Proposal Advocates for Government-Issued Stablecoins Featuring Continuous Rebasing Yield from T-Bill Reserves

An anonymous yet influential voice in the cryptocurrency space, identified only as "⟠," recently outlined a visionary model for a "truly great stablecoin" via a social media post. The proposal calls for a new generation of stable digital currencies issued directly by trusted foreign governments, such as Switzerland, Singapore, or the Cayman Islands. This innovative concept aims to address perceived shortcomings in the current stablecoin market, which the author describes as being in a "transitory period."

The detailed vision encompasses three core features. Firstly, the stablecoin would be a USD-pegged asset issued and backed by a reputable foreign government. Secondly, it would offer a continuously rebasing yield derived from U.S. Treasury bill reserves, with the issuing government and its partners retaining a reasonable take rate. Thirdly, the stablecoin would natively support on-chain splitting of its yield and principal components, akin to the functionality offered by protocols like Pendle Finance.

This advanced design is intended to empower the application layer of the blockchain ecosystem. "This makes it easier for the app layer to permissionlessly build its own complex yield sharing schemes, providing a much better cryptonative alternative to corpo orchestration," the author stated. This level of programmability and integrated yield management is currently absent in most mainstream stablecoins.

The author strongly criticized the existing stablecoin landscape, asserting, "I'd go so far as to say that this industry is not particularly serious until better stables are dominant." This highlights a belief that current stablecoins, while foundational, lack the sophistication and integrated yield mechanisms necessary for the industry's long-term maturity and widespread adoption. The implication is that a truly superior product could "change the industry forever."

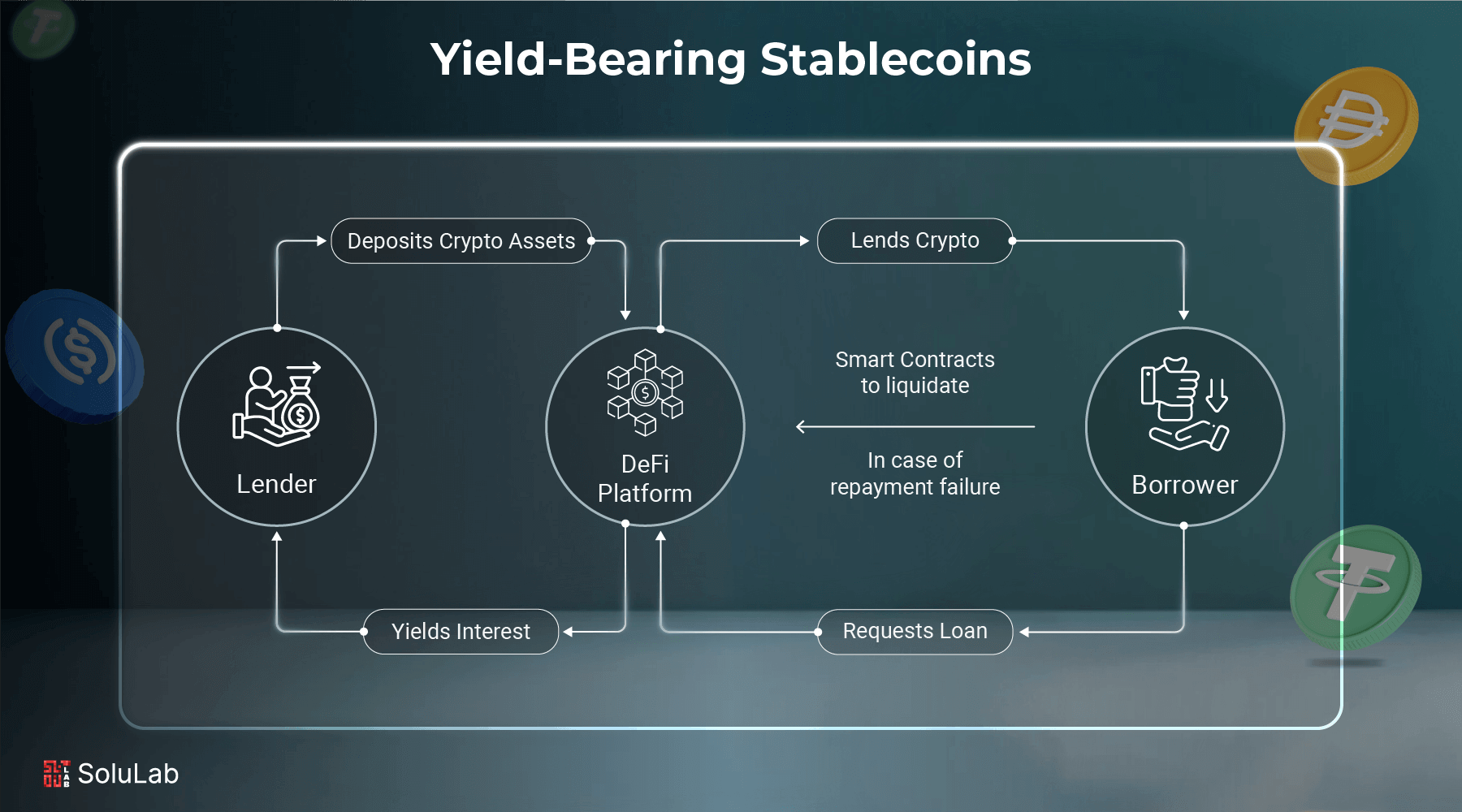

The concept of yield-bearing stablecoins, which generate returns from underlying assets like U.S. Treasuries, is gaining traction, with projects like Mountain Protocol's USDM already in operation. Pendle Finance, referenced in the tweet, specializes in yield tokenization, allowing users to separate and trade the future yield of an asset independently from its principal. This mechanism could enable the proposed stablecoin to offer flexible yield strategies directly on-chain.

However, the regulatory landscape for such an asset remains complex. While countries like Switzerland and Singapore are actively developing stablecoin regulations, the idea of a government-issued, yield-bearing stablecoin faces significant hurdles. For instance, the U.S. GENIUS Act, enacted in July 2025, explicitly prohibits stablecoin issuers from offering any form of interest or yield, indicating a cautious approach from major economies towards yield-bearing digital currencies.