Ticker Tape Predates Lightbulb by a Decade, Highlighting Capital Markets' Role in Innovation

Paul McKinlay, in a recent social media post, underscored the foundational importance of capital markets, noting that the ticker tape was invented more than a decade before the lightbulb. Citing a post by financial journalist Andrew Ross Sorkin and crediting @joincolossus, McKinlay suggested that "without speculation we would be in the dark or burning whale oil," emphasizing the role of financial speculation in driving technological advancement.

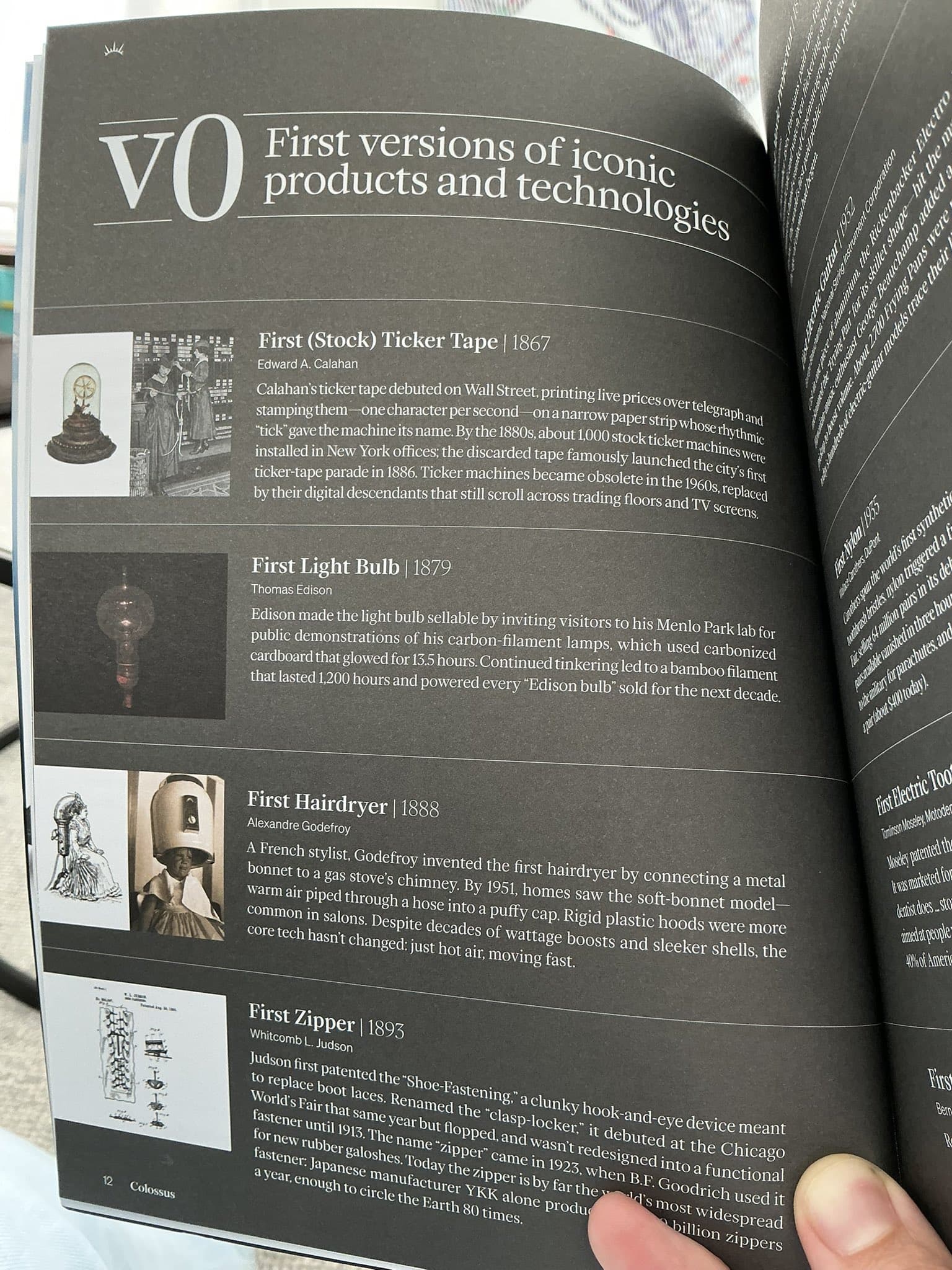

The first telegraphic ticker tape was invented by Edward Calahan in 1867, with Thomas Edison improving upon it and patenting his version in 1871. This innovation revolutionized financial markets by providing near real-time stock price information over telegraph lines, replacing slower manual methods. Before the ticker tape, stock prices were often delivered by messengers, leading to significant delays in information dissemination.

In contrast, the incandescent lightbulb, as we commonly know it, was famously perfected by Thomas Edison in 1879, following earlier rudimentary versions. This places the widespread adoption and impact of the ticker tape firmly ahead of one of the most transformative inventions of the industrial age. The historical timeline highlights how advancements in financial communication and market infrastructure often precede or enable broader technological progress.

Andrew Ross Sorkin, a prominent financial columnist for The New York Times and co-anchor of CNBC's "Squawk Box," frequently discusses the interplay between financial markets, innovation, and economic growth. His perspectives often touch on how capital allocation and risk-taking are crucial for fostering new technologies and industries. The sentiment echoed by McKinlay aligns with Sorkin's known advocacy for dynamic capital markets.

The reference to @joincolossus likely points to Colossus, a media company known for its in-depth interviews with investors and founders, often exploring the mechanisms and philosophies behind capital allocation and business building. This context suggests a broader discussion within financial circles about the historical drivers of progress and the enduring influence of speculative capital on societal development.