Robinhood Eyes $100 Trillion Wealth Transfer with Expanded Financial Ecosystem

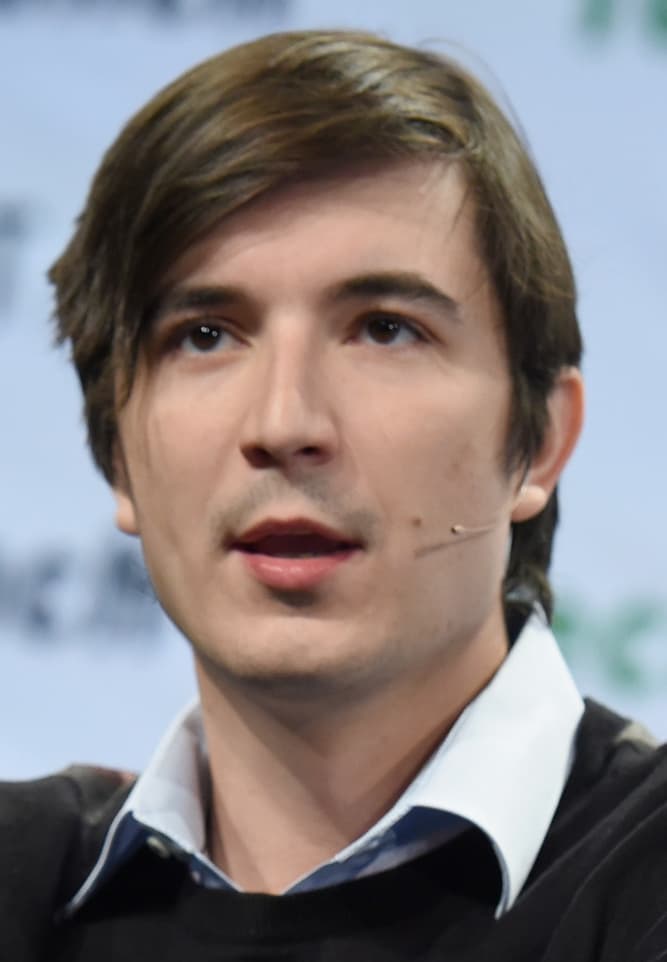

Menlo Park, CA – Robinhood Markets, Inc. is strategically positioning itself to become a comprehensive financial services provider, moving beyond its roots as a trading platform. CEO and Co-Founder Vlad Tenev outlined this ambitious vision, dubbed "Robinhood's $100 Trillion Master Plan" by "The Wolf Of All Streets" podcast, emphasizing the company's intent to capture a significant share of the anticipated generational wealth transfer to millennials and Gen Z. This expansive strategy focuses on integrating banking, wealth management, and advanced crypto solutions.

The company's long-term objective is to serve as the primary financial hub for its users, encompassing a full spectrum of financial needs from daily spending to long-term investments. "The path from a pretty early point was to go beyond trading and to really be the place where our customers can buy, sell or hold any financial asset or conduct any financial transaction through Robinhood," Tenev stated in the podcast. This includes a global expansion and a move into business and institutional services over the next decade.

In line with this vision, Robinhood recently unveiled a suite of new products at its March 2025 "Gold keynote event." Robinhood Strategies offers expert-managed portfolios with a low 0.25% annual management fee, capped at $250 for Gold members, aiming to democratize wealth management. Robinhood Banking, slated for a fall 2025 launch, promises a private banking experience for Gold members, featuring a 4.00% Annual Percentage Yield on savings, estate planning, and even on-demand cash delivery.

Further cementing its technological edge, Robinhood Cortex, an AI investment tool, is set to provide real-time market analysis and insights, including "Stock Digests" and "Trade Builder" features. Tenev highlighted the importance of artificial intelligence, stating, "AI, wealth, and banking are all merging." The company also continues its aggressive push into cryptocurrency and tokenization, with Tenev asserting that "tokenization is coming" and will unlock access to U.S. securities for global users and make private company shares accessible to retail investors.

Robinhood's first-quarter 2025 results underscore its growth, with total net revenues up 50% year-over-year to $927 million and net deposits reaching a record $18.0 billion. The company's crypto notional trading volumes increased over 28% year-over-year to $46 billion, and Robinhood Gold subscribers surged 90% to 3.2 million. Recent acquisitions, including crypto exchange Bitstamp and RIA custodial platform TradePMR, further bolster its strategic expansion and global footprint, despite ongoing regulatory scrutiny in some areas regarding its innovative offerings.