High-Profile SPAC Aims for $260 Million IPO with Trump Jr., Palihapitiya, and Ingraham

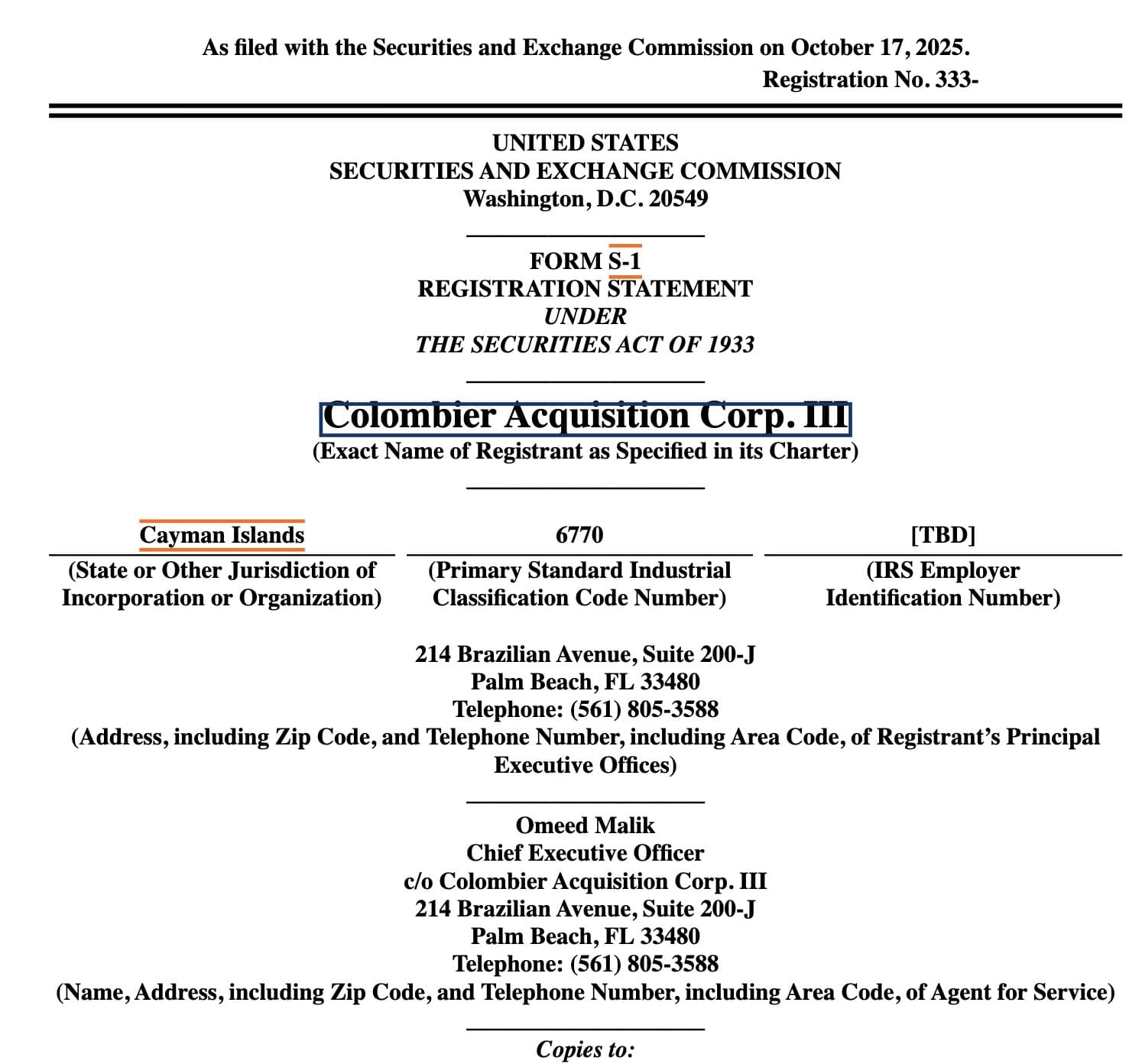

A new Special Purpose Acquisition Company (SPAC), Colombier Acquisition Corp. III, is seeking to raise $260 million through an initial public offering, featuring a board that includes prominent figures Donald Trump Jr., investor Chamath Palihapitiya, and Fox News host Laura Ingraham. The announcement, reported on October 17, 2025, marks a significant development in the financial landscape, bringing together influential personalities from finance, media, and politics.

The blank-check vehicle, which aims to "fund the next chapter of American Exceptionalism and help Make America Grow Again," plans to offer 26 million shares priced at $10 each. This initiative is backed by Omeed Malik and Chris Buskirk's 1789 Capital, a firm known for its conservative-leaning financial endeavors. Palihapitiya, often dubbed "Wall Street's SPAC king," will serve as a director, leveraging his extensive experience in blank-check deals.

Donald Trump Jr., son of U.S. President Donald Trump, has been increasingly involved in various business ventures, including a firearms retailer and a crypto company. Laura Ingraham, known for hosting "The Ingraham Angle" on Fox News, adds a significant media presence to the venture. The tweet announcing the SPAC explicitly stated, > "Chamath Palihapitiya, Donald Trump Jr, and Laura Ingraham are launching a new SPAC... It will be incorporated in the Cayman Islands."

The decision to incorporate in the Cayman Islands aligns with a broader trend among SPACs in 2025, where over 95% of US-listed SPACs choose offshore jurisdictions. This preference is driven by the Cayman Islands' flexible corporate laws, tax neutrality, and lighter compliance obligations for Foreign Private Issuers. It also helps avoid certain US-specific regulatory burdens, such as the 1% excise tax on stock repurchases and the more stringent fiduciary duty standards imposed by Delaware courts.

The SPAC market, while past its 2020-2021 boom, has matured into a more disciplined phase, with international finance centers like the Cayman Islands playing a crucial role. The jurisdiction's "business judgment rule" offers a more favorable environment for management teams and directors, and its "loser pays" cost rule in litigation deters speculative lawsuits, making it an attractive choice for high-profile financial undertakings.