Five-Year Mortgage Rate Forecasts Face High Uncertainty Amid Economic Shifts

A recent social media post has highlighted the significant divergence and inherent risks in long-term economic predictions, stating, "What this chart Indusputably shows.... is that someone .. in five years... will be horrifically wrong," according to the parody account Deep Throat. This sentiment underscores the current landscape of financial forecasting, particularly concerning mortgage rates, where experts offer varied outlooks for the next half-decade.

Recent analyses from financial institutions present a range of predictions for 30-year fixed mortgage rates over the coming five years. Deloitte's Global Economics Research Center, for instance, projects the 10-year Treasury yield, a key determinant of mortgage rates, to hover near 4.5% through 2025 before gradually declining to 4.1% by 2027 and remaining stable through 2029. Goldman Sachs analysts largely concur, expecting the 10-year Treasury to stay around 4.1% until 2027, while the Congressional Budget Office (CBO) forecasts a slight dip to 3.9% by 2029.

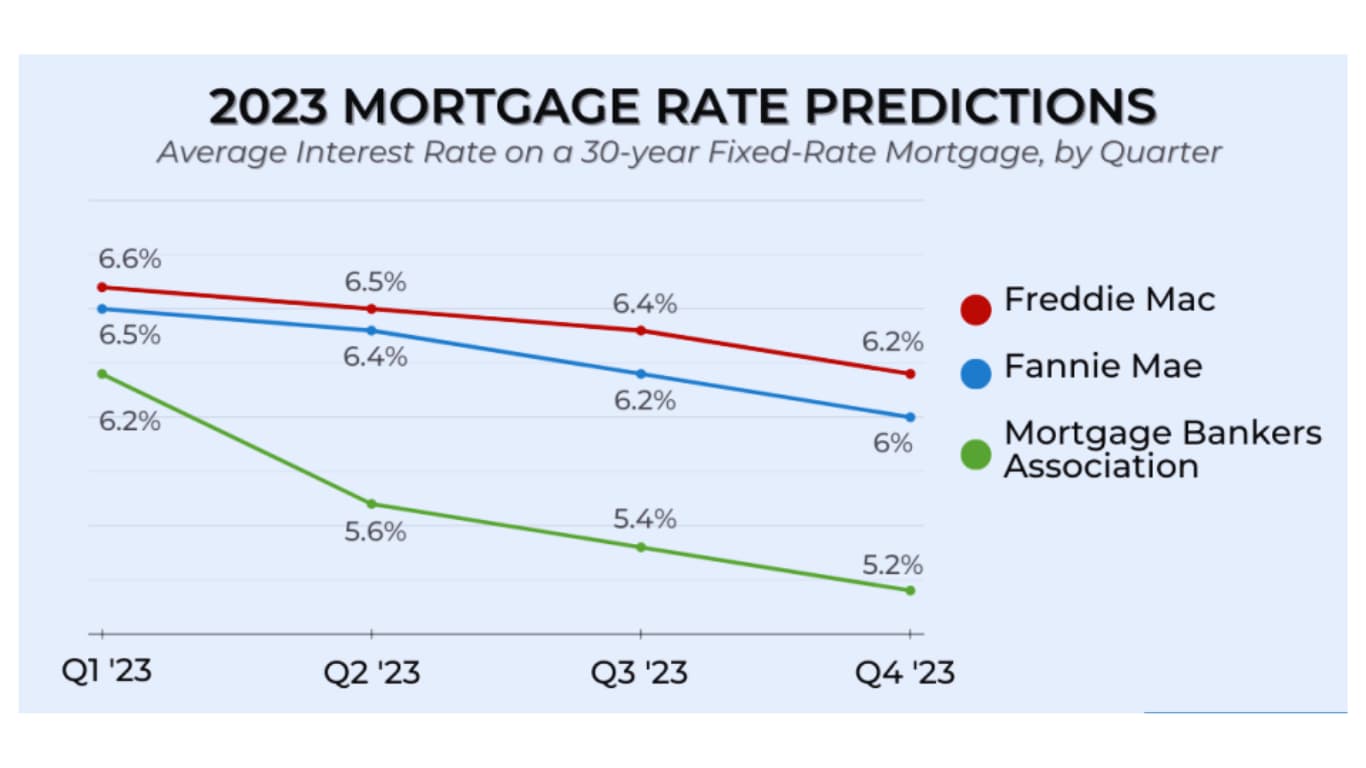

These forecasts, when combined with an estimated spread of 2.1 to 2.3 percentage points between the 10-year Treasury and 30-year fixed mortgage rates, suggest that mortgage rates are unlikely to drop significantly in the near future. Predictions place 2027 mortgage rates in the range of 6.2% to 6.4%. However, experts caution that these long-range estimates are highly susceptible to unforeseen economic disruptions, such as a severe recession, a financial collapse, or another global pandemic, any of which could dramatically alter the trajectory.

The current mortgage rate environment reflects ongoing economic adjustments. As of late October 2025, the average 30-year fixed mortgage rate was around 6.17% (Freddie Mac) or 6.29% (Zillow). The Federal Reserve recently implemented its second consecutive interest rate cut, lowering its benchmark rate by 0.25 percentage points to a target range of 3.75% to 4.00%, signaling concerns about economic softening, particularly in the job market.

Despite these cuts, Fed Chair Jerome Powell's cautious commentary, coupled with conflicting economic data and an ongoing government shutdown disrupting information flow, has introduced volatility. The 10-year Treasury yield ticked up following Powell's remarks, suggesting that a rapid decline in mortgage rates might not be imminent. The end of the Fed's quantitative tightening program, set for December 1, 2025, is another significant policy shift that could influence market dynamics.

For prospective homebuyers and those considering refinancing, this period presents a nuanced market. While rates are considerably lower than their 2024 peaks, the consensus among forecasters points to a period of relative stability rather than a return to historically low levels. The inherent uncertainty in these long-term predictions means that the future path of mortgage rates remains a subject of considerable debate and potential for significant deviation from current expectations.