U.S. Battery Imports from China Surge 20% Amidst Complex Solar Trade Dynamics

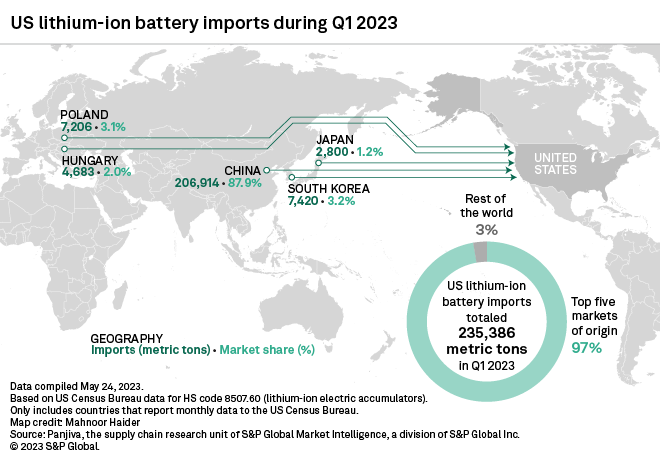

Washington D.C. – U.S. imports of lithium-ion batteries from China experienced a notable 20% increase in value during the first quarter of 2024 compared to the previous year, defying a recent social media assertion that battery imports were "in the gutter." This surge occurs amidst a highly intricate and tariff-laden trade environment for both batteries and solar panels between the two economic giants.A social media post highlighted a perceived paradox, stating, "remarkable that US imports of solar panels from China have actually increased almost as much as African ones, but batteries are in the gutter." However, detailed trade data reveals a more complex reality. While direct U.S. solar panel imports from China remain minimal due to longstanding anti-dumping and countervailing duties, Chinese global PV module shipments increased by 13% in 2024, reaching 235.9 GW.Historically, Chinese solar manufacturers have circumvented U.S. tariffs by establishing production facilities in Southeast Asian countries, including Vietnam, Malaysia, Thailand, and Cambodia, which subsequently became primary suppliers to the U.S. In 2023, the U.S. imported $11.9 billion worth of solar cells from these four nations. The Biden administration has since extended tariffs to these countries, with some duties for certain manufacturers reaching up to 3,521% in 2024 and 2025. Concurrently, Africa's imports of PV panels from China saw a significant 43% rise, reaching 11.36 GW in 2024.Contrary to the "in the gutter" claim, U.S. imports of lithium-ion batteries from China, including those for electric vehicles and energy storage, continue to be substantial. The U.S. imported 70% of its total lithium-ion batteries from China in 2024, amounting to $16 billion. Imports of battery components and parts from China also saw a 32% increase in Q1 2024.These increases in battery imports occurred despite existing tariffs, with the Biden administration further raising duties on Chinese lithium-ion EV batteries from 7.5% to 25% in 2024, and additional tariffs slated for other lithium-ion batteries in 2026. The data underscores the persistent reliance of the U.S. on Chinese clean energy supply chains, as domestic manufacturing capacity for both batteries and solar components continues to develop and strives to meet burgeoning demand.