US Homeownership for Young Adults Projected to Plummet to 12% by 2025

A recent social media post from the popular account "Boring_Business" on X (formerly Twitter) has highlighted a stark decline in homeownership rates among Americans aged 30 and under. The data, presented as a historical comparison, projects that only 12% of individuals in this demographic will be married and own a home by 2025, a significant drop from previous decades.

"Married and own a home by 30 years old in America 1950: 50% 1960: 52% 1970: 48% 1980: 45% 1990: 43% 2000: 35% 2010: 25% 2025: 12% Incredible," stated Boring_Business in the post.

This projected figure for 2025 marks a substantial decrease from 50% in 1950 and 25% in 2010, underscoring growing economic challenges for younger generations. The trend reflects broader shifts in the U.S. housing market and economic landscape, impacting millennials and Gen Z.

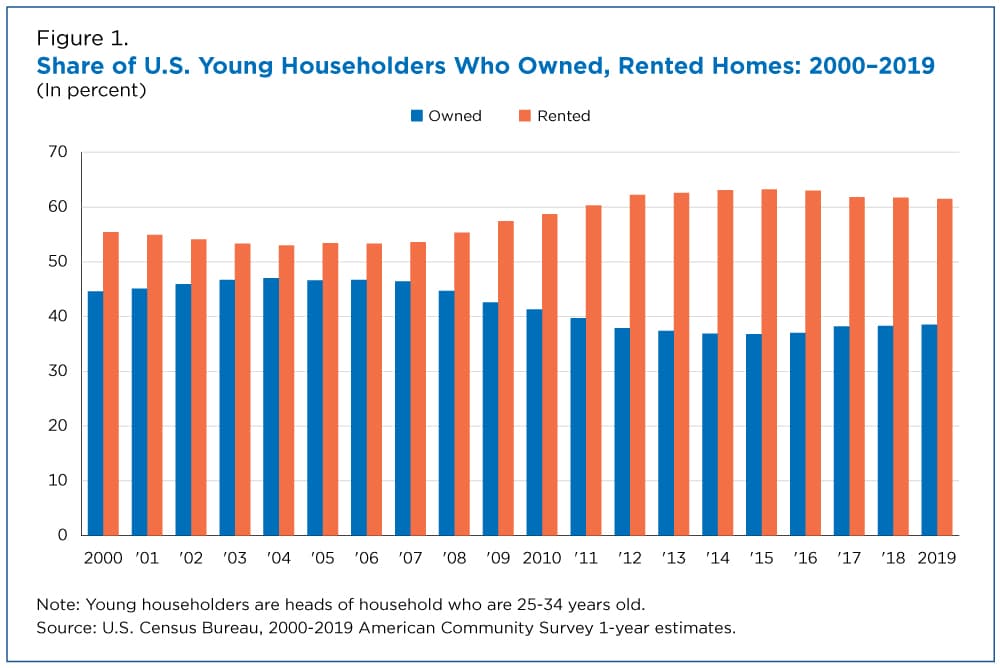

Research from sources like the Pew Research Center and the Urban Institute corroborates a declining trend in homeownership and marriage among young adults. In 2019, only 30% of millennials aged 25 to 34 owned homes, compared to 51% of Baby Boomers and 47% of Gen Xers at the same age. Similarly, the share of young adults aged 25 to 34 who are married and living with a spouse has fallen from 58% in 1990 to 30% in 2019.

Factors contributing to this decline include escalating housing costs, a heavy burden of student loan debt, and stagnant wage growth relative to inflation. These economic pressures make it increasingly difficult for young individuals to accumulate the necessary down payments and qualify for mortgages. The shift also highlights evolving societal norms, with many young adults delaying marriage and family formation.

The implications of these trends extend beyond individual financial stability to broader economic and social structures. Reduced homeownership among younger generations can lead to slower wealth accumulation, increased reliance on rental markets, and potentially reshape future consumption patterns and community development. Experts suggest that addressing housing affordability and economic opportunities for young adults will be crucial to reversing this long-term trend.