Ventuals Addresses Mark Price Upper Bound Incident, Vows Improvements to Trader Experience

Ventuals, a decentralized finance platform enabling perpetual futures trading on private company valuations, has acknowledged a recent incident where several of its markets reached their upper mark price bounds. The company, which operates on Hyperliquid's HIP-3 standard, stated that while the bounds negatively impacted trader experience, they also served to protect short position holders. Ventuals has committed to implementing further improvements.

The incident highlights the critical role of mark price bounds in the risk management framework of decentralized perpetual futures platforms. These bounds are designed to prevent extreme price deviations and potential market manipulation, ensuring the stability and solvency of the trading system. Ventuals' use of the HIP-3 standard allows for configurable parameters, including these protective measures.

According to a statement released by Ventuals on social media, the mark price bounds exist to safeguard the integrity of the platform, particularly in volatile market conditions. "What happened this week when several markets hit their upper bound," Ventuals explained, "impacted trader experience (the bad)." However, the company also noted a positive outcome, stating, "How the bounds actually protected short traders (the good)." This suggests that while some traders may have faced limitations, the mechanism prevented potentially larger losses for others.

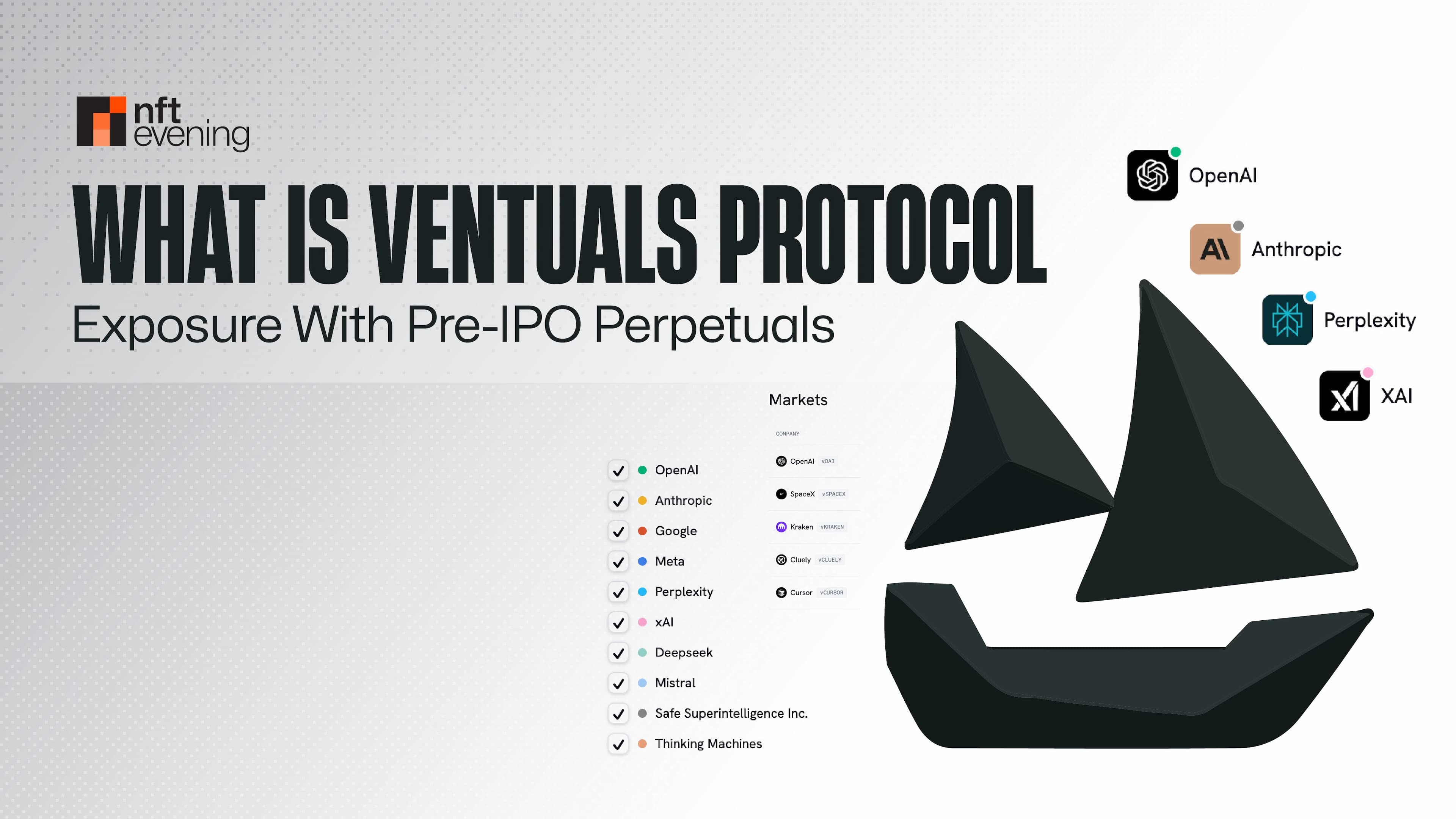

Ventuals is built on Hyperliquid's high-performance infrastructure, utilizing its HIP-3 standard to offer trading on valuations of private companies like OpenAI and SpaceX. The platform aims to democratize access to a multi-trillion dollar asset class traditionally reserved for institutional investors. Such innovative offerings necessitate robust risk controls, including mark price limitations, to manage the unique challenges of pricing illiquid assets in a decentralized environment.

Looking ahead, Ventuals has indicated that it is actively working to address the issues stemming from the recent market behavior. "What we’re doing next to improve this," the company affirmed, signaling upcoming adjustments or enhancements to its mark price mechanisms. These improvements are expected to refine the balance between market stability and seamless trader experience on the platform.