Goldman Sachs Executes $87 Million Russian Asset Sale to Balchug Capital Under Presidential Decree, Highlighting Off-Market Transaction Capabilities

A recent tweet by Michael Luo questioning how Goldman Sachs could sell stock on a Saturday, when markets are typically closed, highlights a common misconception about the intricacies of financial transactions. While public stock exchanges observe weekend closures, certain large-scale, privately negotiated deals, often termed "block trades" or "private placements," can indeed be executed outside conventional trading hours, particularly under specific circumstances and regulatory approvals.

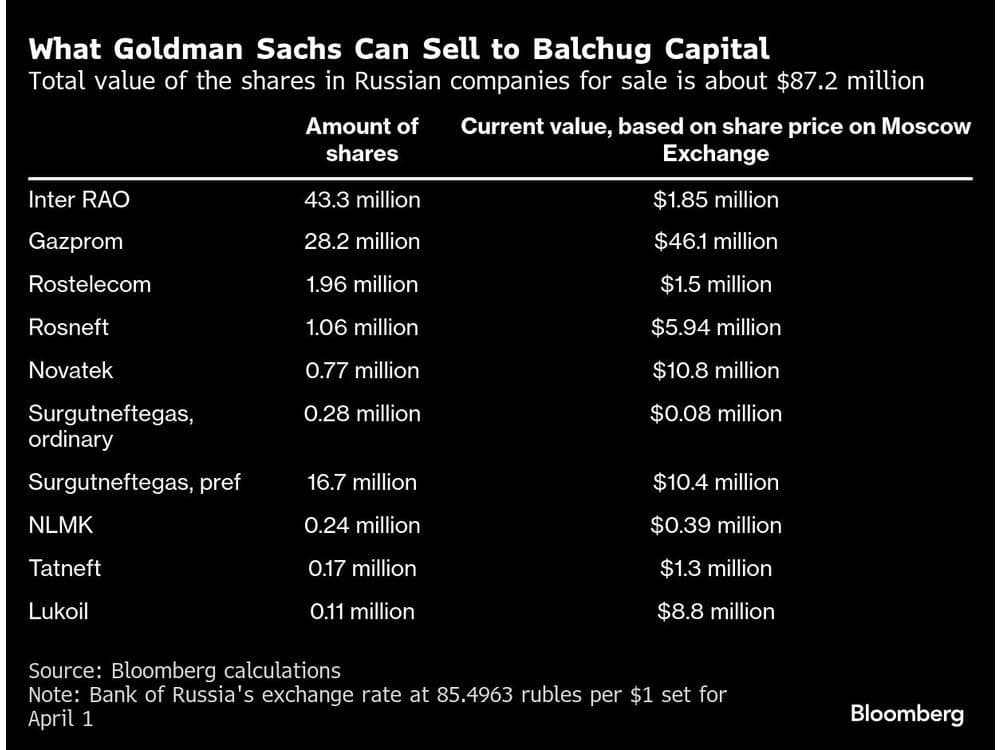

One such significant transaction recently confirmed was Goldman Sachs's sale of its shares in nine major Russian companies to the Armenian investment fund Balchug Capital. Russian President Vladimir Putin authorized this divestment through a special decree, enabling Goldman Sachs to exit the Russian market following its earlier announcement to wind down operations there. The value of these shares was estimated to be around $80 million to $87 million.

This type of strategic sale, involving substantial holdings in entities like Gazprom, Rosneft, and Lukoil, is typically arranged through direct negotiations between institutional parties. These transactions bypass the open market to minimize price disruption and are often facilitated by investment banks. Such private agreements can be finalized on non-trading days, with the official reporting to regulatory bodies occurring on the subsequent business day, a process known as "as/of" reporting.

It is important to distinguish these complex, institutional transactions from the "Saturday rule" often associated with Goldman Sachs. This internal policy, which gained attention in recent years, mandates that junior bankers take Saturdays off to improve work-life balance. This internal human resources policy is entirely separate from the mechanisms and regulations governing the trading of financial instruments.

Ultimately, while the general public cannot trade stocks on a Saturday, the financial world allows for specific, large-volume transactions to be negotiated and executed off-market. These deals are typically reserved for institutional players and often occur under unique conditions, such as the strategic withdrawal from a market or a private placement, demonstrating the multifaceted nature of global finance beyond standard exchange hours.