IRS Mandates New 1099-DA Form for Digital Asset Transactions Starting 2025

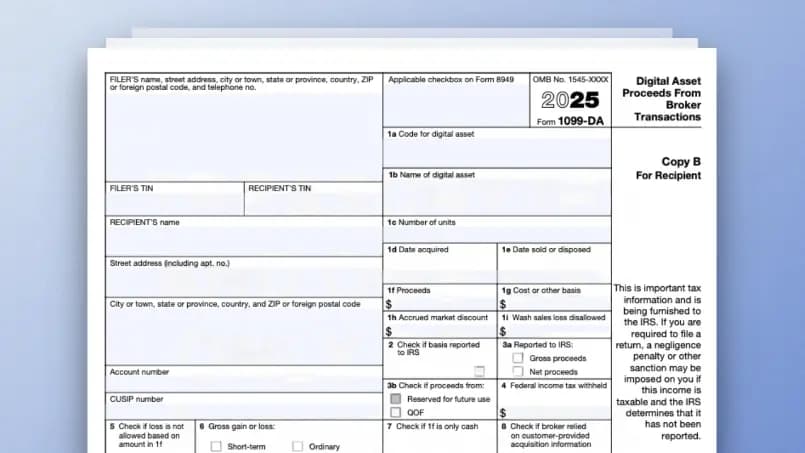

The Internal Revenue Service (IRS) is set to introduce a new Form 1099-DA, requiring custodial platforms to report digital asset transactions to both the agency and their customers, effective for transactions occurring on or after January 1, 2025. This significant change aims to enhance tax compliance within the rapidly evolving cryptocurrency market. According to a recent social media post from CoinTracker, a crypto tax software provider, "Time to get familiar with new IRS Form 1099DA..."

This new reporting obligation applies to a broad range of digital asset activities. Custodial platforms such as Coinbase, PayPal, and Robinhood will now be responsible for issuing Form 1099-DA for various transactions. The form specifically covers crypto sales, exchanges, and redemptions, extending to crypto-to-crypto trades, stablecoin conversions, and NFT sales conducted on centralized platforms.

The implementation of these rules stems from a provision within the 2021 Infrastructure Investment and Jobs Act, which mandated clearer reporting requirements for digital asset brokers. The IRS finalized these regulations, providing guidance for brokers to report sales and exchanges of digital assets, regardless of whether they are classified as securities. This legislative backing underscores the government's intent to bring digital asset taxation in line with traditional financial assets.

A crucial expansion of these reporting requirements is slated for 2026. For transactions occurring on or after January 1, 2026, brokers will additionally be required to report cost basis and gain or loss information for digital assets acquired from that date forward. CoinTracker highlighted this future development, stating, "In 2026, it'll expand to include cost basis for covered assets, reducing guesswork for taxpayers."

This phased approach grants platforms additional time to develop the necessary systems to accurately track and report cost basis information. The introduction of Form 1099-DA and the subsequent cost basis reporting are expected to significantly impact digital asset users, providing greater transparency to the IRS and potentially simplifying tax preparation for many by reducing the guesswork involved in calculating capital gains and losses.