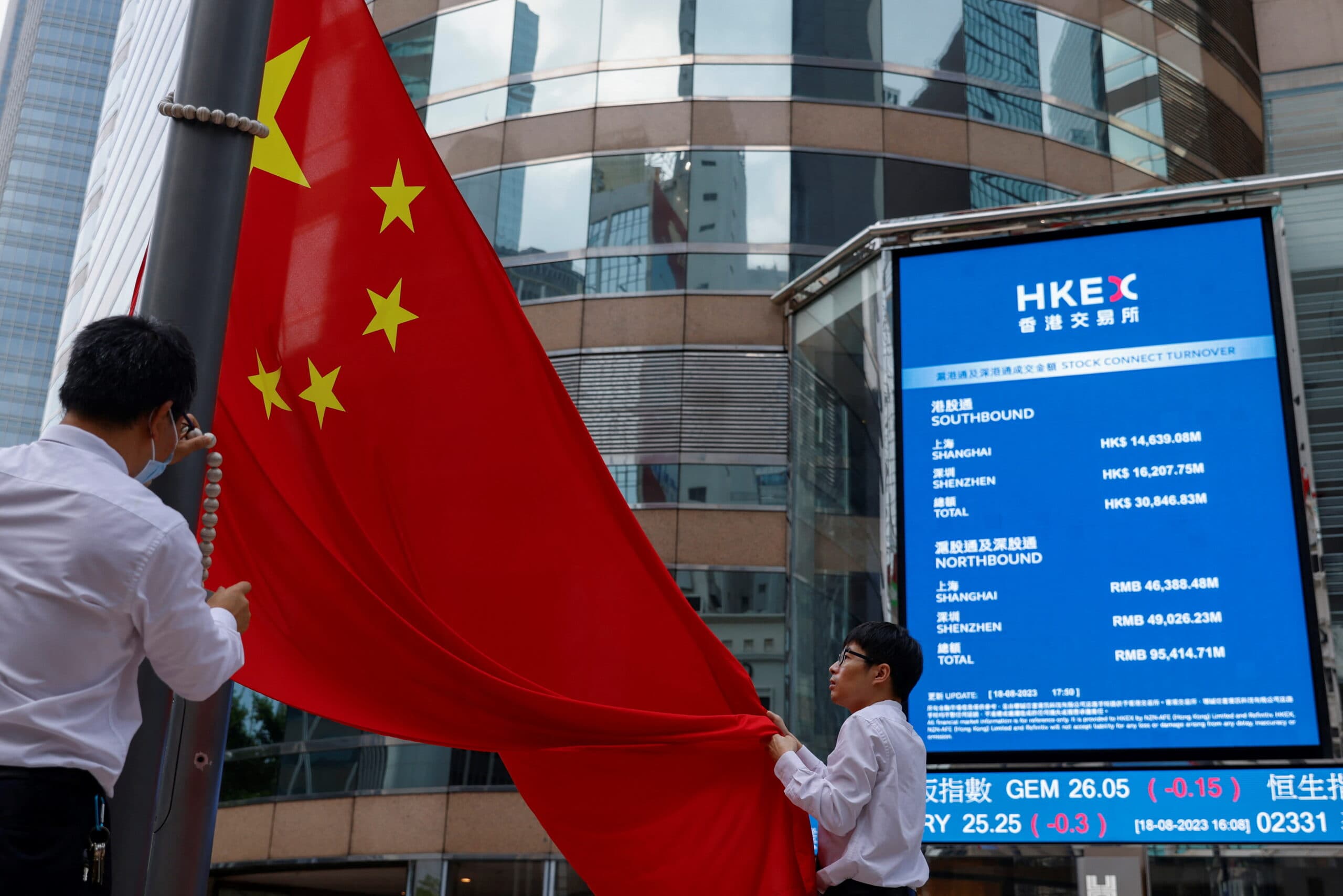

Historically, China's economic growth has been underpinned by robust capital formation and investment. However, the nation faces a complex economic landscape characterized by a prolonged real estate sector downturn, substantial local government debt, and persistent youth unemployment. These internal pressures are compounded by an evolving global trade environment and geopolitical tensions, which have influenced investor confidence and capital flows.

The People's Bank of China (PBC) has consistently employed capital controls and foreign exchange interventions to manage macroeconomic stability. Recent academic research, including a 2024 study published in ScienceDirect, emphasizes the crucial role of these capital controls in mitigating macroeconomic volatility. These measures highlight the government's proactive approach to financial risk management, often prioritizing stability over full market liberalization.

Despite these interventions, concerns persist regarding the health of the financial system. The dominance of state-owned enterprises (SOEs) and the banking sector's exposure to real estate and local government financing vehicles (LGFVs) are frequently cited vulnerabilities. While reforms have aimed to increase market efficiency, the inherent tension between state direction and market forces continues to shape the trajectory of China's capital markets.

The "The "downfall" narrative, as suggested by the tweet, often points to the potential for systemic risks stemming from high debt levels and the opaque nature of some financial instruments. However, proponents argue that the government's significant control and substantial foreign exchange reserves provide buffers against severe crises. The ongoing evolution of China's financial architecture will determine whether its capital markets continue to be a strength or indeed become a critical vulnerability.