Investor Warns Against Selling Reflexive Assets During Market Mania

A prominent market commentator, known by the handle "sacha 🦣," recently issued a cautionary statement to investors, advising against the complete divestment of "reflexive assets" amidst periods of market mania. The tweet, posted on November 8, 2025, emphasized a strategic approach to market participation during highly speculative times.

"never sell 100% of a reflexive asset in the middle of a mania," stated sacha 🦣 on social media.

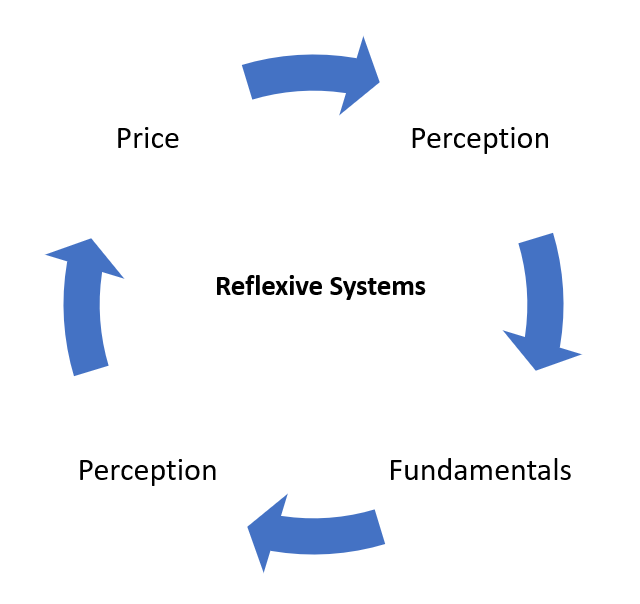

The concept of "reflexivity," popularized by investor George Soros, describes a feedback loop where investor perceptions influence market fundamentals, which then further alters perceptions. This dynamic can lead to asset prices deviating significantly from their intrinsic value, creating booms or busts. Assets susceptible to this phenomenon often see rising prices attract more buyers, pushing values even higher in a self-reinforcing cycle.

Market manias are characterized by widespread irrational exuberance, herd behavior, and the fear of missing out (FOMO) among investors. During such periods, prices can become detached from underlying economic realities, driven primarily by speculative fervor. Historical examples, such as the 17th-century Dutch Tulipmania, illustrate how collective optimism can inflate asset values to unsustainable levels before an inevitable collapse.

Financial experts often highlight the psychological elements of market cycles, where emotions like greed and fear play a crucial role. While the allure of quick profits during a mania can be strong, the commentator's advice suggests a measured approach rather than a complete exit. This strategy aims to balance potential gains with the inherent risks associated with highly speculative market conditions.

The warning underscores the importance of understanding market dynamics and investor psychology. It implies that a complete withdrawal from reflexive assets during a mania might lead to missing out on further upside, but also implicitly cautions against excessive exposure. Investors are encouraged to consider the long-term implications and the potential for sharp reversals when market sentiment is at its peak.