Ethereum's DeFi Dominance Solidified by $66 Billion TVL and Major Upgrades

Ryan Sean Adams, co-founder of the prominent crypto media brand Bankless, recently underscored Ethereum's foundational role in decentralized finance (DeFi), asserting that the network was "built for DeFi." In a recent tweet, Adams declared, "All of this is DeFi. Ethereum was built for DeFi. Ethereum = world ledger. ETH = world reserve asset." This statement highlights the growing conviction among industry leaders regarding Ethereum's enduring significance in the evolving financial landscape.

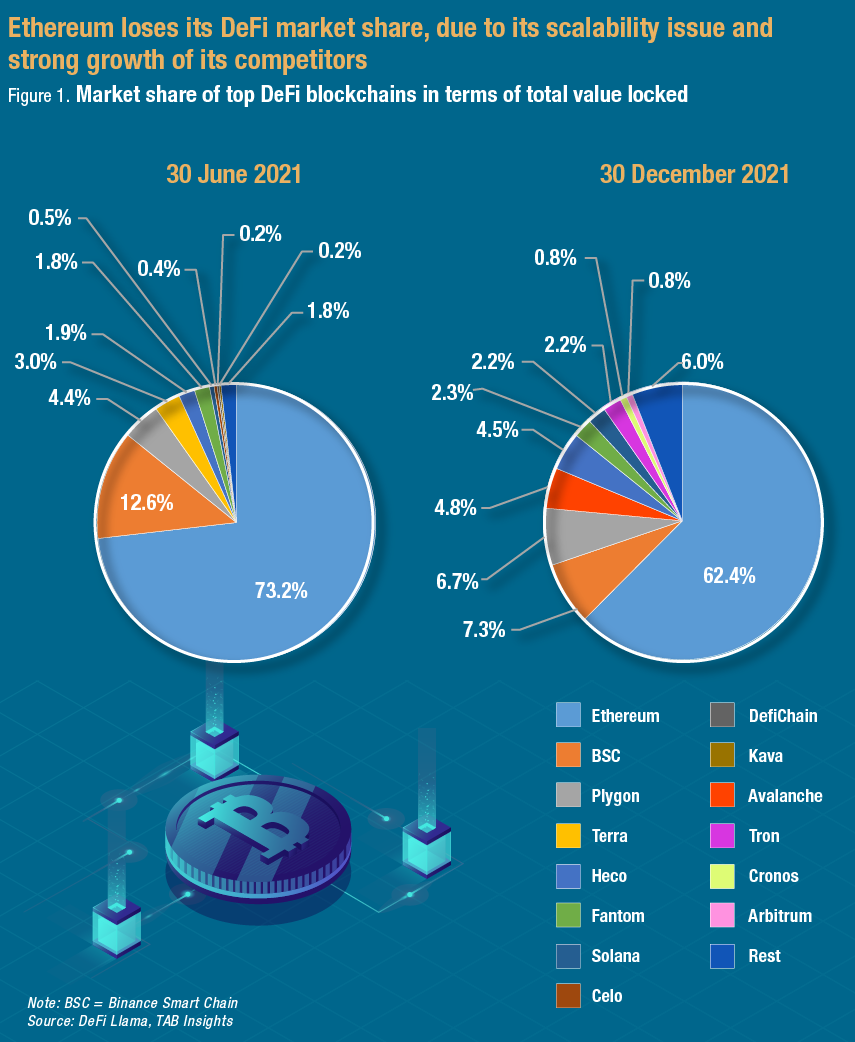

Ethereum continues to dominate the DeFi sector, currently holding approximately 61% of the total value locked (TVL) across DeFi protocols, amounting to roughly $66 billion. This substantial market share reflects the network's robust ecosystem, which facilitates a wide array of decentralized financial services, including lending, borrowing, and trading without traditional intermediaries. The network's foundational smart contract capabilities are central to these innovations, enabling automated and trustless financial operations.

Recent advancements and increasing institutional engagement are further bolstering Ethereum's position. The Pectra upgrade, implemented in May 2025, introduced key enhancements such as higher validator staking limits and the ability to pay gas fees using stablecoins, improving network efficiency and accessibility. Additionally, Layer 2 scaling solutions like Arbitrum and Optimism are significantly reducing transaction costs and congestion, addressing critical scalability challenges.

The market has also witnessed a surge in institutional interest, with significant investment inflows into Ethereum-based products. The approval of spot Ethereum ETFs in July 2024 has opened new avenues for traditional investors, contributing to sustained demand. This institutional adoption, coupled with a record 34.65 million ETH now staked—representing approximately 28.7% of the total supply—is creating upward price pressure by reducing the circulating supply and reinforcing confidence in ETH as a long-term asset.

Adams' vision of "ETH = world reserve asset" aligns with the asset's increasing utility and economic characteristics, often described as "digital gold with yield" due to its staking rewards and deflationary mechanisms. While the DeFi market faces ongoing challenges, including regulatory uncertainties and security risks, Ethereum's continuous development, strong community, and growing integration into both crypto and traditional financial systems position it as a pivotal player in the future of global finance.