U.S. Shifts Cryptocurrency Policy to Strategic Reserve, Debunking Speculative Claims

Washington D.C. – The United States government is implementing a significant policy shift regarding its substantial cryptocurrency holdings, moving towards a strategic reserve model rather than routine liquidation. This development follows an executive order signed by President Donald Trump on March 6, 2025, establishing a Strategic Bitcoin Reserve and a Digital Asset Stockpile. The new directive aims to retain seized Bitcoin as a long-term strategic asset, akin to gold reserves, to maximize its value.

Historically, the U.S. government has liquidated seized cryptocurrencies, often from criminal cases such as the infamous Silk Road operation. Reports indicate that past premature sales of Bitcoin may have cost taxpayers billions in lost value. The new executive order seeks to prevent such occurrences by mandating the retention of Bitcoin acquired through forfeiture proceedings.

While Bitcoin will be held as a strategic asset, a separate U.S. Digital Asset Stockpile will be created for other seized cryptocurrencies, including assets like Ethereum and Dogecoin. These non-Bitcoin assets may be subject to liquidation at the Treasury Department's discretion, though the order does not authorize the purchase of additional assets for this stockpile. The focus remains on managing existing seized assets strategically.

Contrary to recent speculative social media posts, there is no evidence or official directive linking cryptocurrency liquidations to funding public events such as "DC fireworks" or any specific "DOGE directive" for such purposes. A tweet by "Guru Chahal 🇺🇸" claimed, > "It’s the Feds - they got control of these years ago. Now liquidating them to pay for DC fireworks per DOGE directive." This assertion is not supported by the details of the new executive order or any credible government announcements.

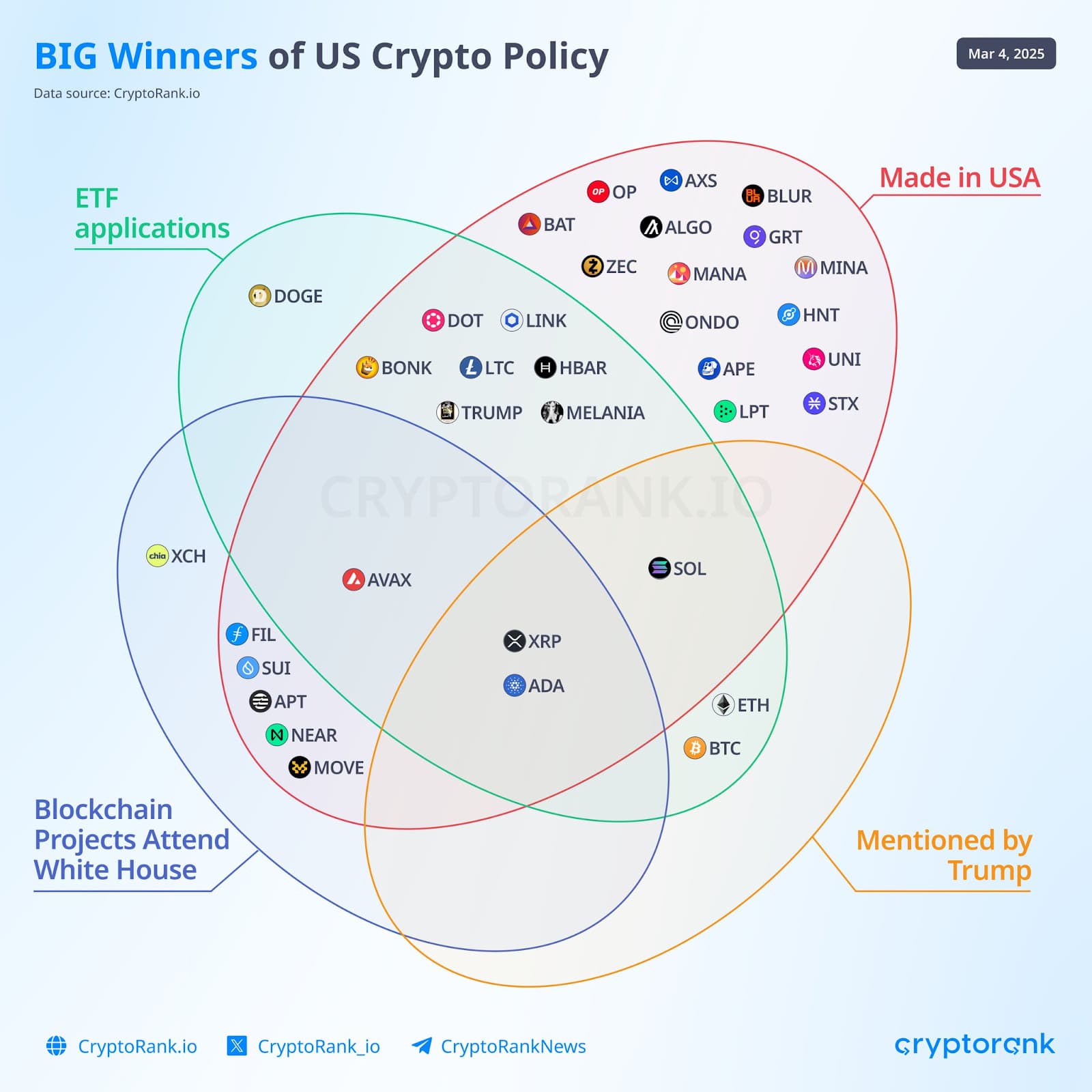

The new policy underscores a broader strategy to integrate digital assets into national economic and security policy, positioning the U.S. as a key player in the evolving cryptocurrency landscape. The Treasury Department has been tasked with evaluating the legal and financial considerations for managing these reserves, with a comprehensive audit of government crypto holdings mandated within 30 days of the order. This strategic shift aims to secure the nation's digital asset position and ensure long-term value from seized cryptocurrencies.