Real Estate Investors Confront Up to 25% Tax on Depreciation Recapture, Ordinary Rates for Section 1245 Assets

Real estate investors leveraging depreciation benefits face a significant tax consideration known as depreciation recapture upon the sale of their properties. This mechanism, described by R.E. Cost Seg in a recent social media post as "Newton's law of tax: What goes down must come up," ensures the Internal Revenue Service (IRS) recovers a portion of previously claimed tax deductions. Understanding this complex tax event is crucial for effective financial planning in real estate transactions.

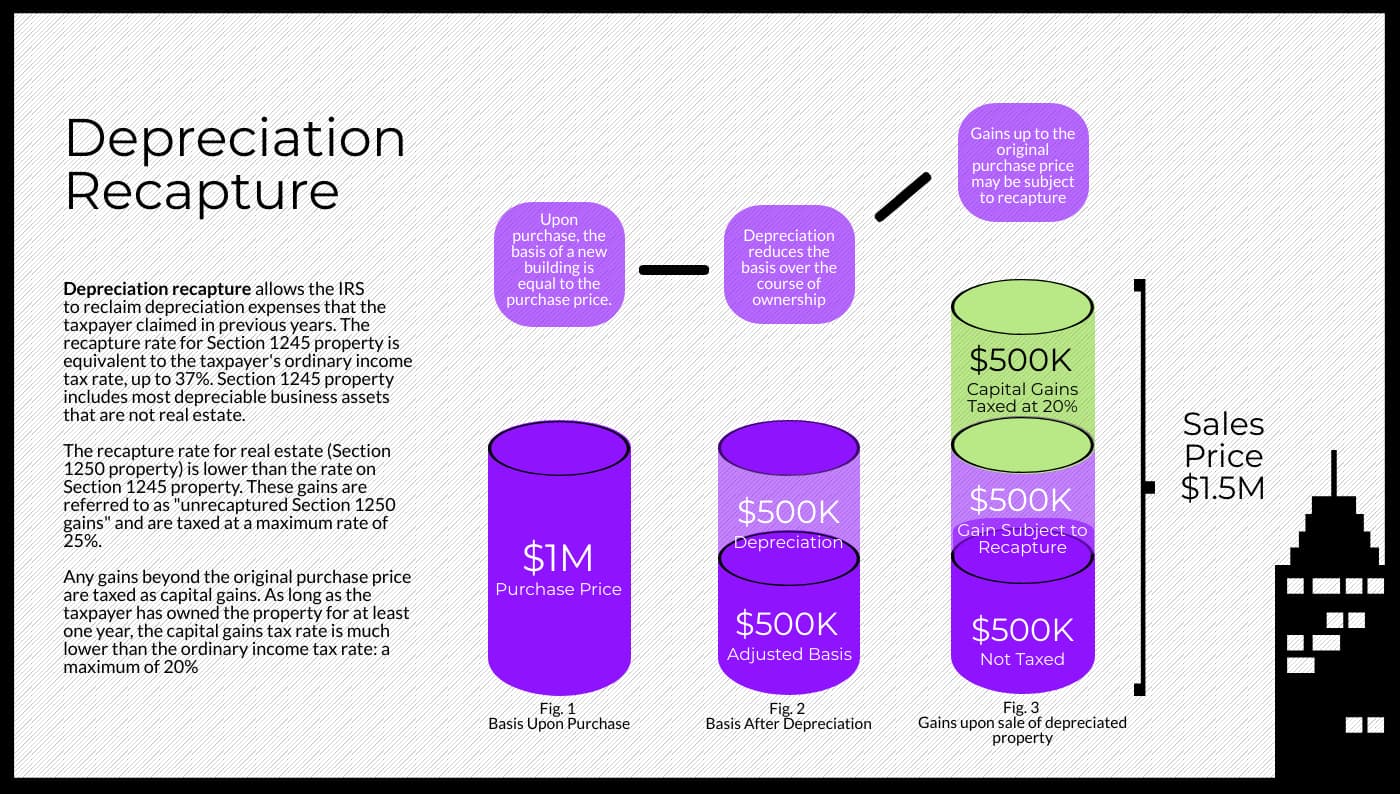

Depreciation recapture is a tax imposed on the gain realized from the sale of a depreciated asset, rather than a direct repayment of the depreciation itself. As R.E. Cost Seg clarified, "> Recapture is not repaying the depreciation. It's a tax on the gain." When a property is depreciated, its tax basis is lowered, meaning the taxable profit at sale is calculated based on the adjusted basis, not the original purchase price.

The tax rates for recapture vary depending on the asset type. According to R.E. Cost Seg, "> To recap the tax rates are: - Sec. 1250 real property: 25% - Sec. 1245 property and 15 year 1250 property: Ordinary Tax Rates." Section 1250 property generally refers to real property like buildings, with a maximum recapture rate of 25%. However, Section 1245 property, which includes accelerated depreciation items such as carpets, cabinets, or site improvements often identified through cost segregation studies, is recaptured at ordinary income tax rates, potentially as high as 37%.

Calculating recapture involves determining the difference between the asset's sale price and its adjusted cost basis (original cost minus accumulated depreciation). The portion of the gain attributable to prior depreciation is then taxed at the applicable recapture rates, which can be higher than long-term capital gains rates. This distinction means that while depreciation offers valuable upfront tax deferrals, investors must plan for the eventual tax liability.

Several strategies can help minimize or defer depreciation recapture. A 1031 like-kind exchange allows investors to defer both capital gains and recapture taxes by reinvesting sale proceeds into a similar property. Additionally, investing in Qualified Opportunity Zones (QOZs) can eliminate recapture on capital gains after a 10-year holding period, a program recently made permanent with new provisions under the "One Big, Beautiful Bill" as of 2025, which also reinstated 100% bonus depreciation.

Other planning methods include strategic asset valuation at the time of sale, where a CPA can help allocate more value to land and structural components to reduce recapturable amounts. Partial dispositions, which involve writing off removed or demolished components, can also mitigate future recapture. Lastly, holding property until death allows heirs to receive a "step-up in basis," effectively eliminating depreciation recapture and capital gains tax liability for them.

Ultimately, while depreciation recapture is an unavoidable aspect of real estate investment, the initial tax deductions function as an "interest-free loan from the government," as noted by R.E. Cost Seg. Proactive tax planning with a qualified professional is essential to navigate these rules and maximize investment returns.