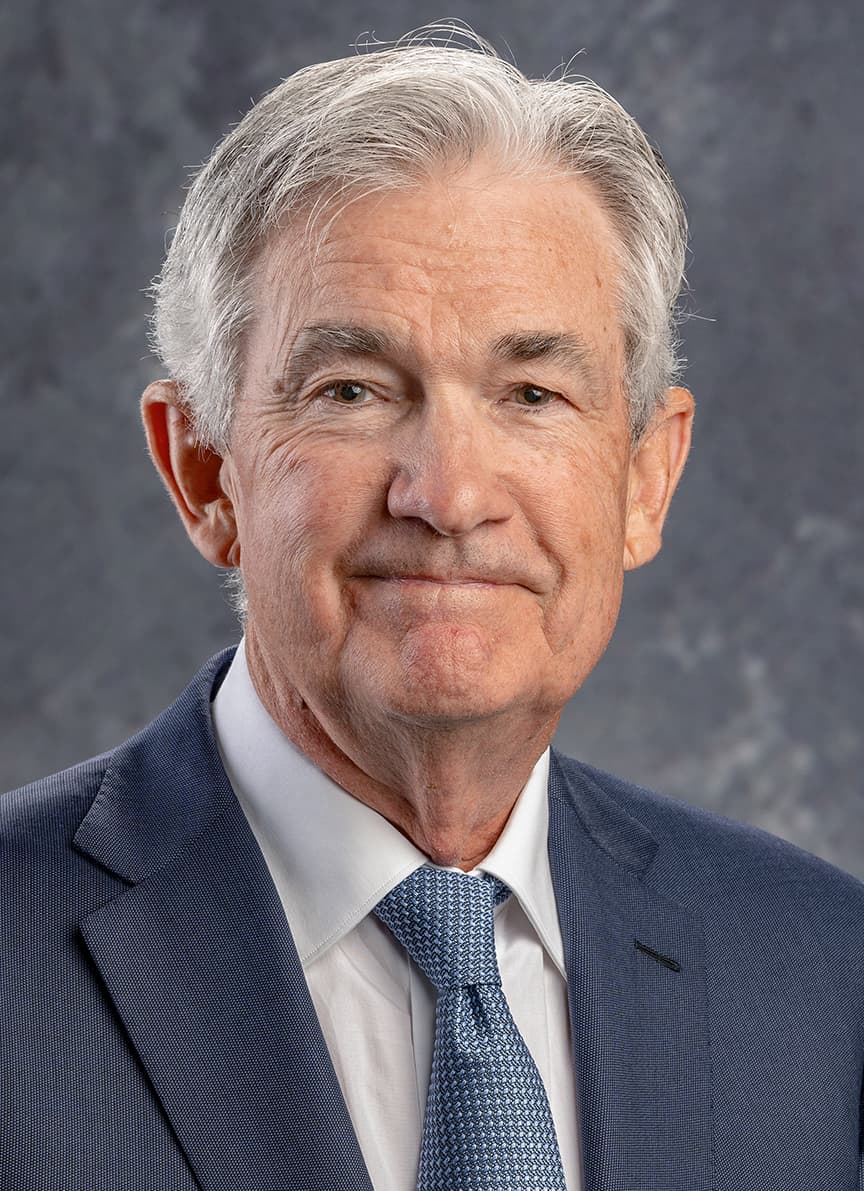

White House Formally Initiates Search for Next Federal Reserve Chair Ahead of May 2026 Term End

Washington, D.C. – The Trump administration has officially commenced the search for a successor to Federal Reserve Chair Jerome Powell, whose term is set to conclude in May 2026. Treasury Secretary Scott Bessent confirmed on Tuesday that a "formal process" is underway to identify the next leader of the U.S. central bank, with an announcement potentially coming as early as October or November. This development follows months of public criticism from President Donald Trump regarding Powell's monetary policy decisions.

President Trump has consistently expressed his dissatisfaction with Powell's refusal to aggressively cut interest rates, advocating for rates to fall below 1% from their current range of 4.25% to 4.5%. "We have a bad Fed chairman, really bad," Trump stated, also criticizing Powell over a $2.5 billion renovation of the Fed's headquarters, which he termed a "fireable offense." Despite the intense pressure, Bessent clarified that the administration does not currently plan to remove Powell before his term expires.

The discussion around Powell's succession has also brought to light the controversial concept of a "shadow Fed chair." This idea, previously floated by some administration officials, involves nominating a successor well in advance to potentially undermine Powell's authority. However, Bessent has cautioned against such a move, stating, "I think it'd be very confusing for the market for a former Fed chair to stay on also," suggesting Powell should step down entirely from the Fed board once his chairmanship ends.

Several prominent figures are reportedly being considered for the role. Among the potential candidates are former Fed Governor Kevin Warsh, National Economic Council Director Kevin Hassett, former World Bank President David Malpass, and current Fed Governors Christopher Waller and Michelle Bowman. Treasury Secretary Bessent himself has been mentioned as a possibility, though he has downplayed such speculation, emphasizing his role in the decision-making process.

The selection of the next Fed Chair carries significant implications for financial markets and the independence of the central bank. JPMorgan Chase CEO Jamie Dimon recently underscored the importance of the Fed's autonomy, stating, "I think the independence of the Fed is absolutely critical." The incoming chair will face the challenge of balancing political pressures with the Fed's dual mandate of maintaining stable inflation and maximum employment.