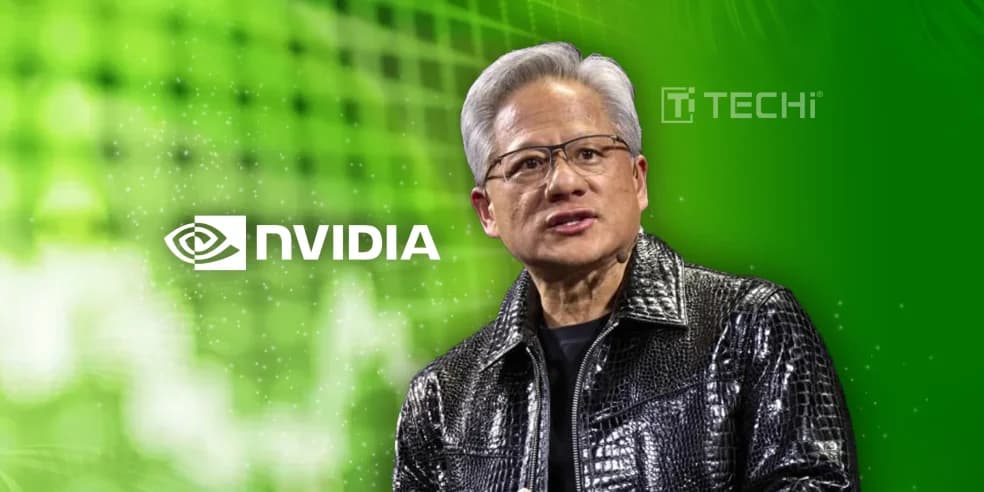

Nvidia CEO Jensen Huang's $14 Million Daily Stock Sales Raise Governance Eyebrows

Santa Clara, CA – Jensen Huang, co-founder and CEO of semiconductor giant Nvidia, has been consistently selling approximately $14 million worth of company stock almost daily for several months this summer, a move that is drawing attention and sparking discussion among investors and corporate governance experts. The sales are being conducted under a pre-arranged Rule 10b5-1 trading plan, a mechanism designed to allow insiders to sell shares without violating insider trading laws.

Nvidia has recently reported robust financial performance, with fiscal year 2025 revenue soaring to $130.5 billion, marking a 114% increase from the previous year. This growth was significantly propelled by strong demand for its Data Center platforms, particularly those supporting large language models and generative AI applications, which saw a 142% year-over-year increase. The company also announced the full-scale production of its new Blackwell architecture AI supercomputers.

Rule 10b5-1 plans enable corporate insiders to establish a predetermined schedule for buying or selling company stock, mitigating concerns about trading on non-public information. These plans are set up in advance, often when the insider does not possess material non-public information, and then executed automatically, regardless of subsequent market developments or information acquired.

However, the consistent, high-volume nature of Huang's sales has prompted questions regarding executive confidence and transparency. Nell Minow, vice chair of corporate governance specialists ValueEdge Advisors, commented on such practices, stating, "What I want from an executive [is] to be very bullish on the stock. I want the executive to be thinking all the time: 'Boy, this is really going to be worth a lot more soon' and not, 'Oof, I better sell some because I’m … experiencing the vertigo of having all my eggs in one basket.'" This sentiment reflects a broader concern among some market observers about the optics of a CEO divesting significant holdings during a period of strong company performance and optimistic market outlook.

While diversification is a common and prudent financial strategy for executives, the timing and scale of such sales can influence investor perception. The ongoing sales by Nvidia's top executive underscore the delicate balance between personal financial planning and maintaining strong market confidence, particularly for a company at the forefront of the booming AI industry.