Cryptocurrency Market Braces for Potential $14 Billion Short Squeeze

The cryptocurrency market is currently facing a significant build-up of short positions, totaling an estimated $14 billion, leading to predictions of an impending "massive short squeeze." This forecast, highlighted by prominent crypto analyst Ash Crypto, suggests a volatile period ahead for digital assets as bearish bets reach critical levels. The substantial volume of short interest indicates a widespread expectation among some traders for a market downturn.

A short squeeze occurs when the price of a heavily shorted asset begins to rise, forcing short sellers to buy back the asset to cover their positions and limit potential losses. This forced buying activity further drives up the asset's price, creating a rapid upward movement. In the highly leveraged cryptocurrency market, such events can be particularly dramatic, leading to sharp price increases across various digital currencies.

The $14 billion figure, as stated by Ash Crypto in a recent social media post, represents a considerable amount of capital betting against the market. Historically, high short interest often precedes significant price reversals, as a large pool of potential buyers (short covering) is created. This dynamic can amplify upward price movements once a trigger event occurs, such as positive news or a shift in market sentiment.

Analysts suggest that such a large accumulation of short positions could indicate either extreme bearish sentiment or a market ripe for a significant correction upwards. The potential for a short squeeze underscores the inherent volatility and speculative nature of the cryptocurrency landscape. Market participants are closely watching for any catalysts that could initiate the predicted squeeze, which could lead to rapid price appreciation for affected assets.

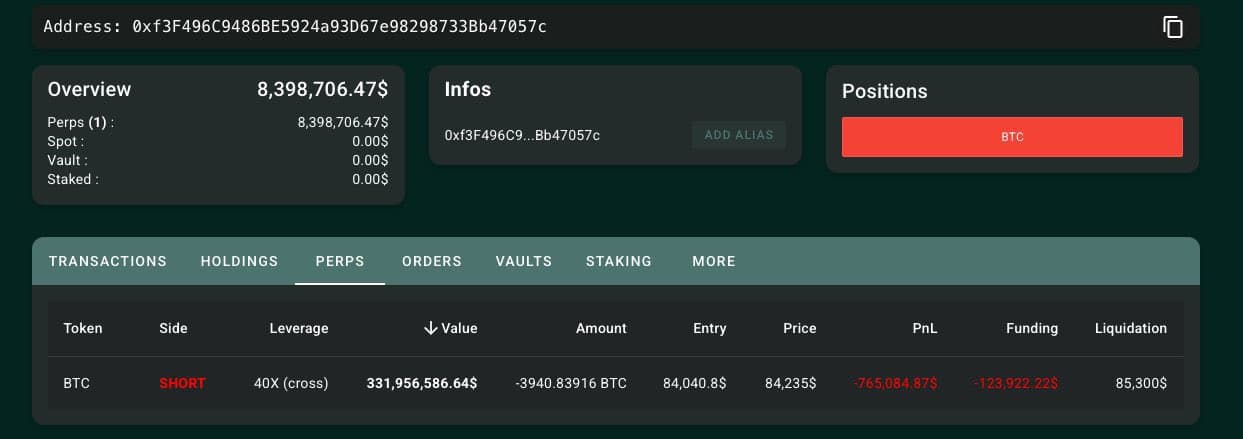

The implications of a multi-billion dollar short squeeze extend beyond individual assets, potentially impacting overall market liquidity and investor confidence. Traders are advised to monitor funding rates, open interest, and liquidation levels across major exchanges, as these metrics often provide early indicators of an impending squeeze. The current market structure suggests that a substantial price movement, driven by the unwinding of these short positions, could be on the horizon.