Onchain Lending TVL Surges to $237 Billion in Q3 2025 Amidst Rapid Growth

Onchain finance is experiencing a significant surge, with decentralized finance (DeFi) lending platforms reaching a record $237 billion in Total Value Locked (TVL) during the third quarter of 2025, marking a 41% increase. This robust growth underscores a bullish sentiment within the sector, as noted by prominent figures like nick.base.eth, who recently stated on social media, "> bullish onchain finance." The expansion is driven by both technological advancements and increasing institutional adoption, positioning onchain finance as a transformative force in global financial markets.

Over the past five years, stablecoin-denominated loans have cumulatively exceeded $670 billion, with monthly volumes hitting $51.7 billion in August 2025, according to a recent Visa report. This recovery in lending activity, following a period of market turbulence between 2022 and early 2024, signals renewed confidence and maturation of the onchain ecosystem. Institutions are increasingly recognizing the potential of blockchain infrastructure to modernize lending and capital markets.

Major financial players are actively engaging with onchain solutions to enhance efficiency and accessibility. Coinbase, for instance, launched ETH-backed loans via the Morpho protocol on Base, offering liquidity to long-term crypto holders without triggering taxable events. Furthermore, Chainlink's new Runtime Environment (CRE) is providing an orchestration layer for institutional-grade smart contracts, enabling secure and compliant integration of external data, cross-chain interoperability, and privacy for entities like J.P. Morgan, Swift, and UBS.

The foundational role of stablecoins and smart contracts is central to this growth, automating lending processes, collateral monitoring, and interest rate calculations with transparency. Protocols such as Morpho, Credit Coop, and Huma Finance are demonstrating viable commercial applications, from aggregated lending marketplaces to financing card programs and cross-border payments. These platforms are attracting significant liquidity and user engagement, indicating a shift towards more sophisticated onchain financial products.

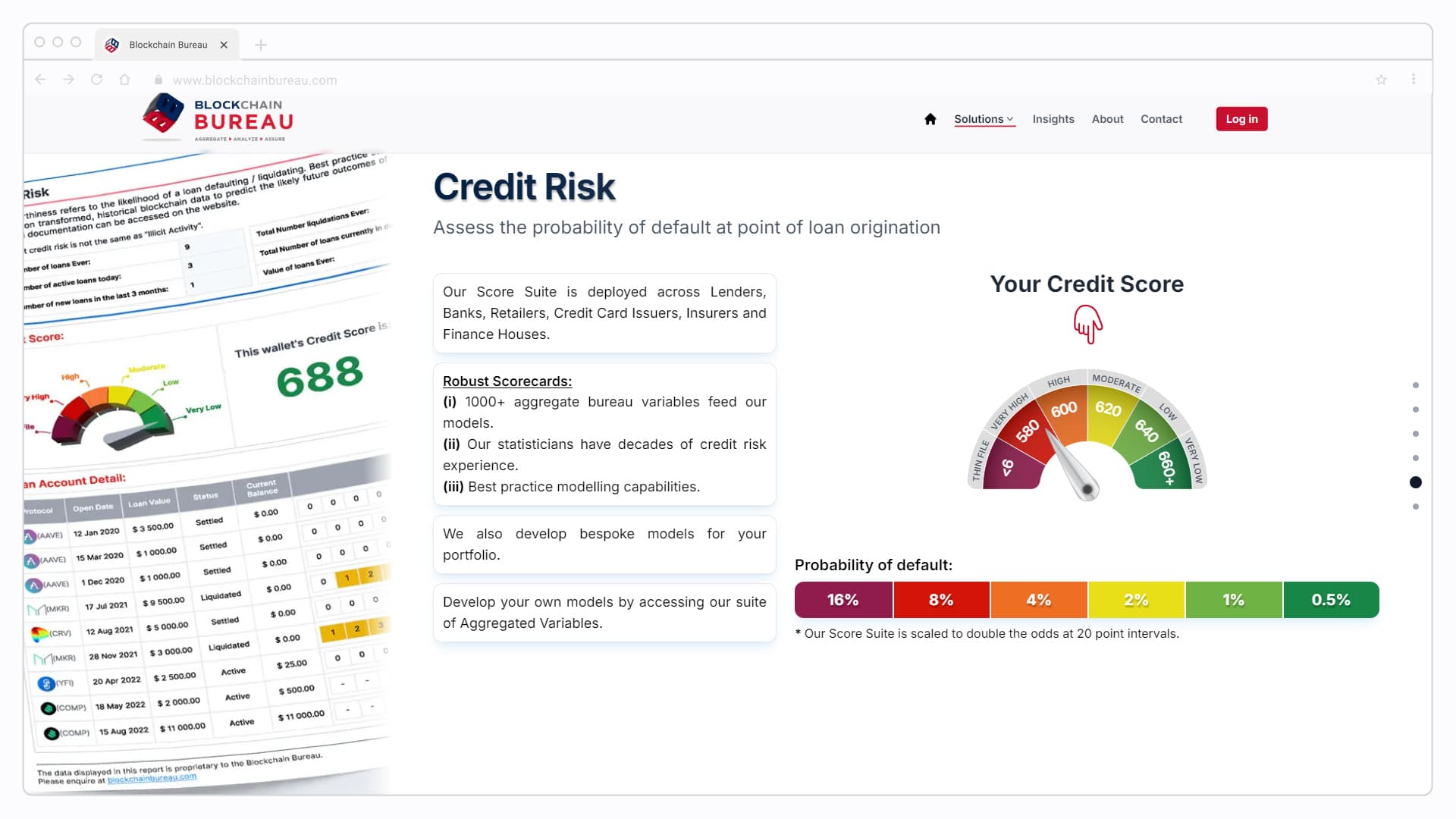

Looking ahead, the sector anticipates further innovation through the tokenization of real-world assets (RWAs), projected to unlock $1-4 trillion by 2030 and expand collateral pools. The development of onchain identity and credit scoring systems is also poised to enable undercollateralized lending, broadening access to credit. These advancements are expected to bridge traditional finance with the efficiency and transparency of programmable money, fostering new opportunities for both institutional and individual participants.