Nvidia's AI Financing Model Sparks 'Shadow Banking' Concerns Amid Market Boom

Recent analyses suggest that Nvidia's pivotal role in the artificial intelligence (AI) ecosystem, particularly through its financing mechanisms, is creating a new form of "shadow banking" reminiscent of the pre-2008 financial crisis. This perspective, highlighted by financial commentators, raises questions about the sustainability and underlying risks of the current AI market boom. The tweet from "bubble boi" stating, "Nvidia acting as the shadow bank for AI will not end well," encapsulates a growing apprehension within financial circles.

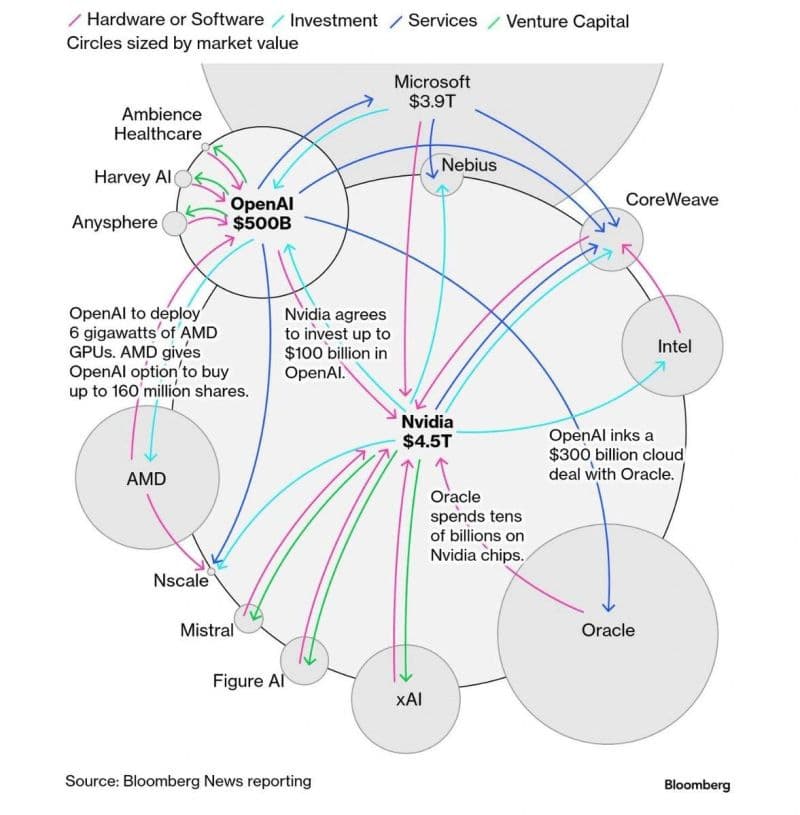

Sinéad O'Sullivan, in a widely discussed Substack post, argues that the AI economy is not merely driven by intelligence but by leverage. She posits that GPUs, compute contracts, and model access rights are functioning as a new collateral class, replacing mortgages from the 2008 crisis. Nvidia, a dominant supplier of AI chips, is central to this system by extending vendor financing, often structured as leases or deferred payments, to companies like CoreWeave, Lambda Labs, and Crusoe.

This financing creates a "daisy chain of debt and destiny," where entities like Microsoft lend to OpenAI, enabling OpenAI to rent GPUs from CoreWeave, which then repays Nvidia. This circular credit loop, where the same GPU can be pledged and re-pledged multiple times, fuels a recursive belief system where credit funds compute, generating hype and raising valuations. Experts like O'Sullivan and Zoltan Poszar, known for his work on shadow banking, illustrate how this system transforms hardware into collateral, collateral into liquidity, and liquidity back into hardware sales.

The current landscape also sees significant governmental involvement, with states globally subsidizing chips, data centers, and demand, effectively becoming co-signers on the AI balance sheet. This "financialized industrial policy" is a speculative arms race. While some, like Goldman Sachs, argue that current tech profits and strong balance sheets differentiate it from past bubbles, critics like James Anderson of Bailey Gifford warn of a "disconcerting rise in AI valuations," drawing parallels to the dot-com era.

The core concern remains whether the cash flows generated by AI will ultimately justify the massive investments and valuations. If AI demand stalls or training costs outpace revenue, the illusion of infinite liquidity could vanish, leading to a collapse in the GPU resale market, defaults on vendor loans, and a significant markdown of AI assets. This scenario, where the collateral itself becomes questionable, underscores the fragility of a system built on leverage rather than proven profitability.