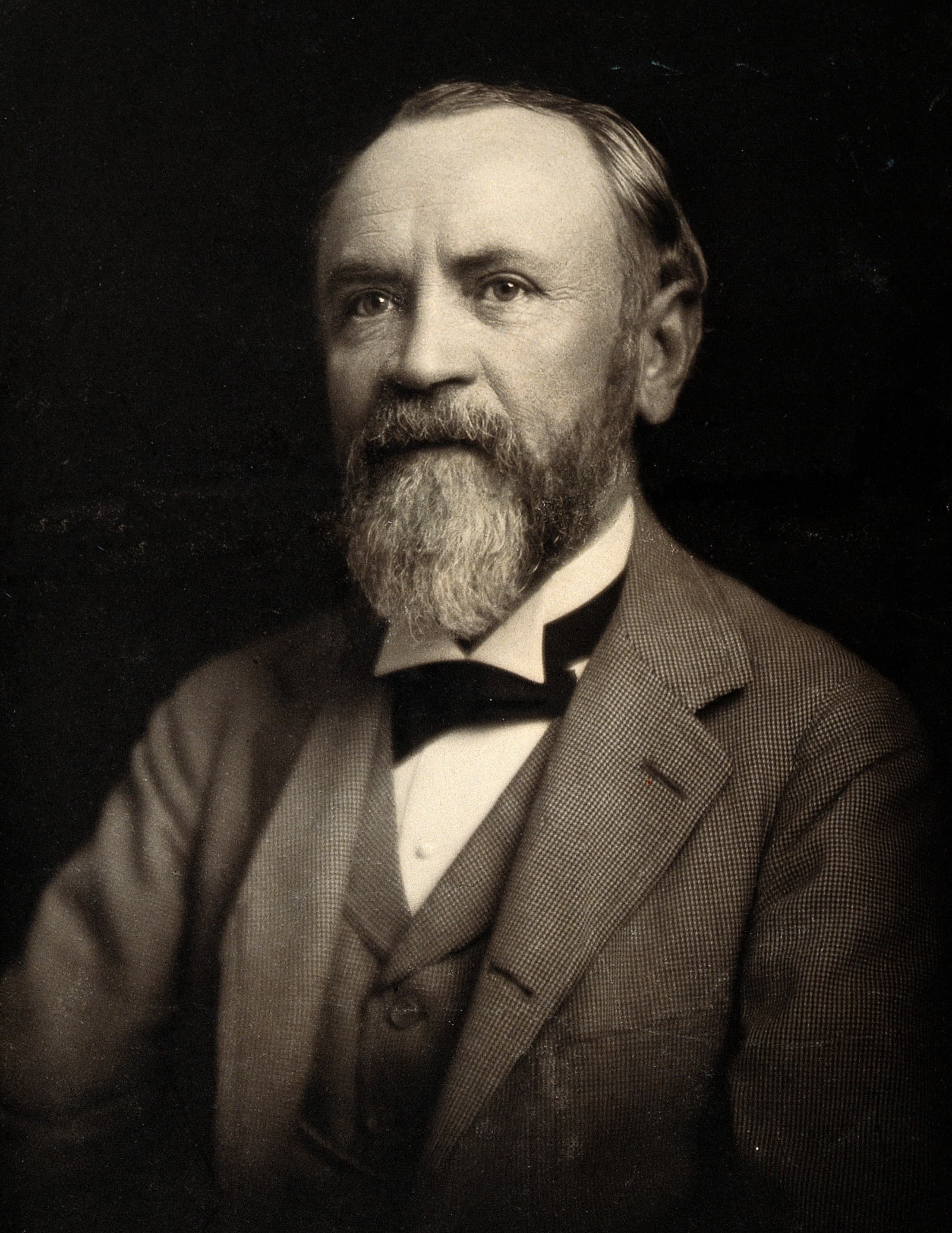

Henry Phipps Jr. (Bessemer Venture Partners): 10 Key Things You Must Know

Overview

Henry Phipps Jr., a pivotal figure in the American industrial era, is best known as a business magnate and philanthropist who played an instrumental role in the success of the Carnegie Steel Company. His legacy is closely tied to the rise of steel manufacturing in the United States during the late 19th and early 20th centuries. While less commonly linked to venture capital, the name Henry Phipps Jr. carries enduring influence, including indirect connections with modern investment entities like Bessemer Venture Partners, which draws inspiration from Phipps family ventures. This article explores his life, business achievements, philanthropy, and lasting impact on industry and society.

1. Early Life and Family Background

Born in 1839 in Philadelphia, Pennsylvania, Henry Phipps Jr. grew up in a family with strong ties to commerce and industry. His early education laid the foundation for an astute business acumen. Phipps was the son of a successful merchant, and this environment exposed him to commercial operations from a young age. His connection with Andrew Carnegie, forged during their youth, would be pivotal in shaping his business career. This early partnership seeded the powerhouse that would become Carnegie Steel.

2. Partnership with Andrew Carnegie

Henry Phipps Jr.'s partnership with Andrew Carnegie began in the 1860s, catalyzing the rise of one of the most influential steel companies in history. As Carnegie’s most trusted business partner, Phipps contributed not only capital but strategic decisions that helped grow the company into a dominant force. While Carnegie was the public face, Phipps's role was crucial in managing operations and investments, nurturing the enterprise through critical early phases.

3. Role in Carnegie Steel Company

Phipps served as vice president of Carnegie Steel, responsible for the company's finances and operations. His prudent financial management and operational insight helped propel Carnegie Steel to become one of the largest and most profitable industrial enterprises of its time. The company's innovations and expansion under Phipps’s stewardship contributed significantly to America’s industrialization.

4. Wealth and Philanthropy

Upon the sale of Carnegie Steel to J.P. Morgan in 1901—forming the U.S. Steel Corporation—Henry Phipps Jr. became one of the wealthiest men in America. Committed to philanthropy, he donated much of his fortune to charitable causes, focusing notably on affordable housing and public health. His efforts included founding the Phipps Houses, New York City’s oldest affordable housing nonprofit, reflecting his dedication to improving urban living conditions.

5. Phipps Houses and Urban Development

Phipps's philanthropic legacy is prominently embodied by Phipps Houses, established in 1905 to provide quality housing for low-income workers. This initiative was revolutionary at the time, representing early efforts to address urban poverty and overcrowding. His commitment to social welfare set a precedent for corporate responsibility and influenced housing policy in New York City and beyond.

6. Influence on Venture Capital and Investment Philosophy

Though Henry Phipps Jr. predates the formal venture capital industry, his investment style embodied principles foundational to modern venture capital—such as risk management, diversification, and interest in innovation-driven growth. The Phipps family's name and legacy continue to inspire investment firms, including Bessemer Venture Partners, which traces its historical roots to the Phipps family's industrial and investment ventures.

7. Connection to Bessemer Venture Partners

Bessemer Venture Partners, a prominent global venture capital firm, carries a name linked to the Phipps family's heritage. 'Bessemer' refers to the Bessemer steel process, famously exploited by Carnegie Steel. Although Henry Phipps Jr. himself did not found this firm, his family's industrial legacy indirectly influences Bessemer’s identity, emphasizing innovation, industry evolution, and long-term investment philosophies akin to Phipps's practices.

8. Legacy in American Industry

Henry Phipps Jr.'s contributions extend beyond steel production; his approach to business, investment, and social responsibility helped shape American capitalism. His blend of entrepreneurship and philanthropy influenced future business leaders and set standards that bridged industrial success with societal stewardship.

9. Family and Succession

Phipps ensured his legacy through his descendants, notably his children who continued philanthropic activities and business investments. The family maintained influence in various sectors, shaping cultural and economic landscapes. Their commitment to charity and responsible investment remained hallmarks of the Phipps name.

10. Modern Recognition and Historical Impact

Today, Henry Phipps Jr. is remembered as a visionary businessman and compassionate philanthropist. Historical analysis credits him with playing a critical role in America's transition to an industrial powerhouse and a model for socially conscious wealth management. His story offers insights into the origins of corporate philanthropy and investment strategies still relevant in 21st-century finance.

Conclusion

Henry Phipps Jr.’s life encapsulates the dynamism of American industry during a time of dramatic change. From his partnership with Andrew Carnegie to his philanthropic endeavors, Phipps exemplified how wealth and social responsibility could coexist. His indirect influence on contemporary venture firms like Bessemer Venture Partners underscores a lasting legacy, blending industrial innovation with prudent investment strategies. Reflecting on Phipps’s story invites us to consider how business success can serve broader humanitarian goals in evolving economic landscapes.

References

- Henry Phipps Jr. Biography – Encyclopedia Britannica

- Carnegie Steel and the Rise of Henry Phipps Jr. – History.com

- Phipps Houses – History and Mission

- The Formation of U.S. Steel – U.S. History Archives

- Bessemer Venture Partners: Legacy and Investment Philosophy

- Henry Phipps Jr.: Philanthropy and Social Impact – The New York Historical Society

- Industrial Philanthropy in America – Journal of American History

- Phipps Family Legacy – The Phipps Conservatory and Botanical Gardens

- Venture Capital History and Evolution – Harvard Business Review

- Steel Industry Innovations and Economic Impact – National Archives