American Households Face Significant Burden as Housing and Transportation Costs Consume Over 40% of Income

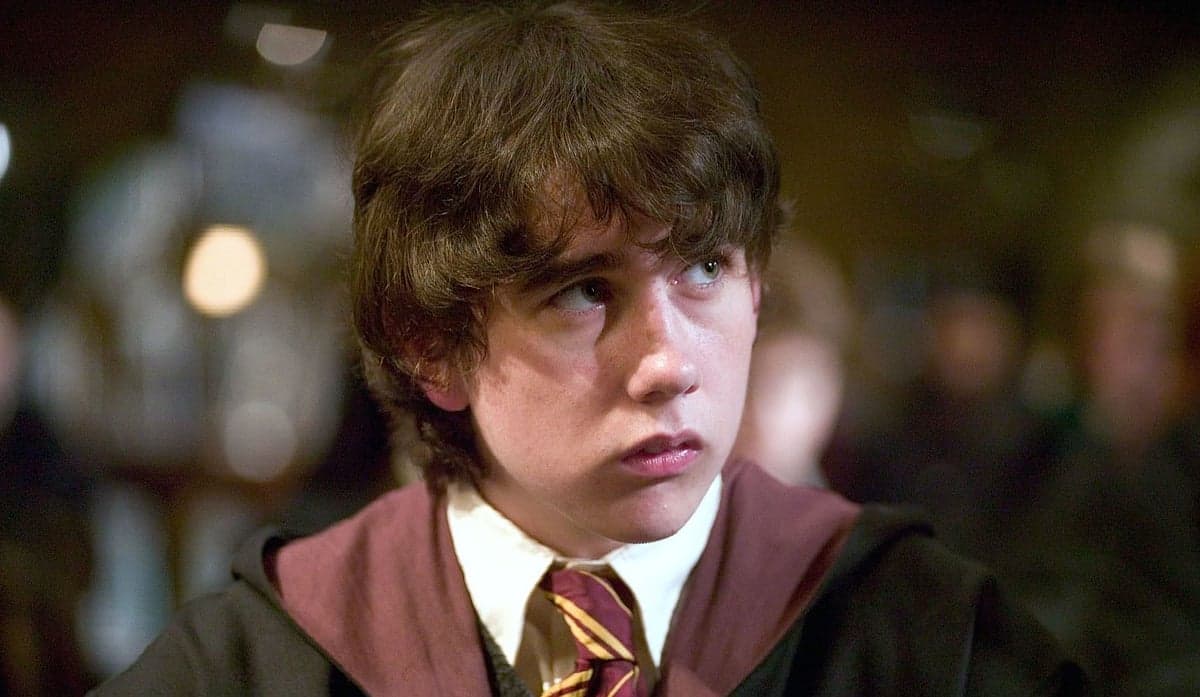

Washington D.C. – A recent social media post by Matthew Lewis has ignited discussion on the escalating financial pressures faced by American households, particularly concerning housing and transportation expenses. The commentary highlights a growing sentiment of economic strain among consumers grappling with rising costs and inflation.

Data from the U.S. Census Bureau's American Community Survey reveals that 31.3% of American households were considered "cost-burdened" in 2023, spending over 30% of their income on housing. For homeowners with mortgages, monthly payments in October 2023 accounted for 40.6% of the median household income, marking the highest share since 2007. Renters often face even higher burdens, with nearly half (49.7%) spending over 30% of their income on rent in 2023.

Beyond housing, transportation stands as the second-largest annual household expenditure. In 2023, U.S. households spent an average of $13,174 on transportation. While the tweet suggested 20% of income on trucks, overall transportation costs, heavily driven by vehicle purchases and operation, can consume a substantial portion of income, particularly for lower-income households, reaching up to 32% of their before-tax income.

The shift towards exurban living, often characterized by more affordable housing compared to inner suburbs, frequently necessitates longer, car-dependent commutes. This trade-off can lead to significantly higher transportation costs, effectively offsetting initial housing savings and contributing to the overall financial burden on households.

Consumer sentiment surveys reflect widespread concern over these economic trends. The University of Michigan's consumer sentiment index saw a decline in August 2025, largely attributed to increasing worries about inflation. Year-ahead inflation expectations rose to 4.9%, prompting many consumers to adjust their spending habits, prioritizing essential goods and seeking lower-priced alternatives.

In his widely shared tweet, Matthew Lewis articulated a critical view of the situation, stating, > "i've been assured this is just want americans want, spend 40% of your income for a home in exurbs and then another 20% on the truck you need to feel accepted in the exurbs, then get angry at the government for inflation and vote for the fascist." This commentary underscores a perception among some that economic policies are failing to address the core financial struggles of the average American.