Central Banks on Track for 16th Consecutive Year of Gold Accumulation, Annual Purchases Exceed 830 Tonnes in 2025

Global central banks are set to continue their unprecedented gold acquisition spree in 2025, with annualized purchases projected to reach over 830 tonnes. This marks the 16th consecutive year of net gold buying by central banks, a significant reversal from the 21 years of net selling that preceded 2010. The sustained demand underscores a strategic shift in global reserve management amidst ongoing economic and geopolitical uncertainties.

The current pace of accumulation highlights a dramatic increase compared to historical averages. Central banks purchased 1,080 tonnes in 2022, 1,051 tonnes in 2023, and 1,089 tonnes in 2024, consistently exceeding 1,000 tonnes annually. This trend places 2025 on track to be the fourth consecutive year where purchases are double the annual average observed between 2011 and 2021, according to data cited by The Kobeissi Letter.

A recent World Gold Council survey indicated that 95% of central banks anticipate an increase in global gold reserves over the next 12 months, with 43% expecting their own reserves to grow. Key drivers for this robust demand include gold's performance during crises, its role in portfolio diversification, and its effectiveness as an inflation hedge. Many central banks also foresee a moderate or significant reduction in US dollar holdings within global reserves over the next five years, favoring gold and other currencies.

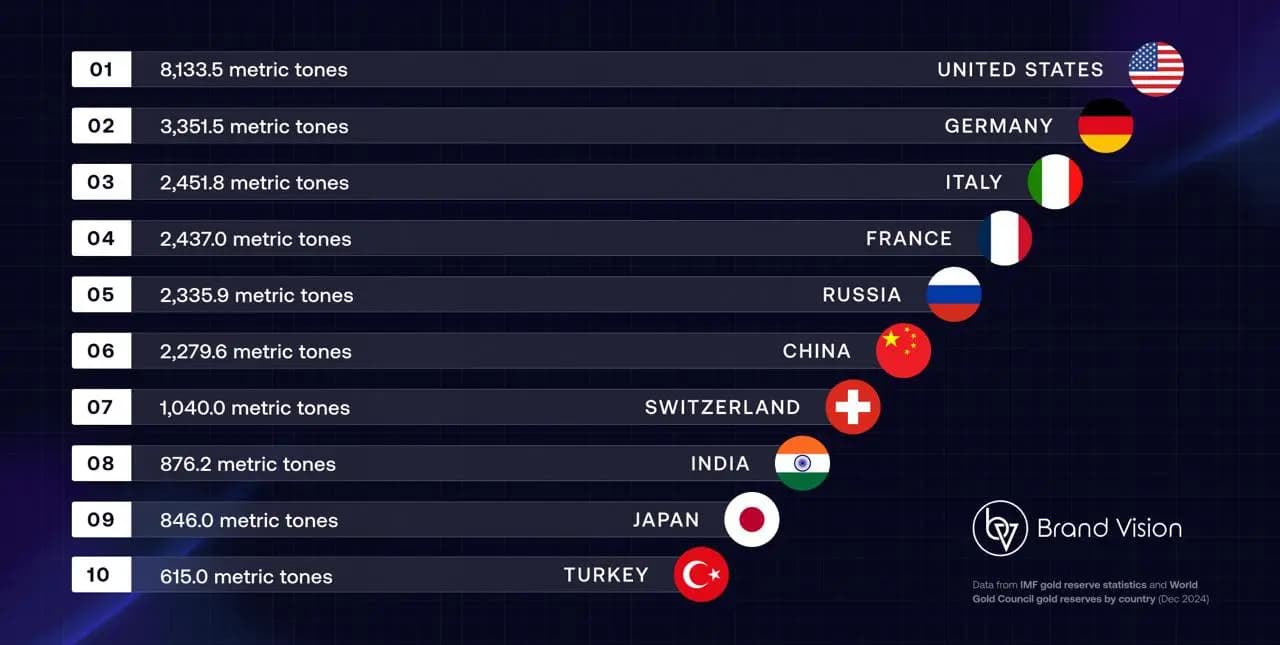

In the first half of 2025 alone, 23 countries augmented their gold reserves, with notable buyers including Poland, Azerbaijan, and Kazakhstan. China and India have also been significant accumulators, with the People's Bank of China reportedly adding to its reserves for 18 consecutive months until mid-2025. This broad-based buying activity reinforces gold's status as a strategic asset and a safe haven.

Analysts from institutions like JPMorgan, Goldman Sachs, and Morgan Stanley project continued strong central bank demand, contributing to bullish gold price forecasts. JPMorgan anticipates gold prices could average $3,675 per ounce by Q4 2025, with some forecasts suggesting a potential rise to $4,000 or even $4,500 per ounce under certain economic scenarios. The consistent purchases by central banks are seen as creating a "soft floor" for gold prices, influencing both institutional and retail investor sentiment.