Solana Solidifies Position as Global Financial Infrastructure with 170% Stablecoin Growth

Solana, a high-performance blockchain, is increasingly being recognized as a foundational platform for global financial infrastructure, a sentiment echoed by its recent strategic positioning and significant institutional adoption. The platform's official social media account boldly declared, "> Solana is Amazon for finance. If you don't believe me or don't get it, I don't have time to try to convince you, sorry." This statement underscores a confident vision for the blockchain's role in the future of finance.

Recent data from late 2025 highlights Solana's rapid ascent in the financial sector. The total supply of stablecoins on Solana surged by 170%, growing from $5.2 billion at the end of 2024 to $16 billion. This impressive growth positions Solana as the third-largest stablecoin chain globally, trailing only Ethereum and Tron, indicating a strong influx of capital and user activity.

The shift in Solana's strategic focus was evident in late 2025 when its official slogan transitioned from "Web3 Infrastructure for Everyone" to "Global Financial Infrastructure for Everyone." This change emphasizes the platform's commitment to supporting institutional applications and financial services. Lily Liu, Chair of the Solana Foundation, further articulated this vision, stating, "Solana is to finance what Netflix is to entertainment, and Amazon is to shopping—a disruptor at internet scale, growing at unprecedented speed, redefining the path of modern finance."

Institutional engagement has moved beyond exploration to active product deployment. In 2025, Visa officially integrated Solana into its stablecoin settlement platform, enabling real-time card settlement services for major stablecoins like USDC and EURC. This landmark integration places Solana alongside established networks such as Ethereum, Stellar, and Avalanche, significantly enhancing its credibility and utility within traditional finance. Mastercard also partnered with MoonPay to connect 3.5 billion Mastercard cards to Solana wallets, facilitating seamless digital asset interaction.

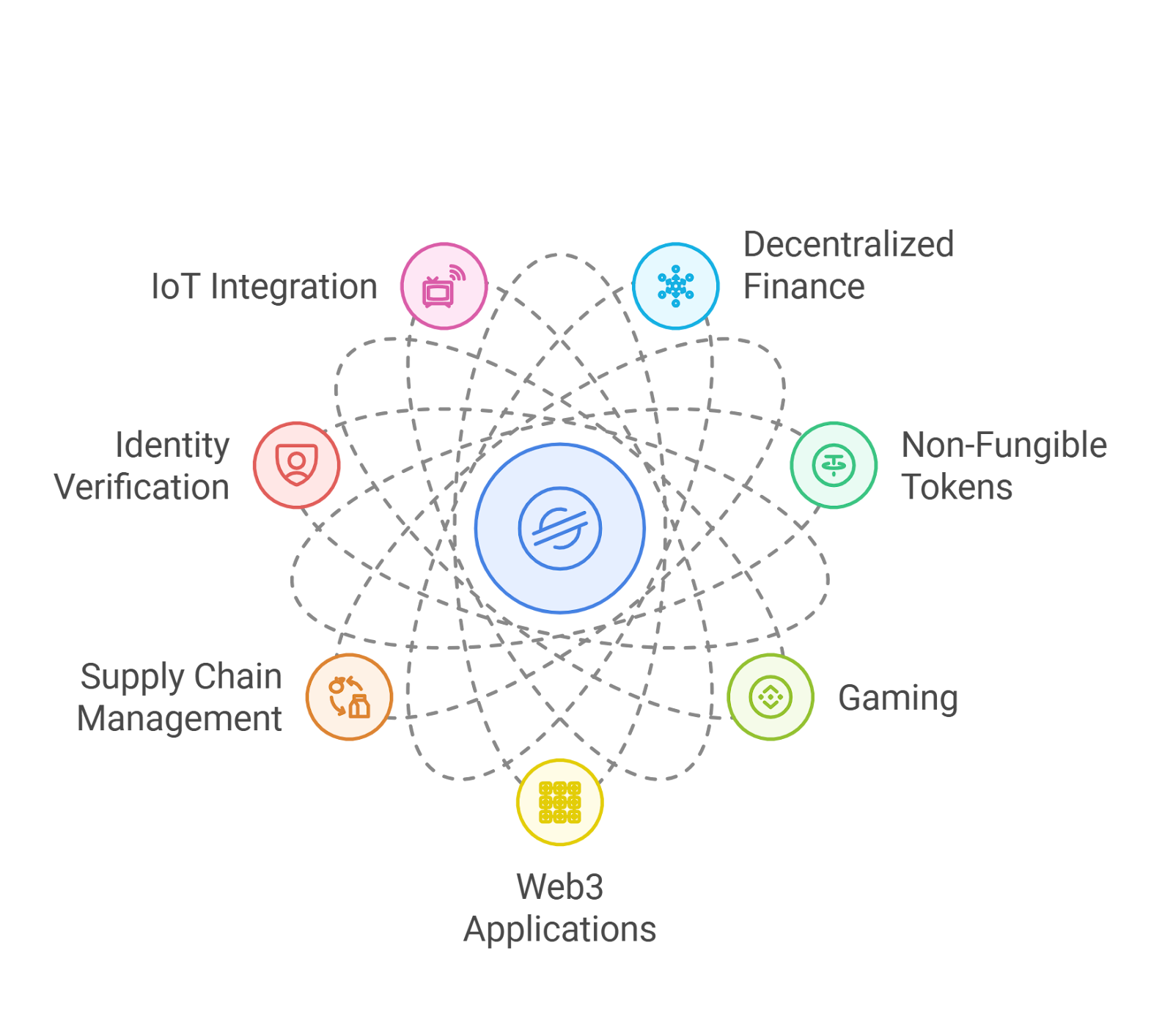

Solana's technical capabilities, including its ability to process thousands of transactions per second with minimal fees (often less than $0.0005), are crucial to its appeal as a financial backbone. These features allow for efficient, low-cost operations that are critical for high-volume financial applications. The platform's robust ecosystem also supports various financial innovations, including decentralized finance (DeFi), real-world asset (RWA) tokenization, and institutional custody solutions.

The global launch of Solana spot ETFs in 2025 further solidified its integration into mainstream capital markets. These ETFs, including "spot + staking" options in the US and Canada, allow investors to gain exposure to SOL and potentially earn staking yields. This development, alongside partnerships like R3 Corda bridging $17 billion in RWA assets to Solana, underscores the blockchain's growing role as a bridge between traditional finance and the crypto economy.