Startup Equity Splits Under Scrutiny: Founders' Outsized Stakes and Performance Dynamics

A recent social media post by "alex 🏴☠️🇺🇸🇺🇦" has ignited discussion within the startup community regarding the impact of founder equity splits on overall company performance. The tweet specifically questioned whether a "25-100x" equity disparity, as reportedly mentioned by investor Deedy Das, correlates with better or worse outcomes, and if the "aligned incentives theory" suggests that "flatter = better" in equity distribution.

The debate centers on how the division of ownership among co-founders and between founders and early employees influences motivation, operational efficiency, and ultimately, a startup's success. This critical decision, often made early in a company's lifecycle, can significantly shape its trajectory and internal dynamics.

Deedy Das, a Principal at Menlo Ventures, has publicly stated that founders, due to their substantial equity (often "25-100x the equity of your employees"), are expected to "put in the effort and set the bar for what's expected." This perspective suggests that a significant equity stake for founders serves as a powerful incentive for intense dedication and leadership, driving the company forward. Das's background includes being part of the founding team at Glean, which grew from under 10 employees to over 300 and achieved a $2.2 billion valuation, underscoring his belief in the impact of founder commitment.

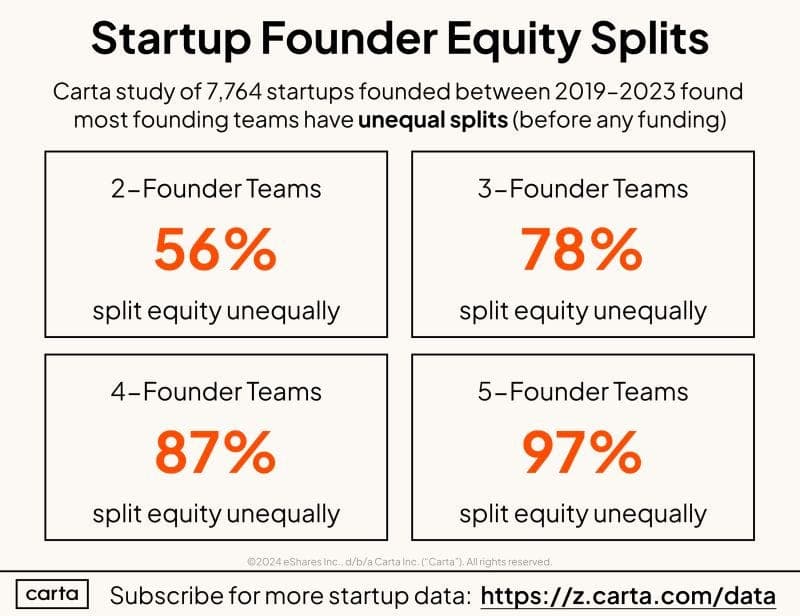

However, data from Carta, a leading equity management platform, provides a more nuanced picture of actual equity distribution. Peter J. Walker, Head of Insights at Carta, reveals that "Most co-founder ownership splits are not 50/50," contrary to a common perception that equal splits are ideal. While some founders opt for parity, many choose weighted distributions based on contributions, roles, and responsibilities. Walker emphasizes that equity dissatisfaction can be a significant source of conflict among co-founders, potentially escalating over time.

Research from institutions like Harvard Business School indicates that while equal splits can foster unity, they may not always be sustainable if individual contributions diverge. Studies suggest that unequal splits, when based on clear, agreed-upon criteria and coupled with mechanisms like vesting schedules, can align incentives more effectively. Vesting ensures that equity is earned over time, mitigating risks associated with early departures and encouraging long-term commitment.

The "aligned incentives theory" posits that when all stakeholders' interests are closely tied to the company's success, performance improves. While a "flatter" equity structure might seem to align incentives more broadly, experts like Walker point out that investor perception also plays a role. Venture capitalists often scrutinize equity splits, viewing a CEO's ability to negotiate and manage difficult conversations (like equity distribution) as an indicator of strong leadership. The market also shows that employees are less confident in the value of their equity when companies face challenges, as evidenced by a 50% drop in employee option exercises from Q4 2022 highs, suggesting that perceived value and clear communication are crucial for maintaining morale and motivation.

Ultimately, the optimal equity split remains a complex decision, with no one-size-fits-all solution. It involves balancing initial contributions, ongoing commitment, risk tolerance, and the strategic vision for growth, all while navigating the expectations of investors and employees in a dynamic market.