United States Stands Alone in Comprehensive Semiconductor Supply Chain Involvement

The United States maintains a unique position in the global semiconductor industry, being the only nation with active involvement across every intricate stage of the supply chain, from design to manufacturing and equipment. This assertion highlights the extreme global and multi-phase nature of semiconductor production, a complex operation characterized by highly specialized and interconnected stages. As stated by Rohan Paul on social media, referencing a 2024 article in the Journal of Economic Perspectives, > "The modern semiconductor supply chain is such an extreme global, multi-phase operation with extremely intricate stages. And the US remains the only country with players involved in every part of the semiconductor supply chain."

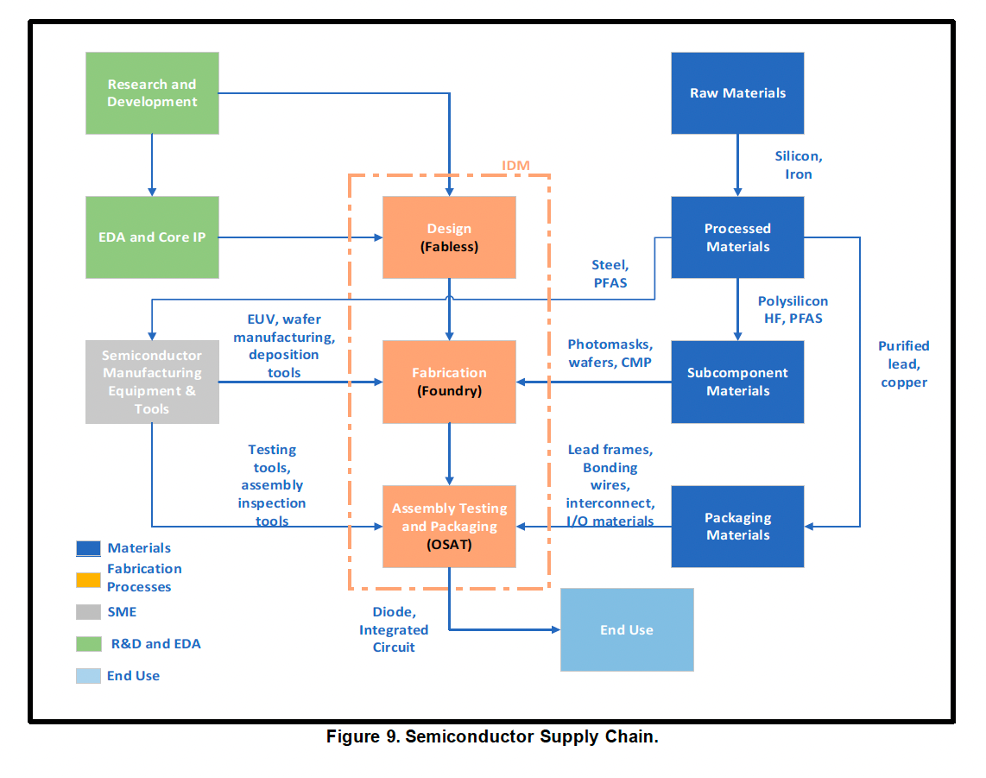

The semiconductor supply chain is notoriously complex, involving hundreds of steps and crossing numerous international borders. While countries like Taiwan and South Korea dominate advanced chip fabrication, and Japan and the Netherlands lead in specialized equipment, the U.S. distinguishes itself through its comprehensive ecosystem. U.S. companies are global leaders in chip design, Electronic Design Automation (EDA) software, and semiconductor manufacturing equipment, which are critical upstream segments.

Despite its strong position in these high-value areas, the U.S. had seen a decline in its domestic chip manufacturing capacity over decades. In response, the U.S. enacted the CHIPS and Science Act in August 2022, allocating over $52 billion in federal incentives and a 25% investment tax credit. This landmark legislation aims to revitalize domestic manufacturing, with projections indicating a 203% increase in U.S. fab capacity between 2022 and 2032, the highest growth rate globally.

The CHIPS Act has already spurred significant private investments, with over $450 billion announced across 28 states for new fabs, expansions, and materials/equipment facilities. Major companies like Intel, TSMC, and Samsung have committed billions to new U.S. plants, aiming to boost the U.S. share of advanced logic chip manufacturing to 28% by 2032, up from near zero in 2022. This strategic effort seeks to enhance supply chain resilience and reduce reliance on concentrated foreign production, particularly amidst geopolitical tensions.

The global landscape remains highly competitive, with other nations like China, the EU, South Korea, and Japan also implementing substantial incentive programs to bolster their domestic semiconductor industries. While the U.S. aims to secure its supply chain, the inherent global interdependence means that a fully localized supply chain is impractical and economically challenging. The ongoing focus is on fostering a robust domestic ecosystem while maintaining critical international partnerships to navigate the complexities and ensure continued innovation and supply stability.