SPAC Market Sees Resurgence for Crypto Firms Amidst Lingering Concerns

The Special Purpose Acquisition Company (SPAC) market, which experienced a significant boom and subsequent bust in recent years, is once again drawing attention, particularly from cryptocurrency companies seeking public listings. Katherine Kirkpatrick Bos, General Counsel at StarkWare and former General Counsel of Maple Finance, recently posed the question on social media, "> "Lots of talk about SPACs in the context of DATs, but what about going public via SPAC as a choice for crypto companies now?"" drawing on her experience as a partner at King & Spalding during the 2020 SPAC surge, where she conducted pre-IPO due diligence.

The SPAC market saw a precipitous decline after its 2020-2021 peak, with many de-SPAC mergers significantly underperforming and some leading to bankruptcies, including WeWork. However, 2025 has witnessed a notable increase, with 50 SPAC IPOs raising approximately $7.6 billion through November, representing a 61% year-over-year increase in deal count. This resurgence is partly attributed to a more favorable regulatory environment and pent-up demand.

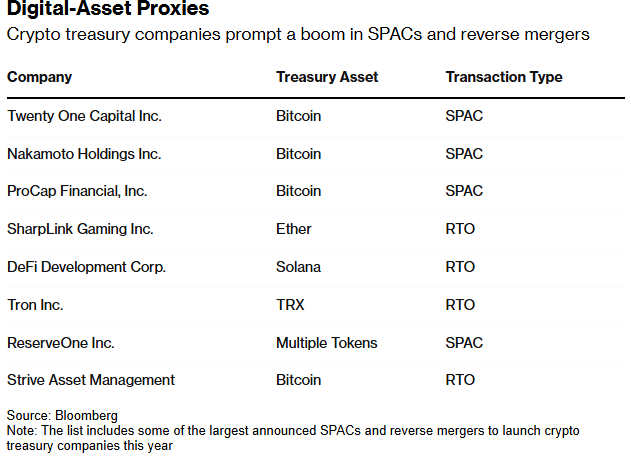

Crypto firms are increasingly exploring SPACs as a faster, less regulated path to public markets compared to traditional IPOs. Recent examples include Securitize, a tokenization firm linked to BlackRock, which announced plans to go public via a SPAC merger valuing its business at $1.25 billion. Blockchain.com is also reportedly considering a SPAC deal for a U.S. public listing in 2025, joining other major crypto players like Circle, Bullish, and Gemini in pursuing such routes.

Despite the renewed interest, significant risks remain, especially for crypto-focused SPACs. The inherent volatility of crypto assets can make these mergers highly speculative, with some analysts warning of a potential "buyer beware" scenario. Experts note that many recent SPACs are targeting "crypto or crypto-adjacent" companies, and a sharp decline in token values could lead to rapid sell-offs and substantial investor losses.

The evolving regulatory landscape, including new SEC rules introduced in 2024, aims to level the playing field between traditional IPOs and de-SPAC mergers. However, the effectiveness of these rules in protecting investors amidst the speculative nature of crypto-linked SPACs remains a key concern for market observers and legal experts like Kirkpatrick Bos. The current environment presents both opportunities for digital asset companies to access public capital and considerable challenges for investors.