Nasdaq's AI-Driven Valuation Surpasses S&P 500 by Over 12 Points

The Nasdaq 100 Index is currently valued at a Price-to-Earnings (P/E) ratio of approximately 35.53, significantly higher than the S&P 500's P/E of around 22.2 (forward P/E) and mid-cap stocks at roughly 15.7 (S&P 600 forward P/E). This valuation disparity highlights a market expectation for substantial future growth, particularly within the technology sector heavily influenced by artificial intelligence (AI).

Rohan Paul, a market observer, highlighted this trend, stating in a recent tweet, "> The Nasdaq is priced at 30x earnings, While the S&P 500 ~23x, and mid-caps ~16x. Nasdaq (dominated by the big tech) already bakes in big AI monetization, so results must prove that the spend on models, chips, and cloud turns into rising margins and real recurring revenue." This perspective underscores the market's aggressive pricing of technology companies, anticipating that investments in AI will translate into tangible financial returns.

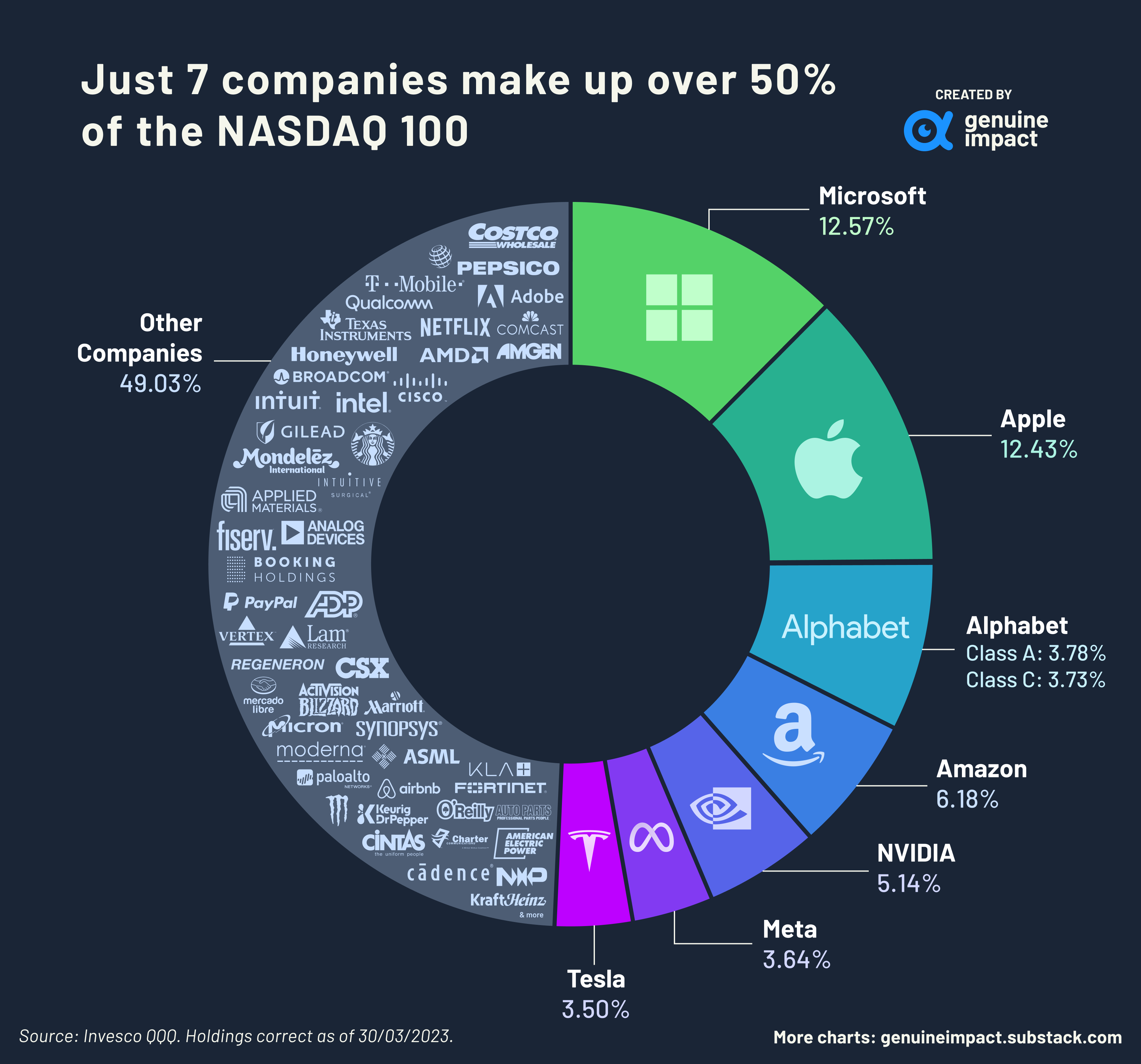

Recent data indicates the Nasdaq 100's current P/E ratio is considered "Overvalued" when compared to its average over the last five years, which ranged between 27.26 and 32.94. This elevated valuation is largely attributed to the strong performance and exceptional profitability of mega-cap technology firms, often referred to as the "Magnificent Seven," which dominate the index. These companies are seen as beneficiaries of emerging technology trends, including cloud computing and AI.

The S&P 500's current P/E ratio, while lower than the Nasdaq's, also suggests a market that is "Strongly Overvalued" relative to its historical modern-era average. This broader market sentiment indicates that investors are willing to pay a premium for earnings across various sectors, though the tech-heavy Nasdaq exhibits the most pronounced expectations. The challenge for these highly valued tech giants lies in demonstrating that their significant expenditures on AI development, chips, and cloud infrastructure will indeed lead to sustained revenue growth and improved profit margins to justify their current lofty valuations.