Wealthy: 10 Key Things You Must Know

Overview

Wealthy is an Indian fintech startup revolutionizing the mutual fund distribution landscape with advanced technology and a strong support ecosystem. Founded in 2015 and headquartered in Bengaluru, Wealthy has positioned itself as a leading platform designed specifically for independent financial advisors and mutual fund distributors. By providing AI-powered onboarding, analytics, and diverse product access, Wealthy enables thousands of distributors to streamline operations, improve customer advisory, and expand their client base. As mutual fund distribution grows in India, Wealthy stands out for its ambition to reach tier 2 and 3 cities, empower financial advisors, and foster inclusive financial growth.

1. Origin and Purpose of Wealthy

Wealthy was co-founded by Aditya Agarwal and Prashant Gupta in 2015 with the intent to empower independent financial advisors (IFAs) and mutual fund distributors across India. Recognizing a gap where many distributors lacked digital infrastructure, Wealthy offers a tech-first platform that simplifies onboarding, client management, and investment product distribution. The company's primary vision is to democratize wealth management by enabling IFAs to compete alongside large financial institutions, fostering a more inclusive investment ecosystem.

2. Platform Features and Technology

Wealthy’s platform incorporates AI-enabled workflows that allow mutual fund distributors to complete their client’s Know Your Customer (KYC) process within two minutes. Its technological suite includes personalized onboarding links, portfolio tracking tools, customized investment proposals, and industry-first features such as SIP (Systematic Investment Plan) options with step-up and multi-day investments. All these capabilities are designed to save distributors time on manual tasks, allowing them to provide better advice and enhance client relationships.

3. Product Range and Financial Services

The Wealthy platform offers an extensive range of over 1,000 financial products, including mutual funds, equity stocks, insurance, fixed deposits, bonds, Portfolio Management Services (PMS), and Alternative Investment Funds (AIFs). This broad portfolio enables distributors to address diverse client needs and build a durable, personalized relationship with their customers through targeted financial solutions.

4. Market Reach and Growth Ambitions

As of 2025, Wealthy partners with over 6,000 mutual fund distributors who serve more than 100,000 clients across 1,000+ towns in India. The platform shoulders client assets worth approximately Rs 5,000 crore (about $600 million). Wealthy is aggressively expanding into smaller cities such as Lucknow and Surat while doubling its physical branch footprint from 20 to around 40 branches by 2026. Their target is to onboard 50,000 distributors and manage Rs 1 lakh crore ($12 billion) in assets under management (AUM) within the next few years.

5. Funding and Investor Support

Wealthy has raised significant capital to fuel its growth, including a notable Rs 130 crore ($14.5 million) Series B funding round led by Bertelsmann India Investments. Other participants include Alphawave Global and Shepherd's Hill, alongside technology entrepreneurs. Altogether, Wealthy has raised approximately $27 million to date. These funds are being allocated to enhancing the technology platform, expanding reach in emerging cities, and investing in distributor training and capacity building.

6. Empowering Independent Financial Advisors

A key focus of Wealthy is to support independent wealth professionals, many of whom are former bankers or relationship managers leaving institutional roles to build their own practices. By providing technology, research support, and access to wide-ranging investment products, Wealthy acts as a comprehensive ecosystem for these advisors. This not only helps them scale their businesses but also contributes to the growth of financial inclusion across India.

7. AI and Analytics in Wealthy

The integration of Artificial Intelligence helps Wealthy streamline distributors’ client onboarding and investment workflows. AI tools enable quick KYC verifications and generate better fund analysis through Wealthy Ratings and Returns Calculators. Additionally, the platform offers more than 10 ready-to-use reports, including holdings and capital gains, enabling distributors to provide professionally tailored advice and maintain transparency with their clients.

8. Client Experience and Family Account Feature

Wealthy provides an investment app designed for end clients as well, allowing them to track their portfolios seamlessly without burdening distributors with frequent queries. Further, the app features a Family Account option that lets distributors add and manage investments on behalf of up to 10 family members, facilitating holistic wealth management and monitoring within families.

9. Competition and Positioning in the Wealth Management Industry

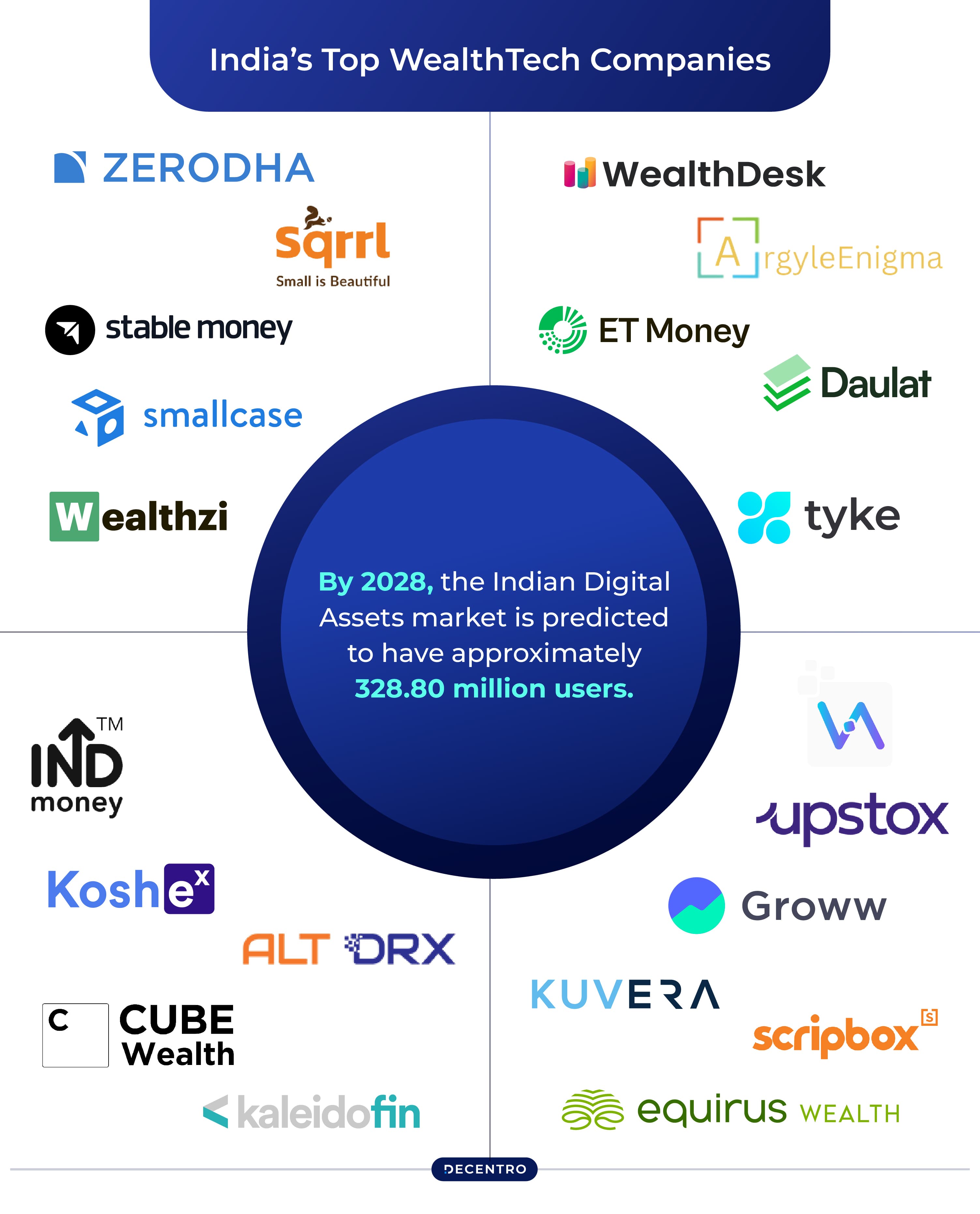

Wealthy competes in a crowded fintech and wealth management space in India that includes players like Groww, Zerodha, and others. However, its distinctive emphasis on empowering mutual fund distributors with best-in-class AI tools and a comprehensive product ecosystem positions it uniquely. Market experts and industry leaders praise Wealthy’s forward-thinking platform and research capabilities as key differentiators.

10. Future Prospects and Industry Impact

With increasing penetration of capital market investments in India, especially in tier 2 and tier 3 cities, Wealthy is poised for robust growth. Its strategy to expand distributor networks, enhance AI capabilities, and provide rigorous training aims to elevate the mutual fund distribution business across the country. As the wealth management industry evolves digitally, Wealthy’s role in democratizing investment access and fostering financial literacy is expected to strengthen substantially.

Conclusion

Wealthy represents a dynamic force in India’s wealth management sector by harnessing technology to empower independent financial advisors and mutual fund distributors. Its broad product portfolio, AI-enabled platform, and strategic growth in underserved markets demonstrate an inclusive vision for investment access. Supported by strong funding and industry endorsements, Wealthy is shaping the future of mutual fund distribution in India. As the platform advances, it prompts a broader reflection: how can technology further dismantle financial barriers and foster wealth creation across diverse populations?

References

- Wealthy Official Website

- Wealthy raises Rs 130 crore led by Bertelsmann India Investments - Economic Times

- Wealth management firm Wealthy raises $14.5 million - Economic Times

- Wealthy app on Google Play Store

- Merriam-Webster Dictionary Definition: Wealthy

- Wealth - Wikipedia

- Wealthy Stocks & Mutual Funds iOS app

- Wealthy Partner App and features

- Financial Times - Wealth Management Industry

- Bertelsmann India Investments Portfolio