Speculation Rises on Potential Financial Leadership Impact on Crypto Markets

Speculation is circulating regarding the potential appointment of a prominent financial figure to a "chair" position and its anticipated positive impact on Bitcoin, cryptocurrencies, and stablecoins. A recent tweet from user @Evanss6 on July 17, 2025, stated, > "if he makes Bessent chair, BTC/crypto/stablecoin plays all do v well." This highlights market watchers' focus on how traditional finance leadership could influence the digital asset landscape.

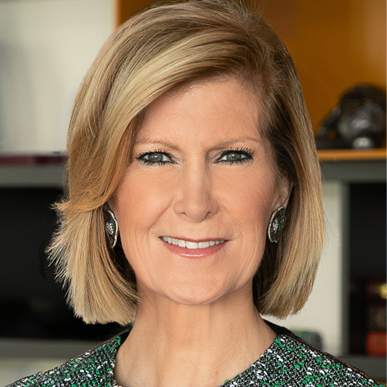

While the tweet's reference to "Bessent" and "he" is unconfirmed, market observers often associate the surname with Mary Callahan Erdoes, the highly influential CEO of Asset & Wealth Management at JPMorgan Chase. Erdoes oversees a vast portfolio and has been a key figure in the firm's strategic decisions, including its evolving engagement with digital assets. Her potential elevation to a more prominent "chair" role within a major financial institution or regulatory body could signal a significant shift in institutional crypto adoption.

JPMorgan Chase, under its leadership, has demonstrated a pragmatic approach to the digital asset space, moving from initial skepticism to active participation. The bank has launched its own blockchain-based payment system, JPM Coin, and explored tokenization, reflecting a growing institutional acceptance of blockchain technology. Erdoes herself has acknowledged the transformative potential of digital assets, emphasizing the need for regulatory clarity and robust infrastructure.

An appointment of someone with Erdoes's stature and experience, particularly if it involves a leadership role with broad influence over financial markets or regulation, could be perceived by the crypto community as a strong endorsement. Such a move might accelerate institutional investment, foster clearer regulatory frameworks, and enhance the legitimacy of cryptocurrencies and stablecoins within mainstream finance. This increased institutional confidence could drive liquidity and demand, potentially leading to the positive market performance alluded to in the tweet.

The cryptocurrency market has increasingly shown sensitivity to institutional involvement and regulatory developments. High-profile appointments within traditional finance or regulatory bodies are often viewed as indicators of future policy direction and broader market acceptance. Should a figure like Mary Callahan Erdoes assume a pivotal "chair" role, it could indeed catalyze further integration of digital assets into the global financial system, benefiting Bitcoin, other cryptocurrencies, and stablecoins through enhanced trust and accessibility.