Central Banks Boost Gold Reserves Amidst Shifting Global Monetary Landscape

London – Central banks worldwide are increasingly diversifying their foreign exchange reserves, with a notable surge in gold accumulation and a growing emphasis on alternative currencies and payment systems. This trend signals a strategic reassessment of the U.S. dollar's long-standing dominance, driven by geopolitical shifts and economic uncertainties.

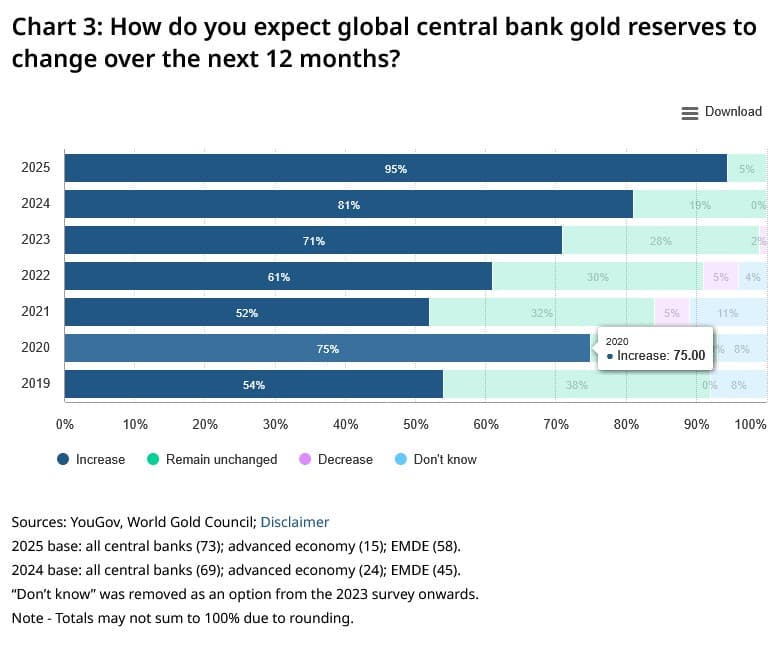

According to the World Gold Council's 2025 Central Bank Gold Reserves survey, 95% of reserve managers anticipate continued growth in central banks' gold reserves over the next 12 months, marking the highest level since monitoring began in 2019. Emerging market and developing economies (EMDEs) are leading this charge, with 48% of EMDE respondents expecting their gold reserves to increase, compared to 21% from advanced economies. Gold is viewed as a reliable protective asset, offering value preservation, portfolio diversification, and stable performance during turbulent periods, especially amidst concerns over inflation and geopolitical circumstances.

This shift comes as discussions around de-dollarization gain traction, particularly among BRICS nations (Brazil, Russia, India, China, and South Africa, now expanded to include Egypt, Ethiopia, Iran, and UAE). These countries are actively seeking to reduce reliance on the U.S. dollar in international trade and financial transactions. While the dollar retains significant transactional dominance in areas like FX volumes and trade invoicing, its share in central bank FX reserves has slid to a two-decade low, falling to just under 60%. Efforts include increasing the use of local currencies for cross-border trade, developing alternative payment systems like BRICS Pay, and exploring central bank digital currencies (CBDCs) such as China's e-CNY and the mBridge project.

The politicization of dollar liquidity, highlighted by instances like the freezing of Russian central bank assets, has accelerated these diversification efforts. For decades, Federal Reserve dollar swap lines functioned as an "unspoken pillar of global stability," providing crucial dollar liquidity during crises like 2008 and March 2020. However, the perception that future dollar access might not be guaranteed or could come with geopolitical conditions is prompting central banks to seek greater financial autonomy. This includes evaluating vulnerabilities to dollar exposure and accumulating gold as a hedge against potential financial weaponization.

Despite these efforts, significant challenges remain for widespread de-dollarization. The dollar's deep entrenchment in global markets, coupled with the lack of robust financial infrastructure and liquidity for many alternative currencies, presents considerable hurdles. Nevertheless, the ongoing accumulation of gold and the development of non-dollar payment mechanisms by central banks underscore a clear strategic intent to foster a more multipolar monetary future.