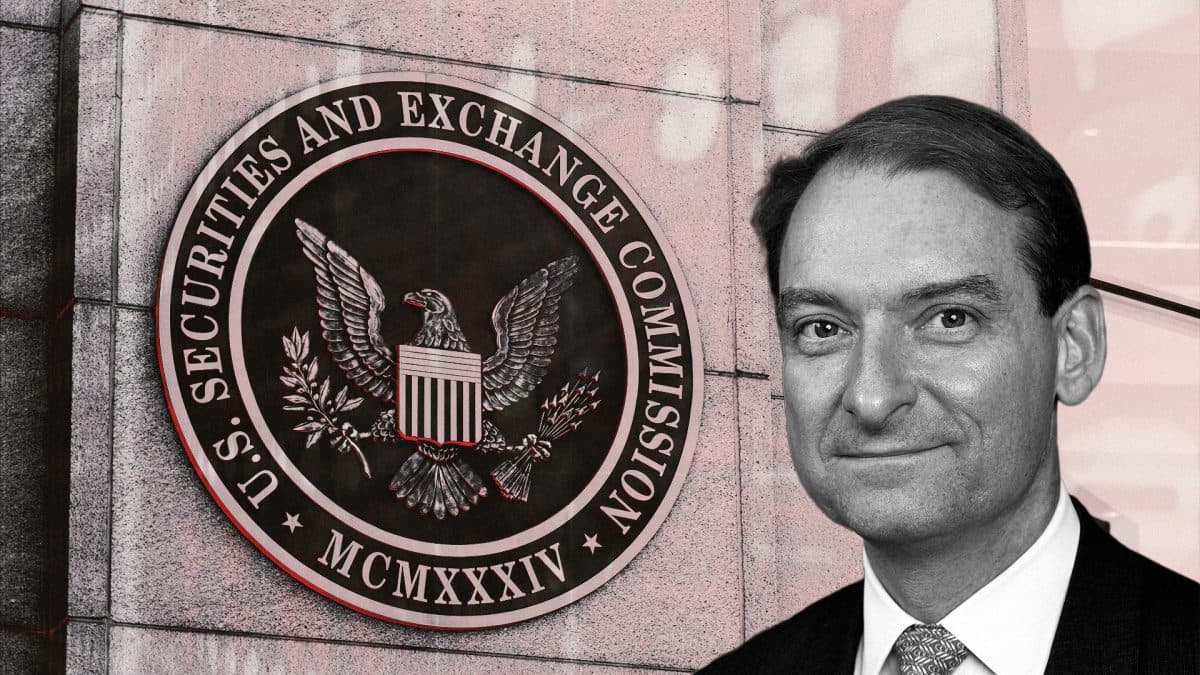

SEC Chairman Atkins Affirms Dynamic Crypto Token Status, Signaling Major Shift for Industry

Washington D.C. – The U.S. Securities and Exchange Commission (SEC) Chairman Paul Atkins recently articulated a significant shift in the agency's approach to digital assets, acknowledging that a crypto token's "security" status can evolve over time. This pronouncement, delivered during a speech on November 12, 2025, at the Philadelphia Fed Fintech Conference, marks a pivotal moment for the burgeoning crypto industry, which has long sought regulatory clarity.In his address, Chairman Atkins introduced "Project Crypto," an initiative aimed at establishing a clear token taxonomy anchored in the longstanding Howey investment contract analysis. He stated, "Most crypto tokens trading today are not themselves securities," but clarified that a token could initially be part of a securities offering. Crucially, Atkins emphasized that "investment contracts can be performed and they can expire," suggesting that a token's security status is not immutable.The Chairman's remarks echo the views of Commissioner Hester Peirce, who has long advocated for a more nuanced approach to crypto regulation, recognizing that networks mature and decentralize. Atkins noted that once a crypto project achieves sufficient decentralization and no longer relies on the essential managerial efforts of others for profit, its tokens could shed their security classification. This perspective aims to prevent innovation from migrating offshore due to rigid regulatory interpretations.Industry observers quickly reacted to the news. Anthony Pompliano, known as "The Wolf Of All Streets," highlighted the profound impact of this stance, tweeting, "> The SEC acknowledging that a token’s 'security' status can change over time is a big deal for the entire crypto industry." This sentiment underscores the market's demand for regulatory frameworks that adapt to the unique lifecycle of digital assets. The SEC is reportedly exploring avenues for non-security tokens to trade on platforms regulated by the CFTC or state-level financial agencies, further signaling a pragmatic evolution in oversight.