MicroStrategy's Bitcoin Acquisition Strategy Faces Headwinds Amidst Declining Volatility

Tysons Corner, VA – MicroStrategy's long-standing strategy of leveraging convertible debt and equity offerings to acquire Bitcoin may be facing significant challenges as market volatility declines, according to prominent analyst Alex Krüger. This shift could impact the company's ability to scale its Bitcoin holdings and signals a potential transition in the broader cryptocurrency market.

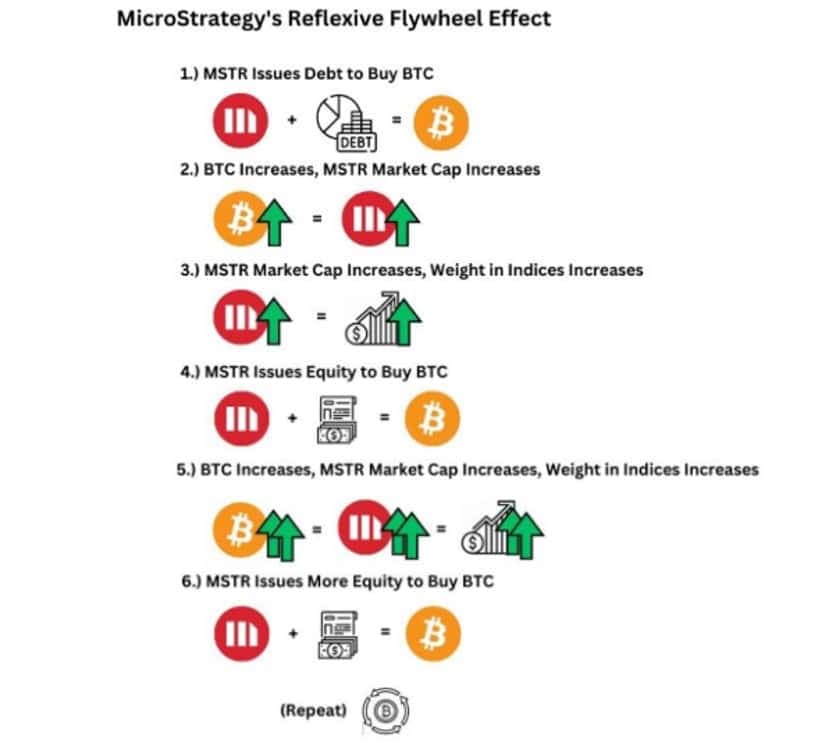

"This is very important for DAT investors, Strategy's (MSTR) in particular," Krüger stated in a recent tweet. He elaborated that MicroStrategy "funds its Bitcoin purchases primarily through convertible debt and equity offerings." Historically, high volatility has increased the value of embedded call options within these convertibles, providing the company with "cheap leverage to buy more BTC."

However, a decrease in volatility makes these options less valuable, potentially forcing MicroStrategy to "offer less favorable terms, which hampers its ability to scale Bitcoin holdings," Krüger explained. He concluded, "The era of MSTR carrying BTC higher is thus over. Other players have to take its place. This is a period of transition."

MicroStrategy has consistently utilized convertible senior notes and at-the-market (ATM) equity offerings to fund its substantial Bitcoin acquisitions. For instance, in November 2024, the company completed a $3.0 billion offering of 0% convertible senior notes due 2029, and in February 2025, it completed a $2 billion offering of 0% convertible senior notes due 2030. These offerings have been instrumental in growing its Bitcoin treasury, which stood at approximately 386,700 bitcoins as of November 24, 2024, acquired at an average price of $56,761 per bitcoin.

The company's approach relies on the attractiveness of its convertible debt, which offers investors the potential for equity upside if MicroStrategy's stock price, often correlated with Bitcoin's performance, rises significantly. If Bitcoin volatility subsides, the embedded call options become less appealing, potentially increasing the cost of capital for future debt issuances. This could indeed hinder MicroStrategy's aggressive accumulation strategy, as highlighted by Krüger.

While MicroStrategy remains the largest corporate holder of Bitcoin, its stock performance has recently shown signs of decoupling from Bitcoin's price, with MSTR falling relative to BTC in some periods of 2025. This suggests that the market may already be re-evaluating the premium associated with MicroStrategy's unique treasury strategy. The analyst's assessment points to a pivotal moment, suggesting that the dynamics of Bitcoin accumulation may now shift to other institutional players or mechanisms.