Tokenized Real-World Assets Near $300 Billion as Token Terminal Expands Data Coverage

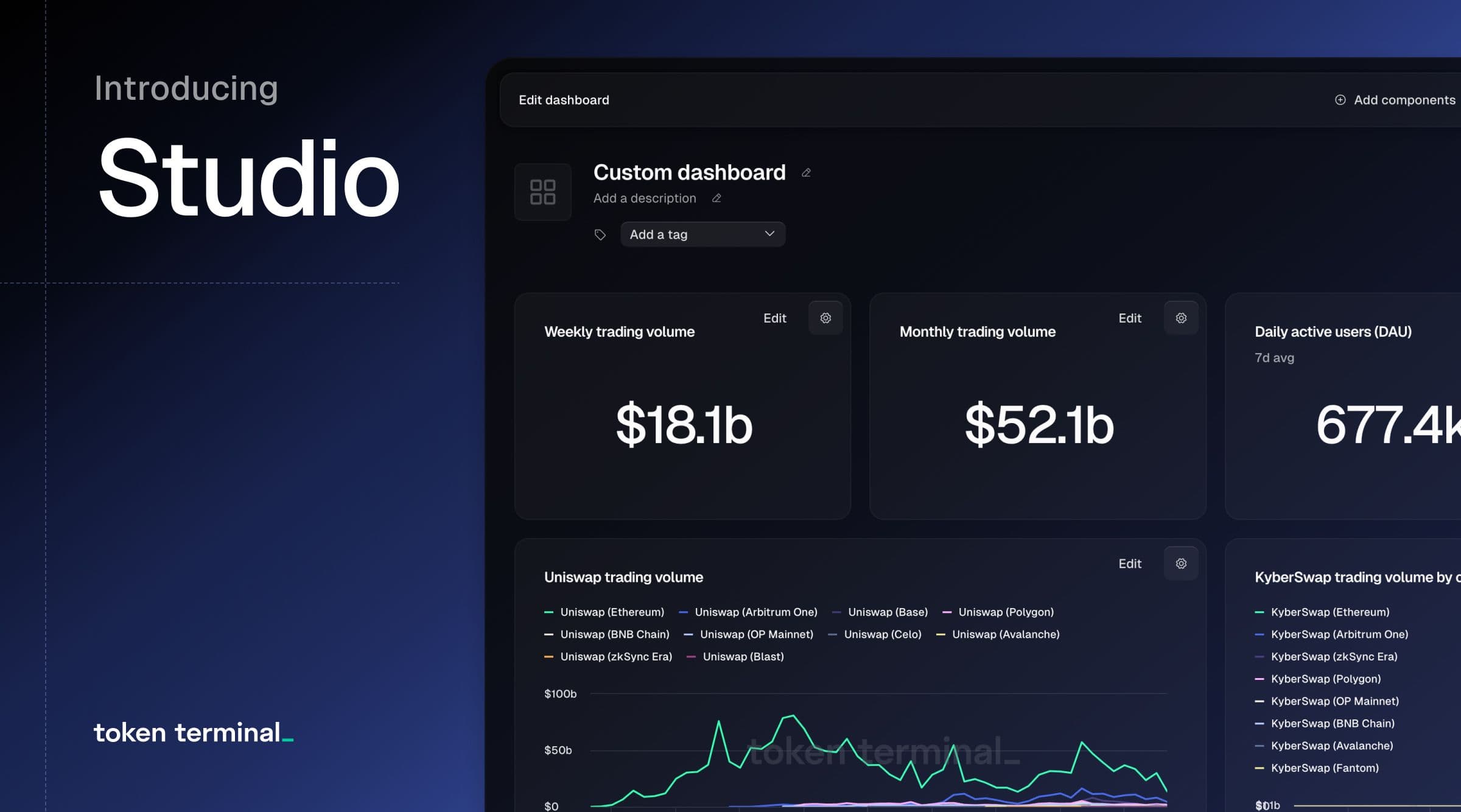

Token Terminal, a leading crypto analytics platform, has announced a significant expansion of its data coverage to include stablecoins, tokenized funds, and tokenized stocks. This move aims to provide deeper insights into the rapidly growing sector of tokenized real-world assets (RWAs), a market now approaching $300 billion. The company highlighted this development on social media, stating, > "More data on stablecoins, tokenized funds, and tokenized stocks: [link to Token Terminal's page]," signaling enhanced analytics for this evolving financial landscape.

The market for tokenized real-world assets is experiencing rapid growth, with recent data indicating it is nearing $300 billion, a milestone initially projected for 2030. According to reports citing Token Terminal and McKinsey, institutional adoption is accelerating, with tokenized RWAs expected to double in size. Some analyses, including one by RedStone Finance, even project this market could reach an astounding $30 trillion by 2034, underscoring a profound shift in global finance.

Stablecoins have played a pivotal role in spearheading the tokenization trend, providing crucial on-chain liquidity. Fidelity Digital Assets noted that stablecoins processed approximately $18 trillion in the past year, surpassing Visa’s annual volume, highlighting their foundational importance. While stablecoins lead the charge, the focus is broadening to include other asset classes as capital increasingly moves onto blockchain networks.

The growth extends significantly to tokenized funds and stocks, attracting major institutional players. Tokenized money market funds, for instance, have garnered over $1 billion in assets under management, with offerings from established firms like BlackRock (BUIDL) and Franklin Templeton (FOBXX). These initiatives demonstrate a growing appetite for bringing traditional financial products onto the blockchain, enhancing efficiency and accessibility.

Ethereum has emerged as a dominant platform for tokenized assets, hosting $201 billion of the global $314 billion total, according to CoinMarketCap. Token Terminal reports that the expansion of tokenized assets is now anchoring Ethereum's $430 billion market capitalization to tangible on-chain activity. This trend signifies a new era where financial systems are increasingly leveraging programmable networks, moving beyond traditional structures into a more integrated digital economy.