US Home Price-to-Income Ratio Hits 5.0 Amid Stagnant Labor Force Growth

The widening chasm between housing costs and average incomes in the United States has reached a critical point, with the national median home price-to-income ratio climbing to 5.0 in 2025. This figure represents a substantial increase from 3.5 in 1985, highlighting a persistent affordability crisis that continues to challenge prospective homeowners.

Social media commentator Kenny Capital underscored the severity of the situation, stating in a recent tweet, > "You have to be incredibly gullible to believe incomes will catch up to home prices when nearly everyone including the dog is already in the workforce." This sentiment reflects a growing concern that current economic conditions offer limited pathways for wage growth to bridge the affordability gap.

Data from the U.S. Bureau of Labor Statistics indicates that the labor force participation rate stood at 62.3% in June 2025, a figure that has remained relatively stable but below its peak of 67.3% in January 2000. While average hourly earnings increased by 3.7% over the past year, this growth has been insufficient to keep pace with soaring home values. The income required to purchase a median-priced single-family home has reportedly doubled since 2019, further exacerbating the challenge for many households.

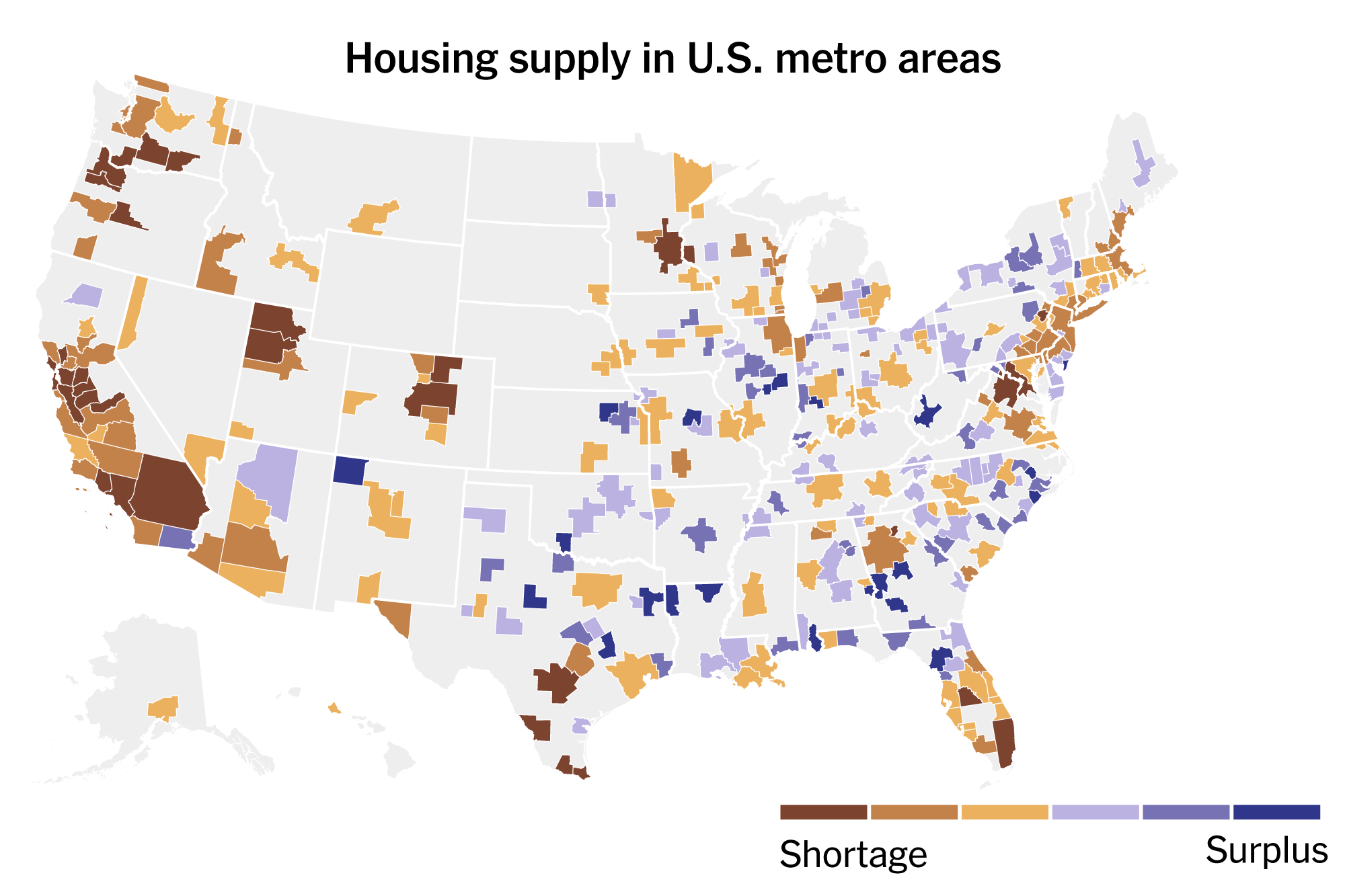

Experts attribute the crisis to a confluence of factors, including a severe shortage of housing supply, particularly for smaller and more affordable homes, and elevated mortgage interest rates. Regulatory hurdles, such as restrictive zoning laws, also continue to impede new construction. Despite a modest increase in housing inventory in some markets, the availability of homes affordable to middle- and lower-income buyers remains critically low.

Solutions proposed by analysts often center on increasing housing supply through reforms to land use and zoning regulations. However, the current economic landscape, characterized by high construction costs and persistent demand, suggests that significant improvements in affordability may take time to materialize.