U.S. Nonfarm Payrolls Rise by 147,000 in June, Surpassing Forecasts

Washington D.C. – The U.S. economy added 147,000 nonfarm payroll jobs in June, significantly exceeding the consensus estimate of 110,000, according to data released by the U.S. Bureau of Labor Statistics (BLS) on Thursday, July 3, 2025. This robust job growth indicates a resilient labor market, a development noted by financial commentator Susan Li, who tweeted: > "June #Jobs better than expected U.S. JUNE NONFARM PAYROLLS +147,000 (CONSENSUS +110,000)."

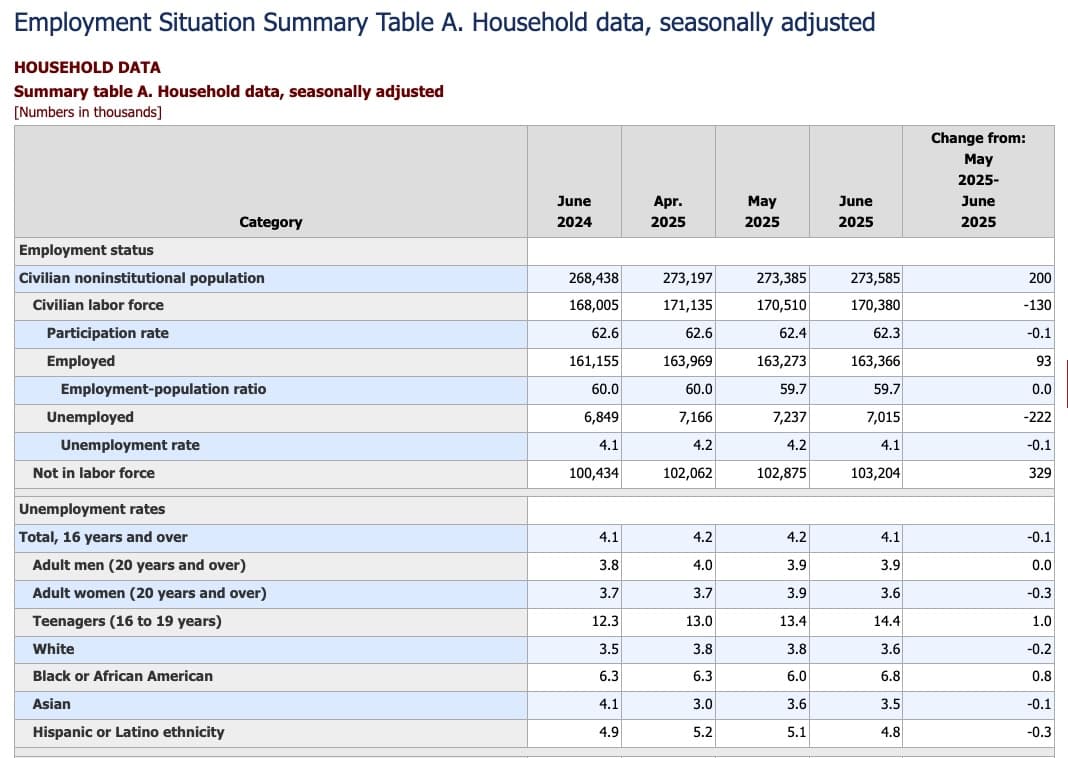

The June figures followed an upward revision for May's job gains, which now stand at 144,000, up from the initially reported 139,000. April's payrolls were also revised higher by 11,000 to 158,000, further highlighting a stronger-than-previously-thought employment trend. The national unemployment rate saw a slight decrease, settling at 4.1% in June from 4.2% in May, remaining within a narrow range observed since May 2024.

Job creation in June was primarily driven by the government and healthcare sectors. State government employment increased by 47,000, largely due to gains in education-related positions, while healthcare added 39,000 jobs. Social assistance also contributed positively with 19,000 new jobs, and the construction sector saw an increase of 15,000. Conversely, the federal government continued to experience job losses, with a decline of 7,000 positions, and manufacturing also saw a decrease of 7,000 jobs.

Average hourly earnings for all private nonfarm payroll employees rose by 8 cents, or 0.2%, reaching $36.30 in June. Over the past 12 months, average hourly earnings have increased by 3.7%. The average workweek for all employees on private nonfarm payrolls edged down slightly by 0.1 hour to 34.2 hours.

This stronger-than-expected jobs report has influenced market expectations regarding monetary policy. Analysts suggest that the data makes a July interest rate cut by the Federal Reserve unlikely. Jeff Schulze, head of economic and market strategy at ClearBridge Investments, stated that the "solid June jobs report confirms that the labor market remains resolute and slams the door shut on a July rate cut," as reported by CNBC. Odds for a July rate cut significantly dropped following the release, with market participants now anticipating the next reduction no sooner than September.