EigenLayer's Total Value Locked Reaches $19.7 Billion Amid Strategic Shift and Upcoming Token Unlock

Blockchain infrastructure provider EigenLayer has seen its Total Value Locked (TVL) surge to an all-time high of $19.7 billion as of September 1, 2025, capturing a significant 70% of the burgeoning restaking market. This impressive growth comes as the platform gears up for a pivotal period, with a key team member expressing strong optimism for the coming year. "The next 12 months of @eigenlayer look incredibly exciting for builders, users and $EIGEN tokenholders," stated @chainyoda on social media, signaling a positive outlook for the protocol and its native token.

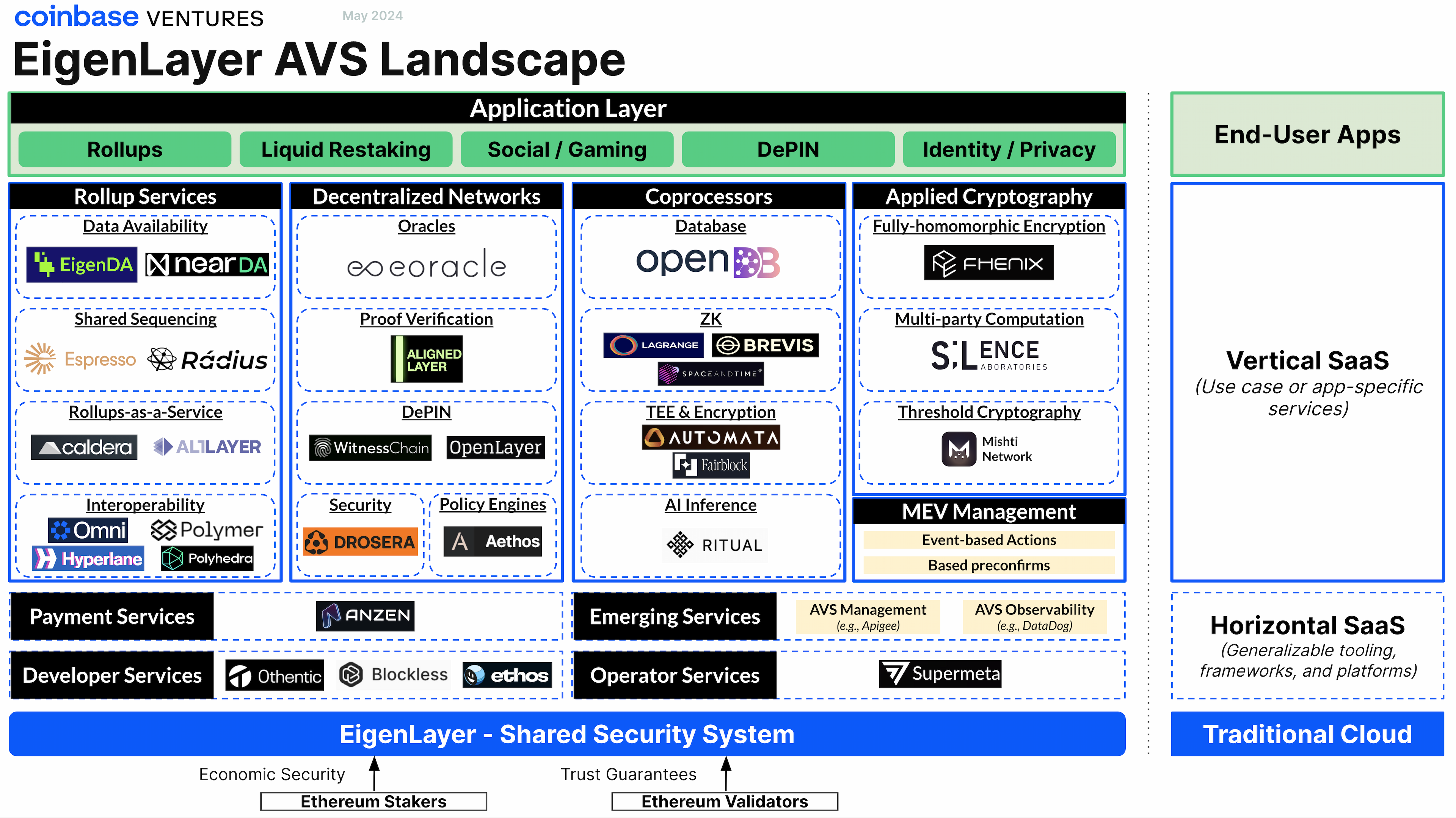

EigenLayer operates as a foundational restaking protocol on Ethereum, enabling users to re-leverage their staked Ether (ETH) or Liquid Staking Tokens (LSTs) to secure various Actively Validated Services (AVSs). This innovative mechanism allows new decentralized applications (dApps) to tap into Ethereum's robust security without the need to bootstrap their own validator sets, fostering a more capital-efficient and secure ecosystem for Web3 development.

Despite the substantial growth in TVL, the EIGEN token has experienced a disconnect in its market performance, currently trading around $1.39, a decrease of 62.57% from its peak in December 2024. A critical upcoming event for the token is the lifting of transfer restrictions on September 30, 2025, which will allow previously airdropped EIGEN tokens to be freely traded on exchanges, potentially introducing new market dynamics.

In a significant strategic pivot, EigenLayer's core developer, Eigen Labs, launched EigenCloud on June 17, 2025. This new developer platform aims to extend crypto-economic trust to both on-chain and off-chain applications, unifying services such as EigenDA for data availability, EigenVerify for dispute resolution, and EigenCompute for decentralized execution. The strategic shift was underscored by a fresh $70 million investment from Andreessen Horowitz (a16z), bringing their total commitment to over $170 million.

The company's sharpened focus on EigenCloud has also led to internal restructuring, including a 25% workforce reduction in July 2025 and the departure of key personnel like Global Community Lead Ana Belén in August 2025. Concurrently, EigenLayer expanded its multi-chain verification capabilities in July 2025, allowing AVSs to operate on Layer 2 solutions such as Coinbase's Base, which is expected to reduce gas costs and accelerate broader adoption across the decentralized landscape.

The next 12 months are poised to be transformative for EigenLayer, as it navigates the full implications of the EIGEN token unlock and continues to advance its EigenCloud initiative. The company's strategic realignment and technological advancements aim to solidify its position as a cornerstone of verifiable computing, aligning with the optimistic sentiment shared by community leaders regarding its future trajectory.