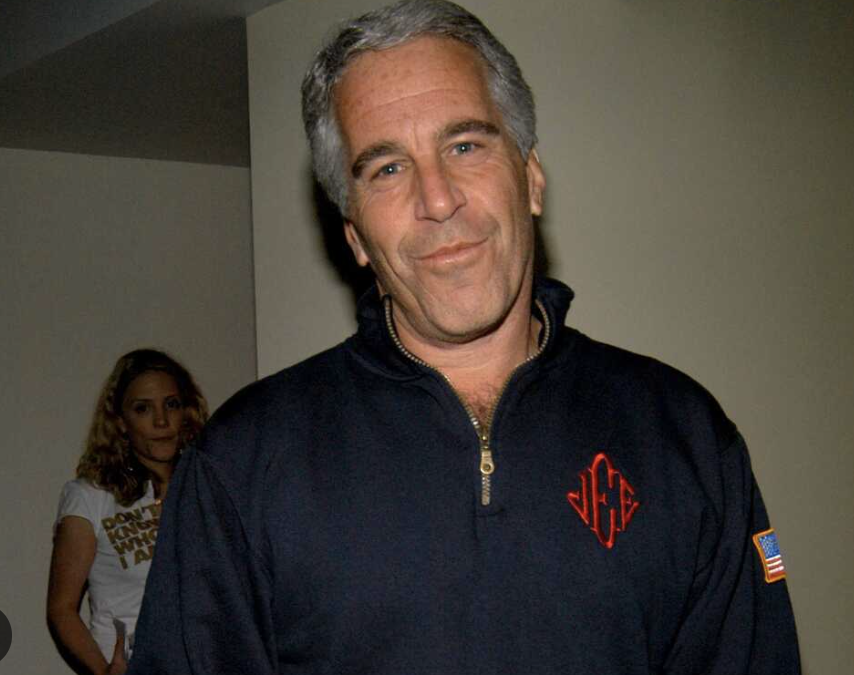

Jeffrey Epstein Estate Receives $112 Million IRS Refund Due to Tax Overpayment

The estate of deceased financier Jeffrey Epstein received a substantial $112 million refund from the Internal Revenue Service (IRS) in 2021. This significant payment stemmed from an overpayment of estate taxes, primarily related to state and foreign tax credits. The refund became publicly known through court filings and was a standard procedure for estates that initially over-calculate their tax liabilities.

The overpayment occurred because the estate had initially paid a higher amount in state and foreign taxes than was ultimately required, allowing for a corresponding credit against federal estate taxes. This adjustment led to the substantial refund, which was processed as part of the estate's ongoing financial administration. The refund highlights the complex financial mechanisms involved in settling large estates, particularly those with international assets.

Despite the refund, Epstein's estate has been burdened with immense financial obligations, including hundreds of millions of dollars paid out to victims of his sex trafficking crimes. The Epstein Victims' Compensation Program, established in 2020, has distributed significant funds to claimants, with the estate's assets being liquidated to meet these demands. The estate continues to face various legal challenges and claims from multiple parties.

The return of such a large sum to the controversial estate prompted public discussion and reminders of its financial dealings. As journalist Yashar Ali recently noted on social media, > "Let’s not forget, Jeffrey Epstein’s estate got a $112 million refund from the IRS." This statement underscored the continued public interest in the financial intricacies surrounding Epstein's affairs.

The refund represents a technical aspect of estate tax law rather than a new financial gain for the estate. Its primary purpose is to rectify an initial overestimation of tax liabilities, ensuring the estate complies with federal tax regulations. The ongoing management of the estate's assets and liabilities remains a complex and closely watched legal process.