Larry Levitt, a prominent health policy expert, recently highlighted a significant disparity in federal health care subsidies, noting that the federal government spent $384 billion last year on tax subsidies for employer-provided health benefits.

Levitt's tweet brought attention to the scale of this spending, particularly in contrast to the ongoing debate surrounding the future of Affordable Care Act (ACA) premium tax credits. The tax exclusion for employer-sponsored health insurance (ESI) allows both employer contributions and often employee contributions to be excluded from income and payroll taxes. This exclusion is considered one of the largest federal tax expenditures.

According to the Tax Policy Center, the ESI tax exclusion is indeed a major federal subsidy for health insurance. While the exact annual figure can vary by year and source, the magnitude of this tax preference is consistently highlighted in health policy discussions. The Congressional Budget Office (CBO) also identifies the favorable tax treatment of employment-based health benefits as one of the federal government's largest tax expenditures, noting that it provides larger subsidies to those with higher incomes or more expensive plans.

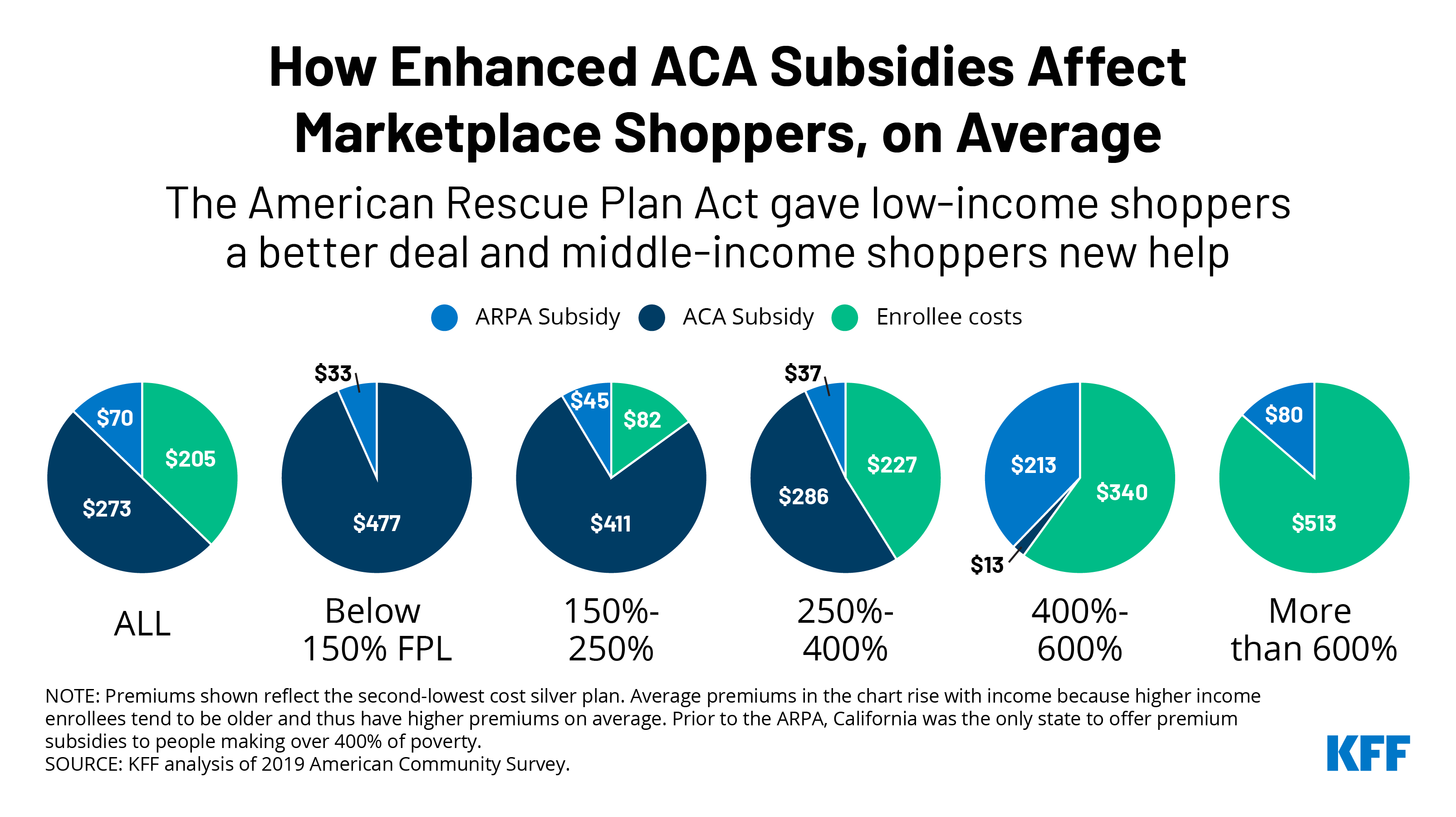

The debate over ACA premium tax credits, which help individuals and families afford health insurance purchased through the marketplaces, often focuses on their cost and extension. These credits were temporarily enhanced by the American Rescue Plan Act of 2021 and further extended by the Inflation Reduction Act of 2022. Policymakers are currently considering whether to make these enhancements permanent.

Levitt's observation draws a parallel between the two subsidy mechanisms, suggesting a need to evaluate the equity and efficiency of both. The ESI tax exclusion, by its nature, offers a greater financial advantage to individuals in higher tax brackets, as the value of the tax exemption increases with one's marginal tax rate. This contrasts with the ACA premium tax credits, which are designed to make coverage more affordable for lower and middle-income individuals. The discussion initiated by Levitt prompts a broader examination of how federal health care subsidies are distributed and their overall impact on health care affordability and equity across different income levels.