Zero Bitcoin Bull Market Peak Indicators Triggered, Coinglass Reports

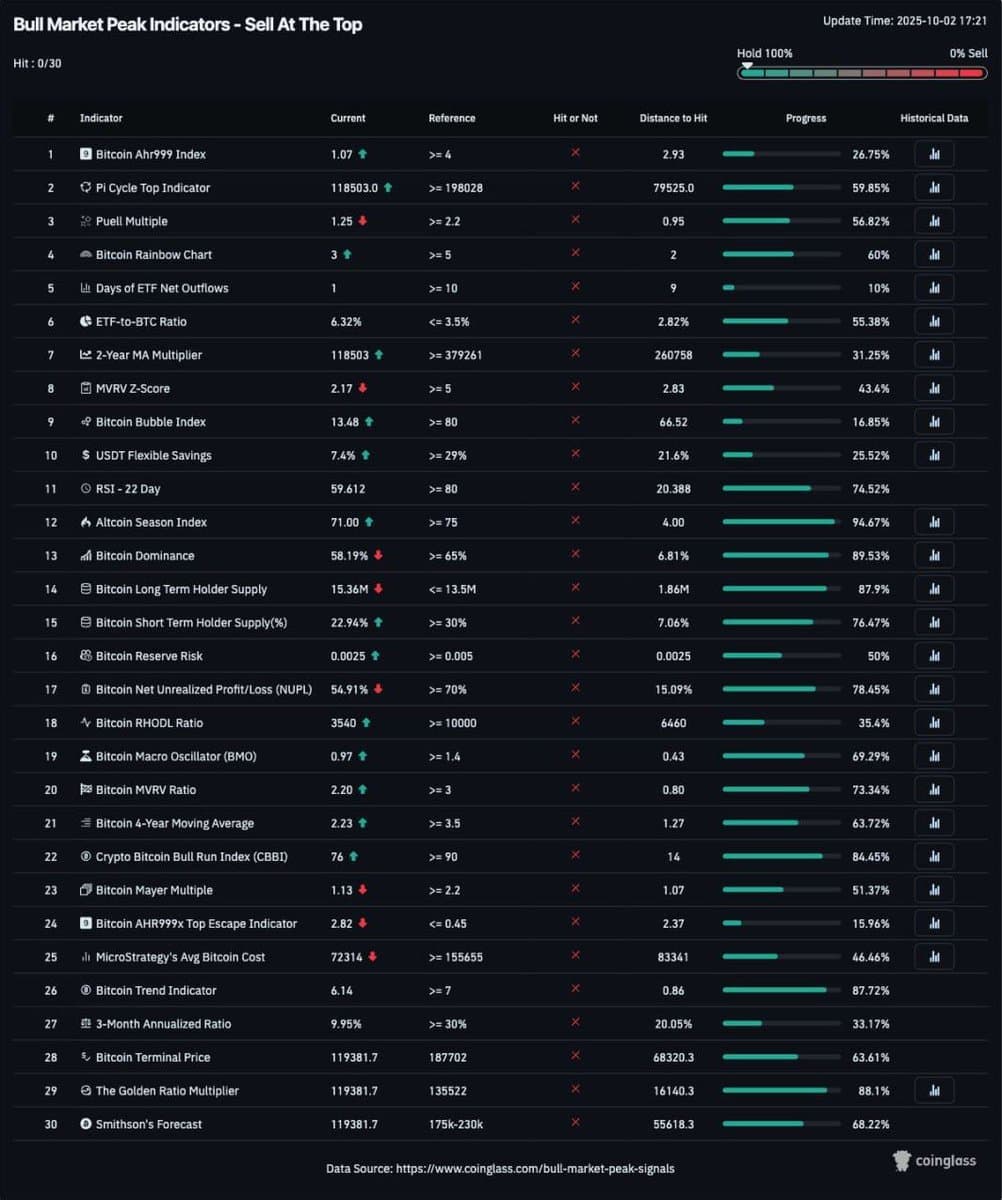

New York, NY – Analytics platform Coinglass reports that none of its 30 monitored bull market peak indicators for Bitcoin have been triggered, suggesting the cryptocurrency market has yet to reach overheated conditions. This assessment, widely followed by traders for sentiment and macro-cycle context, indicates that structural indicators remain significantly below levels historically associated with market tops.

Cointelegraph, citing the Coinglass data, highlighted this development, stating, "Coinglass shows zero bull market peak indicators triggered so far." This comes despite recent price movements and ongoing market discussions about the current cycle's trajectory. The platform's comprehensive dashboard tracks various metrics, including miner revenue pressure, holder profitability, ETF inflows, and risk-adjusted valuation measures.

Currently, the composite reading from Coinglass shows an average progress of approximately 43% towards typical peak thresholds. Key market-cycle indicators such as the Bitcoin Pi Cycle Top, the 2-Year MA Multiplier, the Puell Multiple, and the MVRV Z-Score all remain below their respective peak-signal reference values, according to recent analysis.

While no peak indicators have been fully activated, some metrics are approaching critical levels. Bitcoin dominance stands at 58.16%, nearing Coinglass's reference threshold of 65%. Additionally, the Bitcoin Short-Term Holder Supply, at 29.37%, is within half a percentage point of the 30% level typically associated with overheated market phases.

The absence of triggered peak indicators contrasts sharply with late-cycle periods of past bull markets, where multiple metrics typically converge towards parabolic extremes. This data implies that, despite recent volatility, the market's long-term temperature remains well below historical bull-market peaks, suggesting potential for further growth before a definitive top is reached.