AI/ML Captures 40% of Seed Deals in 1H 2025 as Traditional SaaS Drops to 3-4%

A significant "great rotation" has occurred in seed investing during the first half of 2025, with Artificial Intelligence (AI) and Machine Learning (ML) startups dominating funding, according to a new report from AngelList. This shift has seen AI/ML ventures secure approximately 40% of seed deals, while traditional Software-as-a-Service (SaaS) companies without a core AI component have seen their share plummet to just 3-4% of deal volume. The data, highlighted by SaaStr.ai, indicates a rapid and dramatic reorientation of investor capital.

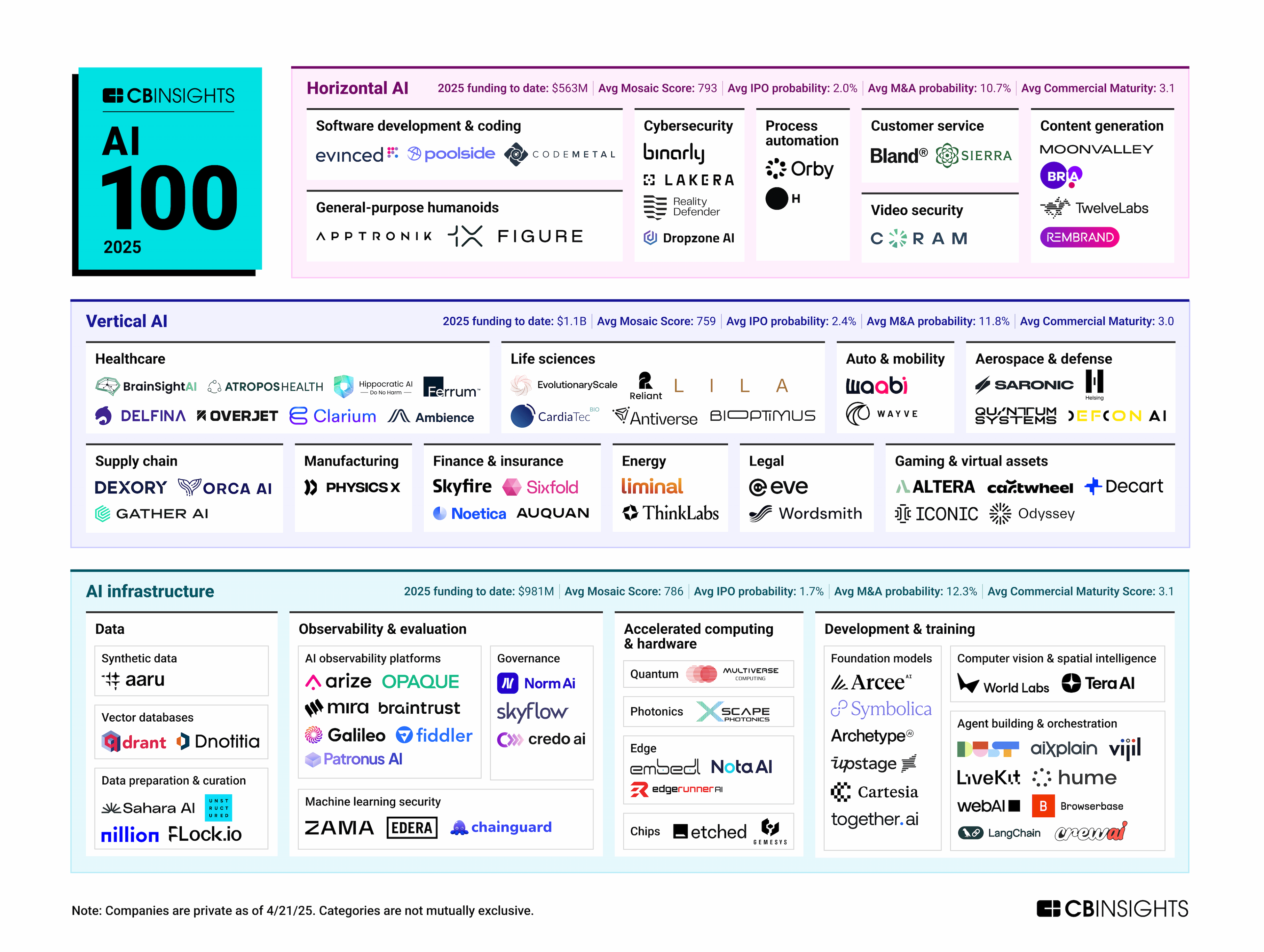

The AngelList report for H1 2025 reveals that the massive 40% "AI/ML" category is not solely comprised of infrastructure plays or foundational models. Instead, it is heavily populated by AI-powered B2B applications that, just two years prior, would have been classified under the broader "SaaS" umbrella. This reclassification reflects a fundamental change in what investors consider fundable within the B2B software landscape.

Industry analysis suggests that what is perceived as the decline of traditional SaaS is, in fact, an absorption of its functionalities into AI-native solutions. Companies building B2B software are now expected to integrate AI as a primary differentiator, moving beyond mere "SaaS platforms with AI features" to become "AI platforms that deliver specific business outcomes." This strategic pivot is crucial for attracting capital in the current market.

The shift extends to capital deployment patterns, where AI-native B2B applications are commanding premium valuations and larger seed rounds. Investors are drawn to the potential for faster scaling, stronger moats through network effects from AI learning, quicker expansion, and the ability to command higher prices due to AI-driven insights. Winning categories like Healthtech and Fintech are also increasingly characterized by their deep integration of AI into core value propositions. The overarching trend points to a systemic move from human-powered software to AI-powered software, redefining the landscape of early-stage venture capital.