Housing Market Sentiment Peaked Two Years Before 2006 Price Decline, Media Reports Show

A recent social media post by "modest proposal" has drawn attention to the extensive media coverage of the U.S. housing market between spring 2005 and mid-2006. The tweet asserted:

"I’m begging people to go back and read the contemporaneous reporting of the housing market from spring of 2005 to mid 2006. It was meticulously documented by the mainstream press how insane consumer behavior was, and how prices subsequently began rapidly declining." This reflection underscores a critical period leading up to the 2008 financial crisis, where early media reports captured shifting market dynamics and consumer sentiment long before the full impact was realized. Academic research further indicates that housing market sentiment, as reflected in news media, peaked approximately two years prior to the actual peak in house prices in mid-2006.

During this period, mainstream news outlets faced criticism from the real estate industry for their increasingly skeptical tone. Richard A. Smith, then vice chairman and president of Realogy Corporation, lamented a "constant flood of media that is so negative," discouraging potential buyers and sellers. However, economists like Robert J. Shiller, author of "Irrational Exuberance," supported the media's critical approach, noting that "the media has been pretty on top of this story, that this might be a psychological event." Former Federal Reserve Board Chairman Alan Greenspan also acknowledged "a little 'froth'" in the market in mid-2005, later admitting it was a euphemism for a bubble.

The "insane consumer behavior" referenced in the tweet was part of an unprecedented housing boom, with average home prices more than doubling between 1998 and 2006. This surge was fueled by factors such as low interest rates and a significant expansion of subprime mortgage lending, enabling more individuals to access homeownership. New single-family home sales reached 1,283,000 in 2005, far exceeding the average of 609,000 per year from 1990-1995, indicating a speculative frenzy.

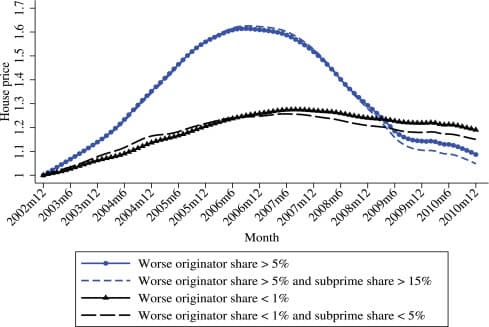

Academic analysis by Cindy K. Soo of The Wharton School, titled "Quantifying Animal Spirits: News Media and Sentiment in the Housing Market," provides empirical backing to the tweet's observation. Her research demonstrates that a housing news sentiment index, derived from the tone of local newspaper articles, forecasted the boom and bust trend with a significant lead. Specifically, the aggregate sentiment index peaked in 2004, a full two years before the national house price index reached its zenith in mid-2006, and was highly correlated with consumer and builder confidence surveys.

The subsequent market correction began in 2006-2007, marked by declining sales, rising inventories, and increasing foreclosure rates in many areas that had seen rapid growth. This downturn in residential investment and the broader housing sector ultimately contributed to the severe strains in global financial markets by 2007, leading to the onset of the Great Recession in December 2007. The early media scrutiny and the documented shift in public sentiment served as crucial, albeit often unheeded, indicators of the impending crisis.