ACA Enhanced Subsidies Expiration Threatens to Double Premiums for Millions

Millions of Americans face the prospect of significantly higher health insurance costs as enhanced Affordable Care Act (ACA) premium tax credits are set to expire on December 31. If Congress does not act to extend these "COVID-era" subsidies, subsidized enrollees could see their annual premium payments more than double in 2026, according to analyses from the Kaiser Family Foundation (KFF). The impending expiration has ignited a fierce debate in Washington, with lawmakers divided on the future of the financial assistance.

Senator Mike Lee (R-UT) recently voiced strong opposition to extending the subsidies, stating on social media, "> The Obamacare Industrial Complex™️ works hard to perpetuate itself—at great expense to hardworking Americans." He further questioned, "> Does that impact your thinking on the Democrats’ efforts (assisted by huge health insurance companies) to extend the COVID-era subsidies now set to expire on December 31?" This highlights a key point of contention regarding the cost and beneficiaries of the current subsidy structure.

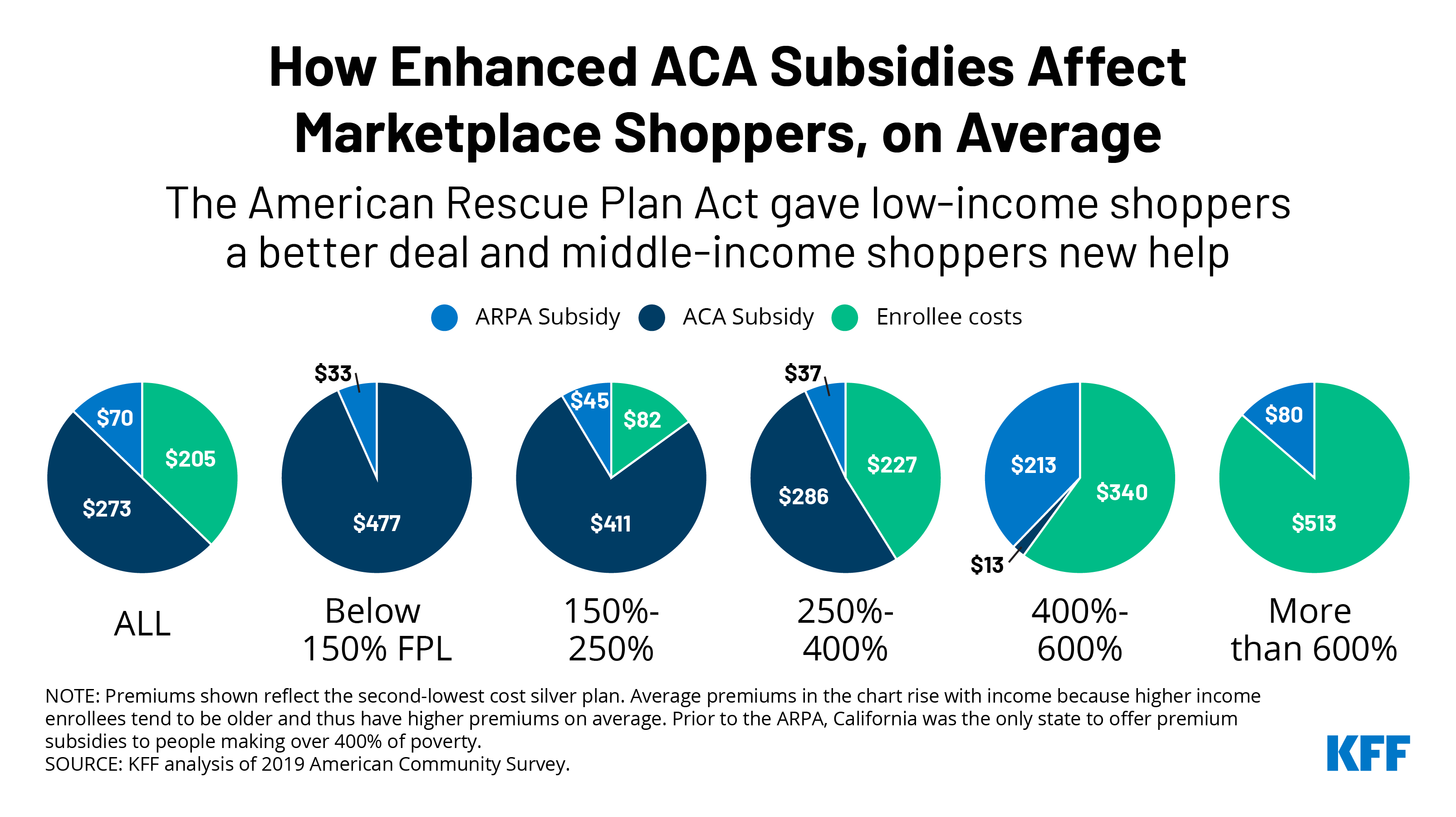

The enhanced premium tax credits, initially introduced by the American Rescue Plan Act in 2021 and extended through 2025 by the Inflation Reduction Act, expanded eligibility and increased the amount of financial assistance available for individuals purchasing health plans through the ACA marketplace. This expansion contributed to a significant rise in marketplace enrollment, more than doubling from approximately 11 million to over 24 million people, with the vast majority receiving enhanced tax credits.

However, critics argue that extending the subsidies would be fiscally irresponsible and primarily benefit insurance companies. The Congressional Budget Office (CBO) estimates that permanently extending the subsidies could add between $350 billion and $488 billion to the federal deficit over ten years. Organizations like the Cato Institute contend that the temporary nature of the pandemic-era relief should not lead to permanent entitlements, citing concerns about fraud and the subsidies funding wealthier individuals.

If the enhanced subsidies expire, KFF projects an average 114% increase in annual premium payments for subsidized enrollees in 2026, from $888 to $1,904. The CBO also estimates that between 2.2 million and 3.8 million more Americans could become uninsured without an extension. The debate continues as the deadline approaches, with significant implications for both federal spending and the affordability of health coverage for millions.