TrueLayer: 10 Key Things You Must Know

Overview

TrueLayer is a pioneering financial technology company specializing in open banking and Pay by Bank solutions. Founded in 2016 and headquartered in London, it has rapidly grown into one of Europe’s leading open banking payment networks. TrueLayer’s platform enables businesses to make payments faster, safer, and more efficient by leveraging real-time bank payments and financial data APIs. Serving a diverse range of industries including e-commerce, finance, travel, and cryptocurrency, TrueLayer is reshaping how digital payments and data sharing are performed across the UK and Europe. This article explores ten fascinating aspects of TrueLayer, highlighting its innovations, growth, and impact on the future of payments.

1. Founding and Evolution of TrueLayer

TrueLayer was founded in 2016 by Francesco Simoneschi and Luca Martinetti with the vision to unlock the potential of open banking. Initially known as Finport, the company aimed to provide developers and businesses with simple, secure, and universal APIs to access bank infrastructure under emerging open banking regulations like PSD2 in Europe. Over the years, TrueLayer evolved from a startup to a major player facilitating real-time financial data sharing and bank payments across multiple sectors. Its early focus on streamlining banking interactions for third-party developers laid the foundation for its current success.

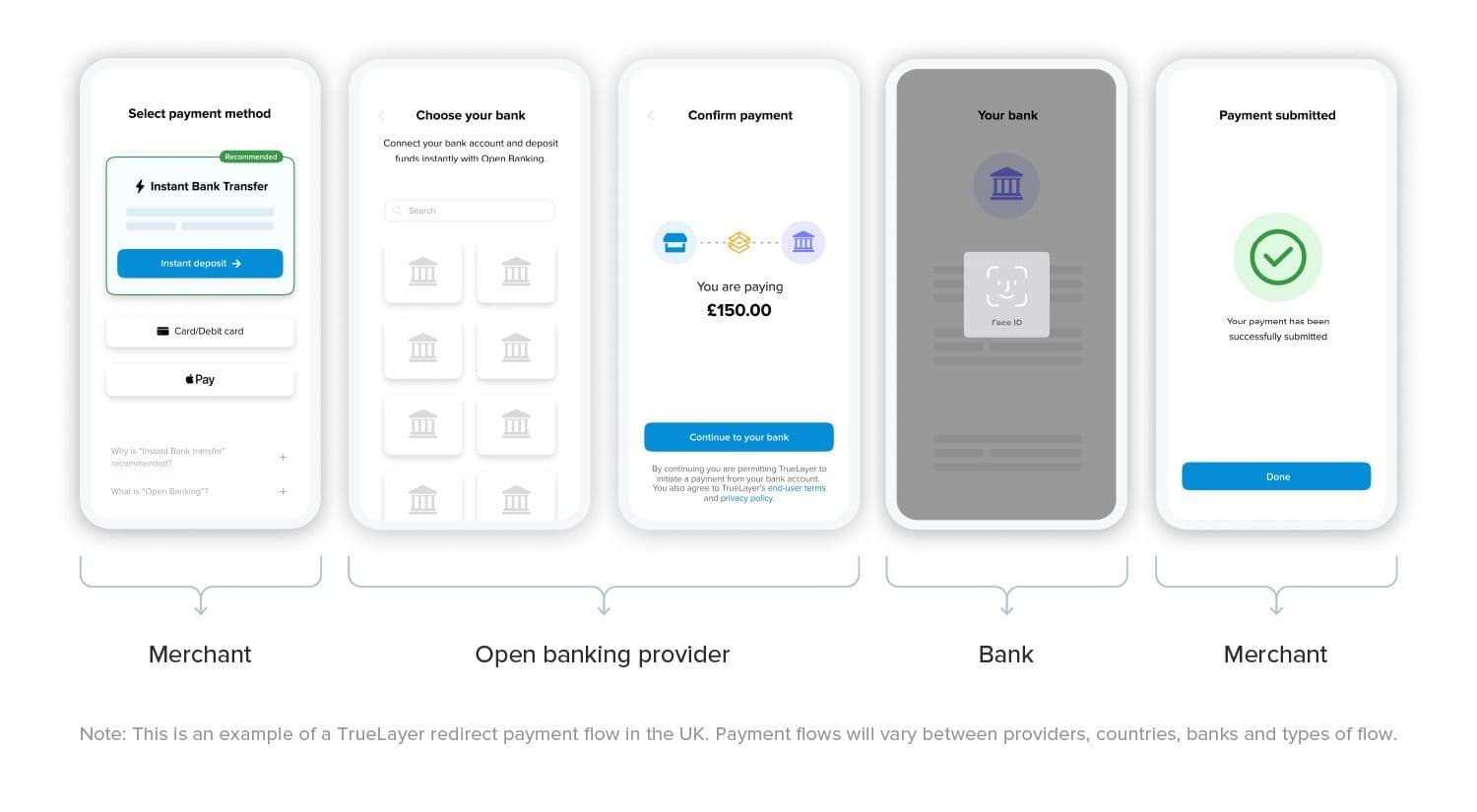

2. What is Open Banking and TrueLayer’s Role?

Open banking refers to the secure sharing of financial data and payment capabilities through APIs, allowing third-party providers to access consumer banking information with consent. TrueLayer is a leading open banking platform that connects businesses directly with banks, facilitating instant payments, data access, and identity verification. By embedding open banking payments, TrueLayer removes dependence on cards, reducing transaction costs and fraud risks while enabling a seamless customer experience. The company’s infrastructure powers millions of transactions monthly using these modern banking rails.

3. TrueLayer’s Pay by Bank Network

One of TrueLayer’s most prominent innovations is its Pay by Bank network. This system enables consumers to pay merchants directly from their bank accounts without the need for credit or debit cards. The Pay by Bank approach reduces fees by over 40%, mitigates card fraud, and speeds up checkout. TrueLayer claims that 71% of customers choose Pay by Bank when given the option, and businesses report a 20% increase in average order value and up to 90% conversion rates among returning customers. This product is a game-changer in digital retail payment solutions.

4. Industry Recognition and Awards

TrueLayer’s commitment to innovation has been recognized with multiple prestigious awards. Notably, it won the 'Payments Innovation of the Year' award at the 2024 FStech Awards for its work on Variable Recurring Payments (VRPs), a flexible alternative to traditional recurring payment methods. Achieving over 1 million VRP transactions in a single month marked a significant milestone. These accolades reflect TrueLayer’s influence in modernizing payments and driving safer, smoother customer transactions.

5. Expansion across Europe and User Growth

TrueLayer has aggressively expanded its footprint throughout Europe. The company processes billions of dollars annually and handles more UK Pay by Bank payments daily than any other provider. Its network grows rapidly, with a new user joining every three seconds. This rapid user adoption helps TrueLayer’s client businesses tap into a growing base that prefers open banking payments. Expansion initiatives also focus on Nordic markets, highlighted by their acquisition of Zimpler, a leading Nordic pay-by-bank operator, strengthening their presence in Sweden and Finland.

6. Strategic Partnerships and Clients

TrueLayer's success is bolstered by strong partnerships with industry giants such as Stripe, Revolut, Coinbase, and Robinhood. These collaborations enable wide adoption of open banking payments and accelerate innovation across multiple sectors including e-commerce, cryptocurrency, and financial services. Partnership with payment orchestration platforms and challenger banks has allowed TrueLayer to embed its API-powered solutions seamlessly, enhancing both merchant capabilities and customer experiences.

7. Technology and Product Suite

TrueLayer offers a comprehensive suite of products designed to simplify payments and onboarding. These include Signup+, which streamlines customer onboarding by combining identity verification with initial payment, and Verified Payouts that enable instant, compliant withdrawals to bank accounts. Their API platform provides robust, secure access to bank data, payments, and identity services. TrueLayer’s technology stack is highly scalable, supporting enterprises while maintaining regulatory compliance and security standards required in the financial industry.

8. TrueLayer’s Financial Performance and Challenges

Despite rapid growth and increasing revenue—63% year-on-year growth reported in 2024—TrueLayer has faced challenges, including rising losses and the need to restructure. The company reported pre-tax losses of $55 million in 2024 and laid off roughly 25% of its staff to streamline operations toward profitability. Additionally, its valuation dropped to about $700 million in late 2024 from previous highs, reflecting broader fintech market trends. Nonetheless, the company remains optimistic about its future and the ongoing shift to open banking payments.

9. Future Prospects and Industry Impact

TrueLayer’s vision is to lead the transition to a card-free payments world by making open banking the preferred payment method. With ongoing enhancements in Variable Recurring Payments, expanding geographical reach across Europe, and continuous product innovations, TrueLayer is poised for long-term success. Its role in increasing payment security, reducing costs, and improving user experience points toward an evolving financial ecosystem where bank data powers diverse digital services, from personal finance to e-commerce.

10. Acquisition of Zimpler and Nordic Market Expansion

In October 2025, TrueLayer announced the acquisition of Zimpler, a growing Nordic pay-by-bank provider. This move marks a significant step in boosting TrueLayer’s presence in the Nordics, adding more than 20 million users and deepening engagement in Sweden, Denmark, and Finland. The acquisition combines technologies and talent to accelerate Pay by Bank adoption in these markets, signaling TrueLayer’s strategic intent to dominate pay-by-bank payments across continental Europe and further disrupt traditional card-based systems.

Conclusion

TrueLayer is redefining the digital payment landscape through innovative open banking technology. From its humble beginnings to becoming a key player processing billions annually, the company exemplifies fintech’s transformative power. By enabling faster, safer payments while dramatically lowering costs and fraud, TrueLayer is championing a future where Pay by Bank becomes the norm. As open banking continues to evolve, TrueLayer’s ongoing developments and European expansion tell a compelling story of disruption, opportunity, and the future of money movement in the digital age.

References

- TrueLayer Official Website

- TrueLayer LinkedIn

- Open Banking UK - TrueLayer Profile

- Finextra - TrueLayer to acquire Zimpler

- Crunchbase - TrueLayer

- Sifted - TrueLayer Revenue and Losses

- PYMNTS - Tencent Leads Funding For Startup TrueLayer

- Orrick - TrueLayer Series E Funding and Partnership

- CB Insights - TrueLayer Overview

- Pitchbook - TrueLayer Profile