California Businesses Face Rising Payroll Taxes Amid State's $55 Billion Unemployment Debt

California businesses are grappling with significant increases in payroll taxes, a burden highlighted recently by prominent restaurateur Chef Andrew Gruel. Gruel, known for his outspoken criticism of state economic policies, recently took to social media to draw attention to the financial strain on employers. The issue stems from California's substantial unpaid unemployment benefit debt to the federal government and widespread pandemic-era fraud.

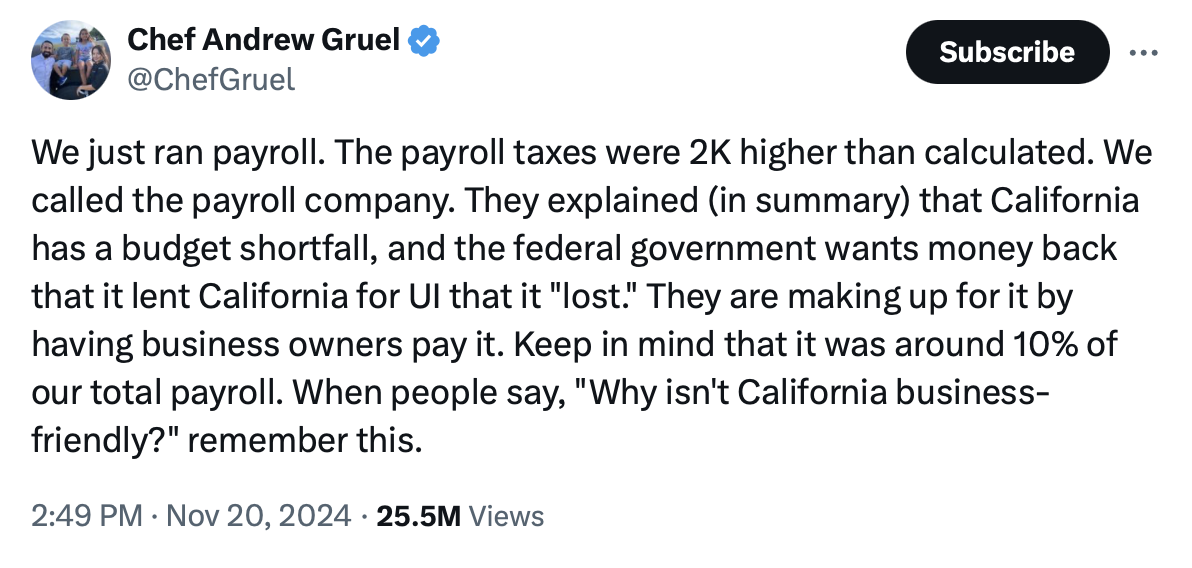

Chef Gruel stated on social media that his restaurant's payroll taxes were "$2K higher than calculated," attributing the discrepancy to California's budget shortfall and the federal government's efforts to recoup unemployment funds. This increase is a direct consequence of the state's failure to repay a $20 billion federal loan, initially provided to cover unemployment costs during the COVID-19 pandemic. California is one of only two states that has not repaid this debt.

The state's unemployment system was also plagued by an estimated $55 billion in fraudulent claims during the pandemic, further exacerbating the financial hole. As a result, federal law mandates increasing payroll taxes on businesses in states with outstanding unemployment benefit loans for two consecutive years. Employers in California now face an additional $21 per employee annually, a figure set to rise in subsequent years until the debt is settled.

Gruel has consistently voiced concerns about state policies, including minimum wage hikes, which he argues "crush the industry all around." He has previously criticized Governor Gavin Newsom's claims regarding job creation, asserting that such policies lead to "unintended consequences" for businesses, such as reduced employee hours and closures of full-service restaurants.

Nationally, the US unemployment rate saw a slight uptick, reaching 4.3% in August 2025, up from 4.2% in July. Job growth has slowed significantly, with only 22,000 nonfarm payroll jobs added in August, well below expectations. This broader cooling of the labor market, coupled with specific state-level financial burdens, presents a challenging economic landscape for businesses, particularly in California.