Florida's Anti-ESG Stance Aligns with ARK Invest's Relocation, Drawing Praise from Cathie Wood

St. Petersburg, Florida – Cathie Wood, CEO and CIO of ARK Invest, has publicly lauded Florida's business environment, citing its "founder, business, consumer, and investor-friendly" policies as a key factor in her firm's relocation from New York City. Wood specifically highlighted the Florida State Board Administration's (SBA) stance, which she described as "180 degrees AWAY from ISS and Glass-Lewis," two prominent proxy advisory firms. This endorsement underscores a growing trend of financial firms seeking states with policies that prioritize pecuniary interests over environmental, social, and governance (ESG) considerations.

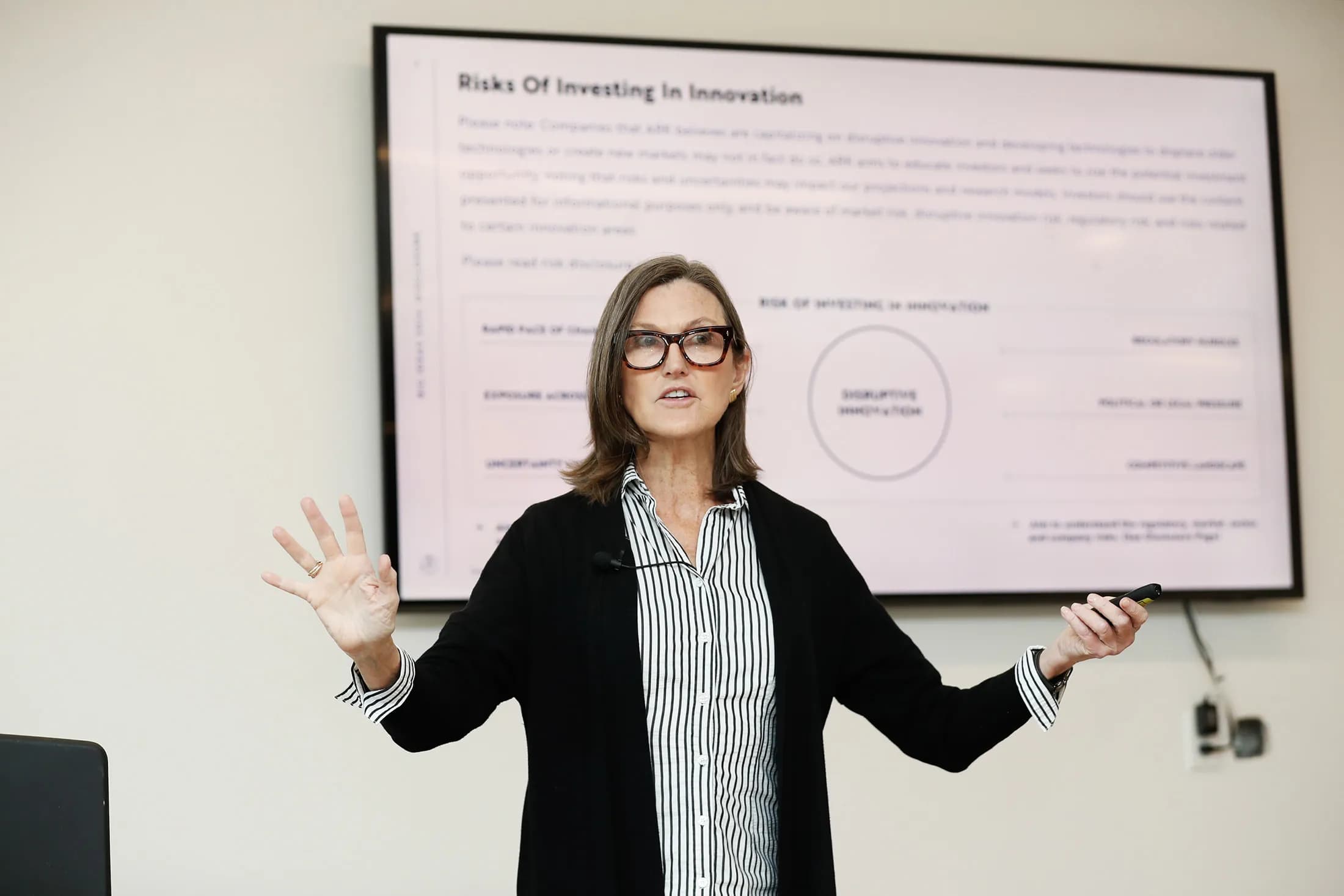

ARK Invest, known for its focus on disruptive innovation, moved its headquarters to St. Petersburg in November 2021. Cathie Wood stated at the time that the Tampa Bay region's "talent, innovative spirit, and quality of life will accelerate our growth initiatives." The firm's relocation was also driven by a desire to "break the mold further" from traditional Wall Street, embracing a city actively investing in technology, science, and innovation.

The Florida State Board Administration has taken a firm position against the perceived influence of ESG and Diversity, Equity, and Inclusion (DEI) policies in investment decisions. Attorney General James Uthmeier initiated an investigation into Glass Lewis & Co. and Institutional Shareholder Services Inc. (ISS) in March 2025, probing potential misrepresentations related to their ESG/DEI policies and possible unlawful collusion. Uthmeier asserted that the state would not allow "ESG goals to handcuff Florida businesses and threaten Floridians investments."

The SBA's investment philosophy mandates that decisions be based "solely on pecuniary factors," explicitly excluding the consideration of social, political, or ideological interests that do not materially affect risk or returns. While the SBA utilizes research from both ISS and Glass Lewis, it maintains independent voting decisions, often diverging from the proxy advisors' recommendations. This approach aligns with a broader state-level push to regulate proxy advisors, which the SBA's Michael McCauley noted has created a "fragmented regulatory environment" in the U.S.

Cathie Wood's public support for Florida's policies, particularly its rejection of what she views as overreach by proxy advisors, positions the state as an attractive destination for investment firms seeking a regulatory environment focused purely on financial returns. The ongoing scrutiny of ISS and Glass Lewis by Florida officials highlights a significant ideological divide within the financial industry regarding the role of non-pecuniary factors in corporate governance.